Tax Collector Form 162 2006

What is the Tax Collector Form 162

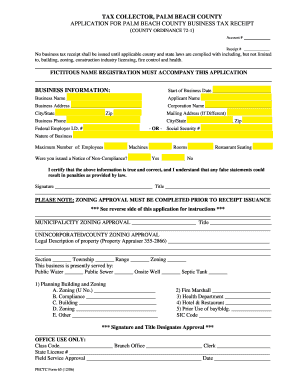

The Tax Collector Form 162 is a crucial document used in various tax-related processes within the United States. This form is typically utilized to report and remit specific tax obligations to local tax authorities. It is essential for ensuring compliance with state and local tax regulations. Understanding the purpose and requirements of the pbctc form 162 is vital for individuals and businesses alike, as it helps in maintaining accurate tax records and fulfilling legal obligations.

How to use the Tax Collector Form 162

Using the Tax Collector Form 162 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the tax obligations being reported. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submission. Depending on local regulations, the form may be submitted online, by mail, or in person at designated tax offices.

Steps to complete the Tax Collector Form 162

Completing the Tax Collector Form 162 requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill in personal information, including name, address, and taxpayer identification number.

- Provide details regarding the tax obligations being reported, including amounts owed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form according to your local tax authority's guidelines.

Legal use of the Tax Collector Form 162

The legal use of the Tax Collector Form 162 is governed by specific regulations that vary by state. This form is legally binding when filled out correctly and submitted in accordance with local laws. It is important to ensure compliance with all relevant tax laws to avoid penalties. The form serves as an official record of tax obligations and payments, making it vital for both individuals and businesses to maintain accurate records.

Who Issues the Form

The Tax Collector Form 162 is typically issued by local tax authorities or county tax collectors. These entities are responsible for managing tax collections and ensuring compliance with tax laws within their jurisdiction. It is advisable to check with your local tax office for the most current version of the form and any specific instructions related to its use.

Penalties for Non-Compliance

Failing to file the Tax Collector Form 162 or submitting inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the implications of non-compliance and to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete tax collector form 162

Complete Tax Collector Form 162 effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals. It offers a superb environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Handle Tax Collector Form 162 on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Tax Collector Form 162 with ease

- Find Tax Collector Form 162 and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Collector Form 162 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax collector form 162

Create this form in 5 minutes!

How to create an eSignature for the tax collector form 162

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pbctc form 162?

The pbctc form 162 is a crucial document used in business transactions that requires electronic signatures. With airSlate SignNow, you can easily manage this form, ensuring a streamlined and efficient signing process. Our platform simplifies how you handle the pbctc form 162, making it easy and compliant with legal standards.

-

How can airSlate SignNow help with the pbctc form 162?

airSlate SignNow offers a user-friendly platform that allows you to quickly complete and send the pbctc form 162. With features like templates and automated workflows, you can enhance your document management process. This ensures you spend less time on paperwork and more on your core business activities.

-

What are the pricing options for using airSlate SignNow for the pbctc form 162?

airSlate SignNow provides competitive pricing for users looking to manage the pbctc form 162 effectively. We offer various plans that cater to different business sizes and needs, ensuring you receive the best value for your investment. You can choose a plan that fits your budget while accessing robust features for document signing.

-

Does airSlate SignNow integrate with other software for the pbctc form 162?

Yes, airSlate SignNow boasts seamless integrations with popular software like Google Drive, Salesforce, and more. This allows you to manage the pbctc form 162 within your existing workflow without disruption. Our integrations help you maintain productivity while simplifying the signing process.

-

What security measures are in place for the pbctc form 162 on airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the pbctc form 162, your documents are protected with advanced encryption and compliance with data protection regulations. You can trust that your sensitive information remains safe while being processed through our platform.

-

Can I use airSlate SignNow for multiple pbctc form 162 documents at once?

Absolutely! airSlate SignNow allows you to manage multiple pbctc form 162 documents simultaneously. You can send bulk requests for signatures, making it efficient for businesses that handle large volumes of documentation frequently.

-

Is there a mobile app for managing the pbctc form 162 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that enables you to manage the pbctc form 162 on the go. Whether you're in the office or out in the field, you can access, send, and sign documents easily through your mobile device. This ensures your business stays agile and responsive.

Get more for Tax Collector Form 162

- Delaware business trust certificate form

- Delaware notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Rule show cause form

- Delaware assumption agreement of mortgage and release of original mortgagors form

- Delaware notices resolutions simple stock ledger and certificate form

- Delaware will form

- Florida promissory note in connection with sale of vehicle or automobile 481379371 form

- Florida painting contract for contractor form

Find out other Tax Collector Form 162

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation