IRS Tax Return Transcript Southern Crescent Technical College Sctech Form

What is the IRS Tax Return Transcript for Southern Crescent Technical College?

The IRS Tax Return Transcript is a document that provides a summary of your tax return information as filed with the Internal Revenue Service. For students at Southern Crescent Technical College, this transcript is often required for financial aid applications and verification processes. It contains essential details such as your adjusted gross income, filing status, and the types of income reported. This document serves as an official record of your tax information, which can be crucial for both academic and financial purposes.

How to Obtain the IRS Tax Return Transcript

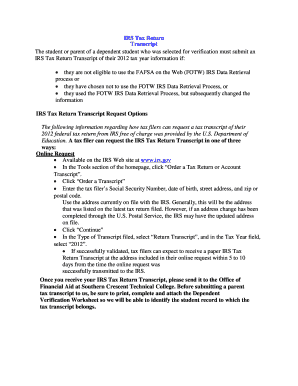

To obtain your IRS Tax Return Transcript, you can use several methods. The easiest way is to request it online through the IRS website, where you can access your transcript immediately. Alternatively, you can order a transcript by mail by completing Form 4506-T and sending it to the IRS. This form allows you to specify the type of transcript you need and the tax years you are requesting. It typically takes five to ten business days to receive your transcript by mail.

Steps to Complete the IRS Tax Return Transcript

Completing the IRS Tax Return Transcript involves several key steps. First, ensure you have your personal information ready, including your Social Security number and filing status. Next, decide whether you will request the transcript online or via mail. If online, navigate to the IRS website and follow the prompts to access your account. If using mail, fill out Form 4506-T accurately, specifying the details required. After submitting your request, check the status if you opted for mail, as it may take some time to process.

Legal Use of the IRS Tax Return Transcript

The IRS Tax Return Transcript is legally recognized as an official document that can be used for various purposes, including financial aid applications, loan applications, and verification of income. Institutions such as Southern Crescent Technical College may require this document to confirm your financial status and eligibility for assistance. It's important to ensure that the transcript is accurate and complete, as discrepancies can lead to delays or issues with your applications.

Key Elements of the IRS Tax Return Transcript

Key elements of the IRS Tax Return Transcript include your adjusted gross income, tax filing status, and the specific forms used in your tax return. Additionally, it may include information about any tax credits or deductions claimed. Understanding these elements is crucial for students at Southern Crescent Technical College, as they may need to provide this information for financial aid or other educational purposes.

Examples of Using the IRS Tax Return Transcript

Students at Southern Crescent Technical College may use the IRS Tax Return Transcript in various scenarios. For instance, when applying for federal student aid through the FAFSA, the transcript serves as proof of income. Additionally, if applying for scholarships or grants, it may be required to demonstrate financial need. Understanding how to use this document effectively can streamline the application process and ensure compliance with financial aid requirements.

Quick guide on how to complete irs tax return transcript southern crescent technical college sctech

Effortlessly prepare IRS Tax Return Transcript Southern Crescent Technical College Sctech on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle IRS Tax Return Transcript Southern Crescent Technical College Sctech on any device using airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

How to modify and eSign IRS Tax Return Transcript Southern Crescent Technical College Sctech with ease

- Locate IRS Tax Return Transcript Southern Crescent Technical College Sctech and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Don’t worry about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Modify and eSign IRS Tax Return Transcript Southern Crescent Technical College Sctech and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs tax return transcript southern crescent technical college sctech

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS Tax Return Transcript, and why do I need it for Southern Crescent Technical College Sctech?

An IRS Tax Return Transcript is a summary of your tax return information, which can be required for financial aid applications at Southern Crescent Technical College Sctech. It provides proof of income that is essential for determining your eligibility for programs and services at the college. Having this document ready can expedite your application process.

-

How can I obtain my IRS Tax Return Transcript for Southern Crescent Technical College Sctech?

You can request your IRS Tax Return Transcript through the IRS website or by calling their customer service. It’s available for free, and you’ll need to provide some personal information to verify your identity. Ensuring you have the transcript crucial for your application to Southern Crescent Technical College Sctech.

-

Are there any fees associated with obtaining my IRS Tax Return Transcript for Southern Crescent Technical College Sctech?

No, obtaining your IRS Tax Return Transcript is free of charge. The IRS provides this service at no cost, which is beneficial for students and their families applying to Southern Crescent Technical College Sctech. Make sure to request it online for quicker access.

-

What do I do if my IRS Tax Return Transcript is incorrect regarding my Southern Crescent Technical College Sctech application?

If you find discrepancies on your IRS Tax Return Transcript, you should contact the IRS immediately to rectify the issue. It is critical that the information aligns with your financial records for Southern Crescent Technical College Sctech. Accurate documentation is vital for your financial aid eligibility.

-

How does the IRS Tax Return Transcript impact my financial aid at Southern Crescent Technical College Sctech?

The IRS Tax Return Transcript is an essential document for verifying your income, affecting the amount of federal aid you may receive. Southern Crescent Technical College Sctech relies on this information to determine your financial support eligibility. Be prepared to submit this transcript when completing your FAFSA.

-

Can I use my IRS Tax Return Transcript for other colleges besides Southern Crescent Technical College Sctech?

Yes, your IRS Tax Return Transcript can be used for financial aid applications at various colleges and universities beyond Southern Crescent Technical College Sctech. It is a standardized document that provides proof of income, making it widely accepted across educational institutions.

-

What features does airSlate SignNow offer for managing IRS Tax Return Transcripts?

airSlate SignNow offers easy document management features that allow you to upload, eSign, and share important files like your IRS Tax Return Transcript. This simplifies the process of submitting your transcript to Southern Crescent Technical College Sctech and keeps your documents secure. The platform enhances efficiency and organization.

Get more for IRS Tax Return Transcript Southern Crescent Technical College Sctech

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497318142 form

- Notice of termination of notice of commencement corporation or llc nebraska form

- Published notice form

- Agreed written termination of lease by landlord and tenant nebraska form

- Published notice of recording of notice of termination corporation nebraska form

- Affidavit that notice of termination sent to all claimants requesting notice individual nebraska form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497318150 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497318151 form

Find out other IRS Tax Return Transcript Southern Crescent Technical College Sctech

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template