Form MO 1041 Fiduciary Income Tax Return Dor Mo

What is the Form MO 1041 Fiduciary Income Tax Return Dor Mo

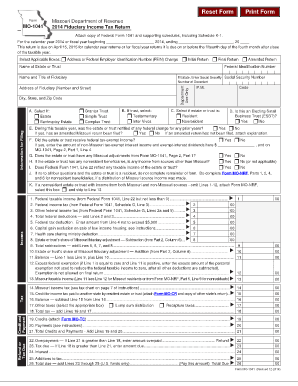

The Form MO 1041 Fiduciary Income Tax Return is a state-specific tax form used in Missouri for reporting income generated by estates or trusts. This form is essential for fiduciaries, such as executors or trustees, who manage the financial affairs of the estate or trust. It allows them to report the income earned during the tax year and to calculate any tax liabilities owed to the state. Understanding this form is crucial for ensuring compliance with Missouri tax laws and for fulfilling fiduciary responsibilities.

Steps to complete the Form MO 1041 Fiduciary Income Tax Return Dor Mo

Completing the Form MO 1041 involves several important steps to ensure accuracy and compliance. Here is a streamlined process:

- Gather necessary documents: Collect all relevant financial documents, including income statements, deductions, and any prior tax returns related to the estate or trust.

- Fill out the form: Enter the required information, including the name and address of the estate or trust, the federal identification number, and the income details.

- Calculate tax liability: Use the provided tax tables and instructions to determine the amount of tax owed based on the income reported.

- Review for accuracy: Double-check all entries for completeness and correctness to avoid errors that could lead to penalties.

- Sign and date the form: Ensure that the fiduciary or authorized representative signs the form, as this is a requirement for submission.

How to obtain the Form MO 1041 Fiduciary Income Tax Return Dor Mo

The Form MO 1041 can be obtained through several convenient methods. It is available for download directly from the Missouri Department of Revenue's website, where you can find the most recent version of the form. Additionally, physical copies may be requested by contacting the Department of Revenue or visiting local tax offices. Ensuring you have the correct and up-to-date form is vital for accurate filing.

Legal use of the Form MO 1041 Fiduciary Income Tax Return Dor Mo

The legal use of the Form MO 1041 is governed by Missouri tax regulations. This form must be filed by fiduciaries to report income generated by estates or trusts, and it serves as a formal declaration of tax obligations to the state. Proper completion and timely submission of this form are essential to avoid legal penalties and ensure compliance with fiduciary duties. Failure to file or inaccuracies in reporting can lead to fines or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form MO 1041 are crucial for compliance. Generally, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For estates or trusts operating on a calendar year, this typically means the deadline is April 15. It is important to stay informed about any changes to these dates, as late filings may incur penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1041 can be submitted through various methods to accommodate different preferences. It can be filed electronically through the Missouri Department of Revenue's online portal, which offers a streamlined process for tax submission. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own benefits, so choosing the one that best suits your needs is advisable.

Quick guide on how to complete form mo 1041 fiduciary income tax return dor mo

Easily Prepare Form MO 1041 Fiduciary Income Tax Return Dor Mo on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and effortlessly. Handle Form MO 1041 Fiduciary Income Tax Return Dor Mo on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Edit and eSign Form MO 1041 Fiduciary Income Tax Return Dor Mo with Ease

- Locate Form MO 1041 Fiduciary Income Tax Return Dor Mo and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form MO 1041 Fiduciary Income Tax Return Dor Mo and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo 1041 fiduciary income tax return dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MO 1041 Fiduciary Income Tax Return Dor Mo?

The Form MO 1041 Fiduciary Income Tax Return Dor Mo is a tax form used in Missouri for reporting the income of estates and trusts. This form ensures fiduciaries comply with state tax laws while detailing income distribution to beneficiaries. Understanding this form is crucial for those managing trusts or estates in Missouri.

-

How can airSlate SignNow assist with Form MO 1041 Fiduciary Income Tax Return Dor Mo?

airSlate SignNow simplifies the process of completing and submitting the Form MO 1041 Fiduciary Income Tax Return Dor Mo by providing an intuitive platform for document e-signature and management. This streamlines the workflow, allowing fiduciaries to easily collect signatures and ensure compliance. Additionally, the platform offers templates to help users get started quickly.

-

What are the pricing options for using airSlate SignNow for Form MO 1041 Fiduciary Income Tax Return Dor Mo?

airSlate SignNow offers flexible pricing plans tailored to the needs of different users. Customers can choose from monthly or annual subscriptions, with various features to accommodate individual or business requirements. The cost-effectiveness of airSlate SignNow makes it an ideal solution for managing Form MO 1041 Fiduciary Income Tax Return Dor Mo efficiently.

-

Is it easy to integrate airSlate SignNow with other software for processing Form MO 1041 Fiduciary Income Tax Return Dor Mo?

Yes, airSlate SignNow provides seamless integrations with various accounting and tax software solutions. This allows users to manage their documents and Form MO 1041 Fiduciary Income Tax Return Dor Mo effortlessly across platforms. The integration capabilities enhance productivity by reducing the need for manual data entry.

-

What features does airSlate SignNow offer that benefit users completing Form MO 1041 Fiduciary Income Tax Return Dor Mo?

airSlate SignNow includes features such as document templates, secure cloud storage, and advanced e-signature options, all of which are beneficial for completing Form MO 1041 Fiduciary Income Tax Return Dor Mo. These features enable users to streamline the entire filing process, ensuring accuracy and timely submission. Moreover, the platform's tracking capabilities allow users to monitor the status of their submissions.

-

Can I use airSlate SignNow on mobile devices for Form MO 1041 Fiduciary Income Tax Return Dor Mo?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing users to complete and e-sign Form MO 1041 Fiduciary Income Tax Return Dor Mo on the go. This mobile accessibility ensures you can manage your tax documents anytime and anywhere, enhancing user flexibility and convenience.

-

What are the benefits of using airSlate SignNow when filing Form MO 1041 Fiduciary Income Tax Return Dor Mo?

Using airSlate SignNow for filing Form MO 1041 Fiduciary Income Tax Return Dor Mo offers numerous benefits, such as saving time and reducing errors with automated workflows. The platform's user-friendly interface makes it accessible to individuals and businesses alike. Furthermore, enhanced document security ensures that sensitive tax information remains protected throughout the process.

Get more for Form MO 1041 Fiduciary Income Tax Return Dor Mo

- Legal last will and testament form for married person with minor children north carolina

- Nc will form

- Legal last will and testament form for married person with adult and minor children from prior marriage north carolina

- Legal last will and testament form for married person with adult and minor children north carolina

- Mutual wills package with last wills and testaments for married couple with adult and minor children north carolina form

- North carolina widow form

- Legal last will and testament form for widow or widower with minor children north carolina

- Legal last will form for a widow or widower with no children north carolina

Find out other Form MO 1041 Fiduciary Income Tax Return Dor Mo

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement