Form W 4na Nebraska

What is the Form W-4na Nebraska

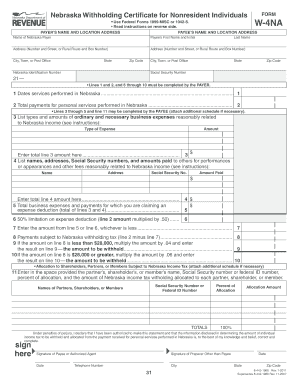

The Form W-4na Nebraska is a state-specific tax form used by employees in Nebraska to determine the amount of state income tax withholding from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld based on an individual's financial situation and personal exemptions. By completing the W-4na, employees provide their employers with the necessary information to calculate the appropriate withholding amount, which helps avoid underpayment or overpayment of state taxes.

Steps to Complete the Form W-4na Nebraska

Completing the Form W-4na Nebraska involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate your allowances based on your personal situation, which may include dependents and other deductions.

- Additional Withholding: If you wish to have extra money withheld, specify the additional amount in the designated section.

- Signature and Date: Sign and date the form to validate your submission.

Once completed, submit the form to your employer for processing.

Legal Use of the Form W-4na Nebraska

The Form W-4na Nebraska is legally binding when filled out correctly and submitted to the employer. It complies with state tax regulations and helps ensure that employees meet their tax obligations. To be considered valid, the form must be signed by the employee, and the information provided must be accurate. Employers are required to retain this form for their records and use it for calculating state income tax withholding.

How to Obtain the Form W-4na Nebraska

The Form W-4na Nebraska can be obtained through several channels:

- Online: Visit the Nebraska Department of Revenue website to download the form directly.

- Employer: Request a copy from your employer, as many companies provide this form to new hires.

- Local Tax Office: Visit your local tax office for a physical copy of the form.

It is important to ensure you are using the most current version of the form to avoid any issues with tax withholding.

State-Specific Rules for the Form W-4na Nebraska

When completing the Form W-4na Nebraska, it is crucial to be aware of specific state rules that may affect your tax situation:

- Allowances: Nebraska has its own guidelines for calculating allowances, which may differ from federal rules.

- Changes in Tax Law: Stay informed about any changes in state tax laws that could impact your withholding.

- Local Taxes: Some local jurisdictions in Nebraska may impose additional taxes, which should be considered when filling out the form.

Understanding these rules can help ensure accurate tax withholding and compliance with state regulations.

Quick guide on how to complete form w 4na nebraska

Effortlessly Prepare Form W 4na Nebraska on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form W 4na Nebraska on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Form W 4na Nebraska Seamlessly

- Obtain Form W 4na Nebraska and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invite link, or download it directly to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, and errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Alter and eSign Form W 4na Nebraska to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4na nebraska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska W 4 form?

The Nebraska W 4 form is a state-specific withholding certificate that employees in Nebraska must complete for accurate tax withholding. It's essential for ensuring that the correct amount of state income tax is withheld from your paycheck. Utilizing airSlate SignNow simplifies the eSigning process for this form, making it easy to manage for both employers and employees.

-

How can airSlate SignNow help me with the Nebraska W 4 form?

airSlate SignNow offers an easy-to-use platform to create, send, and eSign the Nebraska W 4 form digitally. This not only saves time but also ensures that the document is securely stored and accessible anytime. The user-friendly interface allows for quick modifications, making it a perfect solution for managing your Nebraska W 4 efficiently.

-

What are the pricing options for using airSlate SignNow with Nebraska W 4 forms?

airSlate SignNow provides several flexible pricing plans to accommodate businesses of all sizes. Each plan includes the capability to manage documents like the Nebraska W 4 form, with options for additional features based on your needs. Check our website for specific pricing details tailored to your requirements.

-

Are there any benefits to using airSlate SignNow for Nebraska W 4 forms?

Using airSlate SignNow for Nebraska W 4 forms offers numerous benefits, including quicker turnaround times and enhanced document security. It eliminates paperwork hassles, allowing employees to eSign their forms from anywhere. Additionally, it keeps your records organized and easily retrievable.

-

Does airSlate SignNow integrate with other software for Nebraska W 4 management?

Yes, airSlate SignNow offers integrations with several other software applications, enhancing your ability to manage Nebraska W 4 forms efficiently. This includes compatibility with popular accounting and HR platforms, making it easier to synchronize employee data. These integrations can streamline your processes signNowly.

-

Is airSlate SignNow compliant with Nebraska state regulations for the W 4 form?

Absolutely, airSlate SignNow is designed to be compliant with all applicable Nebraska state regulations regarding the W 4 form. Our platform keeps you updated with the latest legal requirements, ensuring you stay in compliance while streamlining your document processes. Trust in our solution for secure and reliable document management.

-

Can I customize the Nebraska W 4 form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Nebraska W 4 form as needed. You can add fields, logos, and specific instructions to match your company’s requirements. This customization capability enables you to create a more personalized experience for employees filling out this important tax form.

Get more for Form W 4na Nebraska

- Commercial property sales package kansas form

- General partnership package kansas form

- Contract for deed package kansas form

- Ks state statutes form

- Kansas poa form

- Revocation of statutory equivalent of living will or declaration kansas form

- Revised uniform anatomical gift act donation kansas

- Employment hiring process package kansas form

Find out other Form W 4na Nebraska

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement