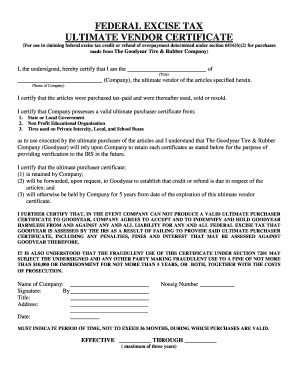

FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ Form

What is the federal excise tax ultimate vendor certificate tire hq?

The federal excise tax ultimate vendor certificate tire hq is a specific form used in the United States to certify that certain tires are exempt from federal excise tax. This form is essential for vendors who sell tires and need to document their tax-exempt status to comply with federal regulations. The certificate serves as proof that the tires sold meet the criteria outlined by the Internal Revenue Service (IRS) for exemption from this tax, which is typically applied to the sale of tires for vehicles. Understanding this form is crucial for businesses in the tire industry to ensure compliance and avoid unnecessary tax liabilities.

How to use the federal excise tax ultimate vendor certificate tire hq

Using the federal excise tax ultimate vendor certificate tire hq involves several key steps. First, the vendor must complete the form accurately, providing all required information about the tires sold and the purchaser. Once filled out, the vendor should retain a copy for their records and provide the original to the buyer. The buyer can then use this certificate to claim the tax exemption when filing their taxes. It is important for both parties to keep a copy of the certificate for their records in case of future audits or inquiries from the IRS.

Steps to complete the federal excise tax ultimate vendor certificate tire hq

Completing the federal excise tax ultimate vendor certificate tire hq requires attention to detail. Here are the steps to follow:

- Gather necessary information, including the vendor's name, address, and taxpayer identification number.

- Provide details about the tires, such as quantity, type, and any relevant specifications.

- Include the purchaser's information, ensuring accuracy in their name and address.

- Sign and date the form to validate its authenticity.

- Make copies for both the vendor's and purchaser's records.

Following these steps ensures that the form is properly completed and legally binding.

Legal use of the federal excise tax ultimate vendor certificate tire hq

The legal use of the federal excise tax ultimate vendor certificate tire hq is governed by IRS regulations. This form must be used correctly to ensure that the tires sold are legitimately exempt from excise tax. Vendors must ensure that the information provided is accurate and truthful, as any discrepancies could lead to penalties or audits. Additionally, the form must be retained for a specific period as outlined by IRS guidelines, typically three years from the date of sale, to ensure compliance and facilitate any necessary reviews by tax authorities.

Key elements of the federal excise tax ultimate vendor certificate tire hq

Several key elements are essential for the federal excise tax ultimate vendor certificate tire hq to be valid:

- Vendor Information: Name, address, and taxpayer identification number of the vendor.

- Tire Details: Description including type, quantity, and any other specifications.

- Purchaser Information: Accurate name and address of the purchaser.

- Signature: The form must be signed and dated by the vendor to confirm its validity.

Ensuring these elements are correctly included is vital for the form's acceptance by the IRS and for maintaining compliance.

Examples of using the federal excise tax ultimate vendor certificate tire hq

Examples of using the federal excise tax ultimate vendor certificate tire hq can help clarify its practical application. For instance, a tire retailer selling a bulk order of tires to a commercial fleet can provide this certificate to the fleet operator. This allows the fleet operator to purchase the tires without incurring federal excise tax. Another example is a tire manufacturer supplying tires to a government agency, which may also qualify for tax exemption. In both cases, the proper completion and use of the certificate are critical for tax compliance and financial accuracy.

Quick guide on how to complete federal excise tax ultimate vendor certificate tire hq

Finalize FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ seamlessly

- Locate FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Modify and eSign FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal excise tax ultimate vendor certificate tire hq

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does tire hq offer for document signing?

Tire hq provides a comprehensive suite of features that streamline the document signing process. It includes customizable templates, multi-signature options, and real-time notifications to keep you informed. These features make it easy to manage and track your documents efficiently.

-

How much does tire hq cost?

The pricing for tire hq is designed to be cost-effective, catering to businesses of all sizes. If you opt for our basic package, you will enjoy essential features at a competitive rate. For more advanced capabilities, our premium packages are also available to meet varied business needs.

-

Is tire hq suitable for small businesses?

Absolutely! Tire hq is particularly beneficial for small businesses seeking an affordable and efficient solution for document management. Our easy-to-use platform helps streamline workflows while keeping costs low, making it a perfect choice for limited budgets.

-

Can tire hq integrate with other software solutions?

Yes, tire hq offers seamless integrations with various popular software solutions. This allows you to connect your existing tools with our platform, enhancing efficiency and workflow. Popular integrations include CRM systems, cloud storage, and project management software.

-

What are the benefits of using tire hq for electronic signatures?

Using tire hq for electronic signatures offers numerous benefits, including increased efficiency and improved document security. It eliminates the need for printing and scanning, speeding up the process signNowly. Additionally, our platform complies with legal standards, ensuring your documents are secure and valid.

-

How secure is tire hq when signing documents?

Tire hq prioritizes document security with robust encryption protocols and strict authenticity checks. This ensures that your sensitive documents remain private and protected against unauthorized access. Our compliance with industry standards further enhances the security of your electronic signatures.

-

What support options are available for tire hq users?

Tire hq provides comprehensive support options to assist users whenever needed. Our dedicated support team is available via email and chat to address any queries you may have. Additionally, we offer extensive online resources, including tutorials and FAQ sections to help you make the most of our platform.

Get more for FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ

Find out other FEDERAL EXCISE TAX ULTIMATE VENDOR CERTIFICATE Tire HQ

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo