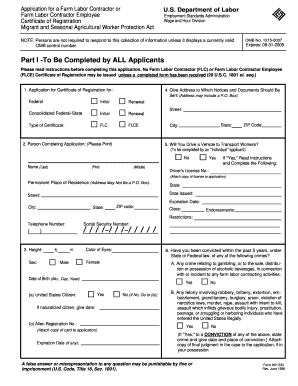

Wh 530 Form

What is the WH 530?

The WH 530 form is a document used by employers in the United States to report and withhold taxes for employees who qualify for certain tax exemptions. This form is particularly relevant for employers who hire workers that may be eligible for specific tax benefits under the Internal Revenue Code. Understanding the WH 530 is crucial for ensuring compliance with tax regulations and for maximizing potential tax savings for both employers and employees.

How to Use the WH 530

To effectively use the WH 530 form, employers must first determine the eligibility of their employees for the exemptions outlined in the form. Once eligibility is confirmed, employers should complete the form accurately, providing all necessary information, including employee details and the specific exemptions being claimed. After filling out the form, it should be submitted to the appropriate tax authorities to ensure that the exemptions are recognized and processed correctly.

Steps to Complete the WH 530

Completing the WH 530 form involves several key steps:

- Gather necessary employee information, including name, address, and Social Security number.

- Identify the specific tax exemptions that apply to the employee.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the relevant tax authority.

Legal Use of the WH 530

The WH 530 form must be used in accordance with federal and state tax laws. It is essential for employers to understand the legal implications of using this form, as improper use can lead to penalties and fines. Compliance with Internal Revenue Service (IRS) guidelines and state-specific regulations is crucial to ensure that the tax exemptions claimed are valid and legally recognized.

Required Documents

When completing the WH 530 form, employers should have several documents ready, including:

- Employee's Social Security card or number.

- Proof of eligibility for tax exemptions, such as prior tax returns or exemption certificates.

- Any relevant state-specific tax documentation.

Form Submission Methods

The WH 530 form can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a hard copy of the completed form to the appropriate address.

- In-person submission at designated tax offices.

Penalties for Non-Compliance

Failure to properly complete and submit the WH 530 form can result in significant penalties for employers. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. It is essential for employers to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete wh 530

Complete Wh 530 effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Wh 530 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Wh 530 with ease

- Locate Wh 530 and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Modify and eSign Wh 530 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 530

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WH 530 form?

The WH 530 form is a crucial document used for reporting employment-related information for certain tax purposes. Employers use this form to report the withholding of federal income tax for their employees. Understanding the WH 530 form is essential for businesses to ensure compliance with tax regulations.

-

How can airSlate SignNow help with completing the WH 530 form?

airSlate SignNow provides an efficient platform to easily fill out and eSign the WH 530 form. Our intuitive interface allows users to quickly enter the required information and ensure accuracy. This streamlines the process, saving you valuable time and resources.

-

Is the WH 530 form eSigning compliant with federal regulations?

Yes, using airSlate SignNow for eSigning the WH 530 form complies with federal regulations for electronic signatures. Our platform meets the standards set by the Electronic Signatures in Global and National Commerce (ESIGN) Act. This gives you peace of mind that your digitally signed forms are legally binding.

-

What are the pricing options for airSlate SignNow when using the WH 530 form?

airSlate SignNow offers various pricing plans to fit your business needs, whether you are a small startup or a large enterprise. Prices are competitive and designed to provide a cost-effective solution for managing your WH 530 form and other documents. You can start with a free trial to explore the features before committing to a plan.

-

Can I integrate airSlate SignNow with other software for managing the WH 530 form?

Absolutely! airSlate SignNow offers seamless integration with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to efficiently manage the WH 530 form alongside your existing workflows, enhancing productivity and organization.

-

What features does airSlate SignNow provide for the WH 530 form submission?

With airSlate SignNow, you can automate the entire process of filling out and submitting the WH 530 form. Features such as templates, real-time collaboration, and secure document storage enhance your experience. You'll also benefit from tracking functionalities to know when your form is completed.

-

Are there any security measures for handling the WH 530 form with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the WH 530 form. We implement advanced encryption protocols and secure data storage practices to protect your information. Additionally, you can control user access and permissions for added peace of mind.

Get more for Wh 530

- 26 us code422 incentive stock optionsus codeus form

- Proxy statement tesla form

- Hotel investors trust form

- This agreement and plan of merger this quotagreementquot dated as of may form

- Finance dictionaryderivative financecollateralized debt form

- This security agreement this quotagreementquot is made and entered into as of this 30th form

- Certificate of designations preferences rights and secgov form

- Certificate of designations the series a 1 secgov form

Find out other Wh 530

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form