Ga Dmv Heavy Vehicle Tax Form 846 2009-2026

Understanding the Vehicle Declaration Form

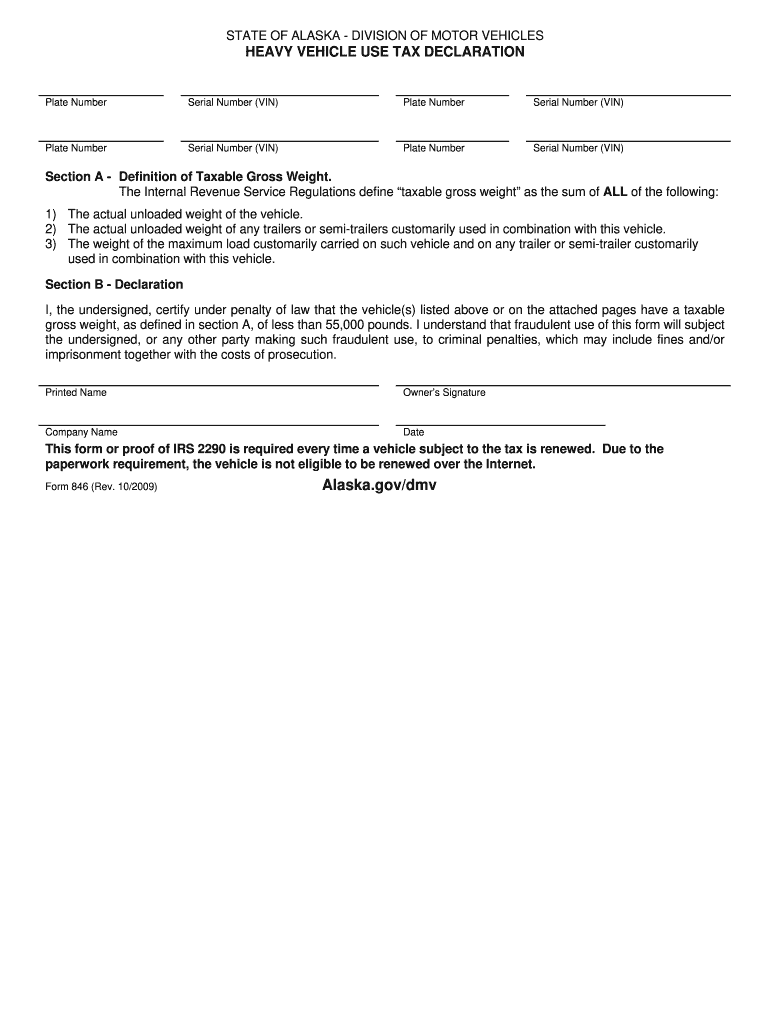

The vehicle declaration form is a legal document used to provide essential information about a vehicle, including its ownership, technical specifications, and condition. This form is often required when registering a vehicle, transferring ownership, or for tax purposes. It serves as a formal declaration to state authorities regarding the vehicle's details and the owner's intent. Ensuring that all information is accurately filled out is crucial for compliance with state regulations.

Steps to Complete the Vehicle Declaration Form

Completing the vehicle declaration form involves several important steps:

- Gather necessary information: Collect details about the vehicle, such as make, model, year, VIN (Vehicle Identification Number), and current mileage.

- Provide personal information: Include your name, address, and contact details as the vehicle owner.

- Fill out the form: Accurately enter all required information in the designated fields of the form.

- Sign and date: Ensure that you sign the form and include the date of completion to validate the document.

Legal Use of the Vehicle Declaration Form

The vehicle declaration form holds legal significance, as it is often required by state departments for various transactions. When properly completed and signed, it serves as a binding document that can be used in legal proceedings if necessary. It is important to ensure compliance with applicable laws, including those outlined in the ESIGN Act and UETA, when submitting the form electronically.

How to Obtain the Vehicle Declaration Form

The vehicle declaration form can typically be obtained from your local Department of Motor Vehicles (DMV) or the appropriate state agency responsible for vehicle registrations. Many states also provide downloadable versions of the form on their official websites, allowing for easy access and completion. It is advisable to check your state’s specific requirements to ensure you are using the correct version of the form.

Required Documents for Submission

When submitting the vehicle declaration form, you may need to provide additional documentation to support your application. Commonly required documents include:

- Proof of identity (e.g., driver's license or state ID)

- Title of the vehicle

- Bill of sale, if applicable

- Any previous registration documents

Form Submission Methods

There are several ways to submit the vehicle declaration form, depending on your state’s regulations:

- Online: Many states allow electronic submission through their DMV websites, which can streamline the process.

- By mail: You can print the completed form and mail it to your local DMV office.

- In-person: Visiting a DMV office allows for direct submission and immediate assistance with any questions.

Penalties for Non-Compliance

Failure to complete and submit the vehicle declaration form as required can result in penalties. These may include fines, delayed vehicle registration, or legal action in cases of fraudulent information. It is important to adhere to the submission deadlines and ensure that all information is accurate to avoid potential complications.

Quick guide on how to complete heavy vehicle use tax declaration form 846

Simplify your existence by filling out Ga Dmv Heavy Vehicle Tax Form 846 with airSlate SignNow

Whether you need to register a new automobile, obtain a driver’s license, transfer title, or carry out any other activity regarding vehicles, managing such RMV paperwork as Ga Dmv Heavy Vehicle Tax Form 846 is a necessary hassle.

There are several methods to obtain them: via postal service, at the RMV service center, or by downloading them from your local RMV website and printing them locally. Each of these options is time-consuming. If you’re seeking a quicker way to complete them and endorse them with a legally-recognized signature, airSlate SignNow is the optimal selection.

How to fill out Ga Dmv Heavy Vehicle Tax Form 846 effortlessly

- Click Show details to read a brief overview of the form you are interested in.

- Select Get form to initiate and open the document.

- Follow the green label indicating the mandatory fields if that pertains to you.

- Utilize the top toolbar and leverage our advanced tools to modify, comment, and enhance the appearance of your document.

- Insert text, your initials, shapes, images, and other components.

- Choose Sign in in the same toolbar to create a legally-recognized signature.

- Review the document text to ensure it contains no mistakes or inconsistencies.

- Click Done to complete the document processing.

Using our service to complete your Ga Dmv Heavy Vehicle Tax Form 846 and other associated documents will save you considerable time and effort. Enhance your RMV form processing from the very beginning!

Create this form in 5 minutes or less

FAQs

-

What is the process to get a heavy vehicle use tax form?

Heavy Vehicle Use Tax is to be filed annually for every heavy vehicle truck running across USA and some parts of Canada. For filing this there are many agents present but it is best that you choose an Authorized IRS filing agent. You can try out (www.expresstrucktax.com) here for your assistance. Your HVUT once filed with them will be transmitted to the IRS instantly within few minutes.On return you would receive a Stamped Schedule 1 which becomes your payment proof.Here is an example of how to file with expresstrucktaxContact: 704.234.6005E-file IRS HVUT Form 2290

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the heavy vehicle use tax declaration form 846

How to make an eSignature for your Heavy Vehicle Use Tax Declaration Form 846 online

How to generate an electronic signature for your Heavy Vehicle Use Tax Declaration Form 846 in Google Chrome

How to generate an electronic signature for putting it on the Heavy Vehicle Use Tax Declaration Form 846 in Gmail

How to generate an eSignature for the Heavy Vehicle Use Tax Declaration Form 846 straight from your mobile device

How to make an electronic signature for the Heavy Vehicle Use Tax Declaration Form 846 on iOS devices

How to make an eSignature for the Heavy Vehicle Use Tax Declaration Form 846 on Android devices

People also ask

-

What is a vehicle declaration form?

A vehicle declaration form is a document that provides essential details about a vehicle, such as its specifications and ownership. This form is often required for various legal and administrative processes, including vehicle registration and compliance checks. airSlate SignNow streamlines the process of completing and eSigning these forms, making it quick and efficient.

-

How does airSlate SignNow help with vehicle declaration forms?

airSlate SignNow offers a user-friendly platform that allows you to easily create, send, and eSign vehicle declaration forms. Our solution simplifies the documentation process, ensuring that all necessary information is captured accurately and promptly. This reduces the time spent on paperwork and leads to better compliance and record-keeping.

-

Is there a cost associated with using airSlate SignNow for vehicle declaration forms?

Yes, airSlate SignNow provides various pricing plans designed to meet the needs of different users. Whether you're a small business or a larger enterprise, you can choose a plan that fits your budget and requirements for managing vehicle declaration forms. Additionally, we offer a free trial so you can explore the platform's features before committing.

-

Can I customize my vehicle declaration form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your vehicle declaration forms to suit specific legal requirements or organizational branding. You can add fields, modify content, and design the layout according to your needs, ensuring that the forms are both functional and visually appealing.

-

What features does airSlate SignNow provide for vehicle declaration forms?

airSlate SignNow includes several features that enhance the management of vehicle declaration forms, such as eSignature capabilities, cloud storage, and mobile accessibility. You can track the status of your forms in real-time, send reminders for signatures, and maintain an organized repository of all completed documentation. These features optimize the entire process, making it efficient and hassle-free.

-

Are there any integrations available for airSlate SignNow to use with vehicle declaration forms?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, document management tools, and cloud storage services. This allows for a fluid workflow when dealing with vehicle declaration forms, as you can connect with tools you already use. By integrating, you can enhance data accuracy and minimize manual entries.

-

How secure is the use of vehicle declaration forms on airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your vehicle declaration forms and sensitive data. All signed documents are securely stored and can only be accessed by authorized users, ensuring your information remains confidential and compliant with industry regulations.

Get more for Ga Dmv Heavy Vehicle Tax Form 846

Find out other Ga Dmv Heavy Vehicle Tax Form 846

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form