Cares Act Unemployment Form

What is the Cares Act Unemployment

The Cares Act Unemployment program was established to provide financial assistance to individuals who lost their jobs due to the COVID-19 pandemic. This federal initiative expanded unemployment benefits to include those who typically do not qualify, such as self-employed workers and independent contractors. Under this program, eligible individuals can receive additional weekly benefits on top of their state unemployment compensation, significantly aiding those facing economic hardships.

Eligibility Criteria

To qualify for the Cares Act Unemployment benefits, applicants must meet specific criteria. Individuals must have lost their job or experienced reduced hours due to the pandemic. This includes employees who were furloughed, laid off, or had to quit their jobs for COVID-19 related reasons. Additionally, self-employed individuals and gig workers are eligible if they can demonstrate a loss of income. Each state may have its own guidelines, so it is essential to check local requirements.

Steps to Complete the Cares Act Unemployment

Completing the Cares Act Unemployment application involves several key steps:

- Gather necessary documentation, including proof of employment and income.

- Visit your state’s unemployment website to access the application form.

- Fill out the application accurately, providing all required information.

- Submit the application online or via mail, as per your state’s guidelines.

- Monitor your application status and respond to any requests for additional information.

Required Documents

When applying for Cares Act Unemployment benefits, applicants typically need to provide various documents to verify their eligibility. Commonly required documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Employment history, including pay stubs or W-2 forms.

- Documentation of the reason for unemployment, such as termination letters or furlough notices.

Form Submission Methods

Submitting the application for Cares Act Unemployment benefits can be done through various methods, depending on state regulations. Most states encourage online submissions for faster processing. However, applicants may also have the option to submit forms via mail or in-person at designated unemployment offices. It is crucial to follow the specific instructions provided by your state to ensure timely processing of your application.

IRS Guidelines

Understanding IRS guidelines related to unemployment benefits is essential for applicants. Unemployment benefits received under the Cares Act are considered taxable income. Recipients should keep track of the total amount received, as this will need to be reported on their federal tax return. The IRS recommends that individuals set aside a portion of their benefits to cover potential tax liabilities.

Quick guide on how to complete cares act unemployment

Finalize Cares Act Unemployment seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a splendid eco-friendly substitute to conventional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Cares Act Unemployment on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Cares Act Unemployment effortlessly

- Obtain Cares Act Unemployment and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Highlight pertinent sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information carefully and then click the Done button to preserve your modifications.

- Select how you wish to send your form – via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Cares Act Unemployment to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cares act unemployment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

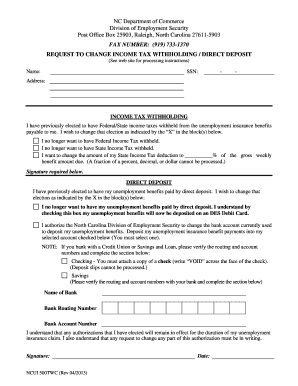

What is the form to take taxes out of Texas unemployment?

The form to take taxes out of Texas unemployment is a required document that allows individuals to designate how much tax will be withheld from their unemployment benefits. By completing and submitting this form, you ensure that the appropriate state and federal taxes are automatically deducted from your payments.

-

How can airSlate SignNow help with the form to take taxes out of Texas unemployment?

airSlate SignNow provides an easy-to-use platform for eSigning and sending the form to take taxes out of Texas unemployment. With a few clicks, you can complete the form electronically, ensuring quick submission and compliance with Texas state requirements.

-

Is there a cost associated with using airSlate SignNow for submitting the form?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses alike. By using our services to manage the form to take taxes out of Texas unemployment, you can save time and streamline your document workflow.

-

What features does airSlate SignNow offer for handling unemployment tax forms?

airSlate SignNow offers features like secure eSigning, document templates, and real-time tracking for the form to take taxes out of Texas unemployment. These features help ensure that your documents are processed promptly and securely, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for managing tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your document management process. This allows you to easily handle the form to take taxes out of Texas unemployment alongside other financial or HR software.

-

What are the benefits of using airSlate SignNow for unemployment tax forms?

Using airSlate SignNow simplifies the process of managing the form to take taxes out of Texas unemployment and ensures efficiency in your operations. You benefit from increased accuracy, quicker turnaround times, and the convenience of completing documents from anywhere.

-

How secure is the airSlate SignNow platform for submitting sensitive tax forms?

airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and compliance with various data protection regulations. This ensures that your form to take taxes out of Texas unemployment remains private and secure throughout the submission process.

Get more for Cares Act Unemployment

- Determining contractor status form

- Ex 1025 employment agreement and change in control form

- Direct deposit form oregongov

- From time to time idioms by the free dictionary form

- Flexible work arrangement acknowledgement form

- A labor relations guide for supervisors administering form

- Employee performance appraisal form epa 3 wv division of

- Employees performance feedback planning worksheet

Find out other Cares Act Unemployment

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure