MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report Form

What is the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

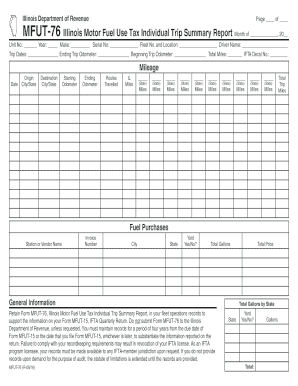

The MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report is a crucial document for individuals and businesses that use motor fuel in Illinois. This report is designed to summarize fuel usage for tax purposes, specifically for those who operate vehicles that are not registered in Illinois but travel within the state. It ensures compliance with state tax regulations and helps in accurately calculating the motor fuel use tax owed to the state.

How to use the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

Using the MFUT 76 involves accurately documenting each trip taken within Illinois. This includes noting the date, starting and ending locations, total miles traveled, and the amount of fuel consumed. It is essential to keep detailed records to support the information provided in the report. Once completed, the report must be submitted to the appropriate state authority as part of the tax filing process.

Steps to complete the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

Completing the MFUT 76 requires several steps to ensure accuracy and compliance:

- Gather Information: Collect data on all trips taken, including dates, routes, and fuel usage.

- Fill Out the Form: Enter the collected data into the MFUT 76 form accurately.

- Review Entries: Double-check all entries for accuracy to avoid discrepancies.

- Submit the Report: Send the completed report to the designated state agency by the filing deadline.

Key elements of the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

The MFUT 76 includes several key elements that must be filled out correctly:

- Trip Date: The date on which the trip occurred.

- Starting and Ending Locations: Addresses or descriptions of where the trip began and ended.

- Total Miles Traveled: The distance covered during the trip.

- Fuel Consumption: The amount of fuel used during the trip, typically measured in gallons.

Filing Deadlines / Important Dates

Timely submission of the MFUT 76 is essential to avoid penalties. The filing deadlines are typically set by the Illinois Department of Revenue and may vary based on the reporting period. It is advisable to check the specific deadlines for quarterly or annual submissions to ensure compliance.

Penalties for Non-Compliance

Failure to accurately complete and submit the MFUT 76 can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to understand the implications of non-compliance and to ensure that all information is reported accurately and on time.

Quick guide on how to complete mfut 76 illinois motor fuel use tax individual trip summary report

Effortlessly Complete MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Modify and eSign MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report with Ease

- Find MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mfut 76 illinois motor fuel use tax individual trip summary report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

The MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report is a crucial document for businesses operating in Illinois that details the fuel use tax for individual trips. This report provides a summary of fuel consumption, ensuring compliance with state tax regulations. Understanding this report is essential for accurate tax filing and avoiding potential penalties.

-

How can airSlate SignNow assist with the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

airSlate SignNow streamlines the process of preparing and submitting the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report. Our eSigning capabilities enable you to easily sign and send this essential document electronically. This results in faster processing times and reduced paperwork.

-

Is there a cost associated with using airSlate SignNow for the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans are flexible and cater to various business sizes and needs. By utilizing airSlate SignNow, you can reduce administrative costs associated with handling the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report.

-

What features does airSlate SignNow offer for creating the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

airSlate SignNow offers features like customizable templates, document tracking, and secure eSigning to facilitate the creation of the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report. These tools allow for efficient management of your documentation and help ensure compliance with Illinois regulations. Additionally, our cloud storage guarantees easy access to your reports anytime.

-

Is airSlate SignNow suitable for large fleets needing to file the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

Absolutely! airSlate SignNow is ideal for businesses of all sizes, including those with large fleets that require filing the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report. Our platform can handle multiple documents simultaneously, ensuring that all your reports are prepared and submitted efficiently. This adaptability makes it a perfect solution for larger operations.

-

Can airSlate SignNow integrate with other platforms for managing the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

Yes, airSlate SignNow provides integration capabilities with various third-party applications, making the management of the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report seamless. You can connect with popular software, such as accounting and fleet management systems, allowing for streamlined data transfer and improved workflow. This integration simplifies the entire process from data collection to report submission.

-

What benefits does using airSlate SignNow provide for the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report?

Using airSlate SignNow for the MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report allows for faster processing, increased accuracy, and enhanced compliance with tax regulations. The electronic signature feature reduces time spent on paperwork while ensuring that your documents are legally binding. These efficiencies can lead to signNow time and cost savings for your business.

Get more for MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

- Renovation contractor package nebraska form

- Concrete mason contractor package nebraska form

- Demolition contractor package nebraska form

- Security contractor package nebraska form

- Insulation contractor package nebraska form

- Paving contractor package nebraska form

- Site work contractor package nebraska form

- Siding contractor package nebraska form

Find out other MFUT 76 Illinois Motor Fuel Use Tax Individual Trip Summary Report

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online