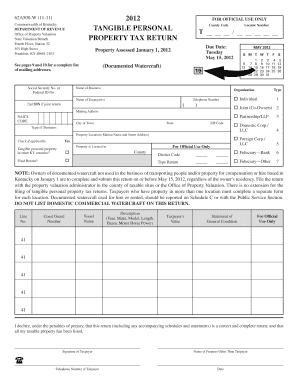

Online Kentucky Tangible Personal Property Tax Return Form

What is the property return form?

The property return form is a crucial document used for reporting tangible personal property for tax purposes. This form is typically required by state tax authorities to assess the value of personal property owned by individuals or businesses. It ensures that property is accurately accounted for in tax assessments, which can include items such as machinery, equipment, and furniture. Understanding the purpose of this form is essential for compliance with state tax regulations.

How to use the property return form

Using the property return form involves several straightforward steps. First, gather all necessary information about the tangible personal property you own, including descriptions, values, and acquisition dates. Next, fill out the form accurately, ensuring that all sections are completed. Once the form is filled out, review it for any errors before submitting it to the appropriate tax authority. Depending on your state, you may have the option to submit the form online, by mail, or in person.

Key elements of the property return form

The property return form contains several key elements that are essential for accurate reporting. These typically include:

- Property Description: A detailed description of each item of tangible personal property.

- Value Assessment: The assessed value of the property, which is often determined based on market value or depreciation.

- Owner Information: The name and contact details of the property owner.

- Acquisition Date: The date when the property was acquired, which can affect tax calculations.

Filing deadlines / important dates

Filing deadlines for the property return form can vary by state, but it is typically due on a specific date each year. It is important to be aware of these deadlines to avoid penalties. Commonly, forms must be submitted by the end of the first quarter of the tax year. Checking with your state tax authority for the exact due date is advisable to ensure compliance.

Required documents

When completing the property return form, certain documents may be required to support the information provided. These can include:

- Purchase Receipts: Proof of purchase for the property being reported.

- Appraisals: Professional appraisals may be necessary to substantiate the value of high-value items.

- Previous Tax Returns: Past returns may provide context for the current filing and help ensure consistency.

Penalties for non-compliance

Failure to file the property return form on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial to understand the importance of timely and accurate submissions to avoid these consequences. Regularly reviewing state regulations can help ensure compliance and minimize risks.

Quick guide on how to complete online kentucky tangible personal property tax return form

Achieve Online Kentucky Tangible Personal Property Tax Return Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Online Kentucky Tangible Personal Property Tax Return Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Online Kentucky Tangible Personal Property Tax Return Form with ease

- Obtain Online Kentucky Tangible Personal Property Tax Return Form and click on Get Form to commence.

- Use the tools we offer to finish your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Online Kentucky Tangible Personal Property Tax Return Form to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online kentucky tangible personal property tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Online Kentucky Tangible Personal Property Tax Return Form?

The Online Kentucky Tangible Personal Property Tax Return Form is a digital solution that allows taxpayers in Kentucky to report their tangible personal property online. This convenient form simplifies the reporting process, reduces paperwork, and ensures timely submission of your tax return.

-

How do I access the Online Kentucky Tangible Personal Property Tax Return Form?

You can access the Online Kentucky Tangible Personal Property Tax Return Form directly through our airSlate SignNow platform. Simply visit our website, and follow the user-friendly prompts to complete and submit your tax return easily and efficiently.

-

Is there a fee to use the Online Kentucky Tangible Personal Property Tax Return Form?

Yes, there may be a nominal fee associated with using the Online Kentucky Tangible Personal Property Tax Return Form through airSlate SignNow. However, this fee often outweighs the benefits, as it provides you with a fast and straightforward way to handle your tax return online.

-

What features does the Online Kentucky Tangible Personal Property Tax Return Form offer?

The Online Kentucky Tangible Personal Property Tax Return Form includes features such as eSignature capabilities, automated reminders, and secure document storage. These features ensure that your tax return process is streamlined and secure, providing you peace of mind throughout the filing season.

-

How can the Online Kentucky Tangible Personal Property Tax Return Form benefit my business?

Utilizing the Online Kentucky Tangible Personal Property Tax Return Form can signNowly benefit your business by saving time and reducing errors in your tax filings. It enables you to file your returns efficiently, ensuring compliance with Kentucky regulations while also allowing you to focus more on your core business activities.

-

Can I integrate the Online Kentucky Tangible Personal Property Tax Return Form with other software?

Yes, the Online Kentucky Tangible Personal Property Tax Return Form can be integrated with various accounting and tax preparation software. This seamless integration minimizes duplicative data entry and enhances overall efficiency in your financial processes.

-

Is the Online Kentucky Tangible Personal Property Tax Return Form secure?

Absolutely! The Online Kentucky Tangible Personal Property Tax Return Form is designed with top-notch security measures to protect your sensitive information. We utilize encryption and secure storage to ensure that your data remains confidential throughout the filing process.

Get more for Online Kentucky Tangible Personal Property Tax Return Form

- Commercial contractor package mississippi form

- Excavation contractor package mississippi form

- Renovation contractor package mississippi form

- Concrete mason contractor package mississippi form

- Demolition contractor package mississippi form

- Security contractor package mississippi form

- Insulation contractor package mississippi form

- Paving contractor package mississippi form

Find out other Online Kentucky Tangible Personal Property Tax Return Form

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe