Berks Local Income Tax Form

What is the Berks Local Income Tax Form

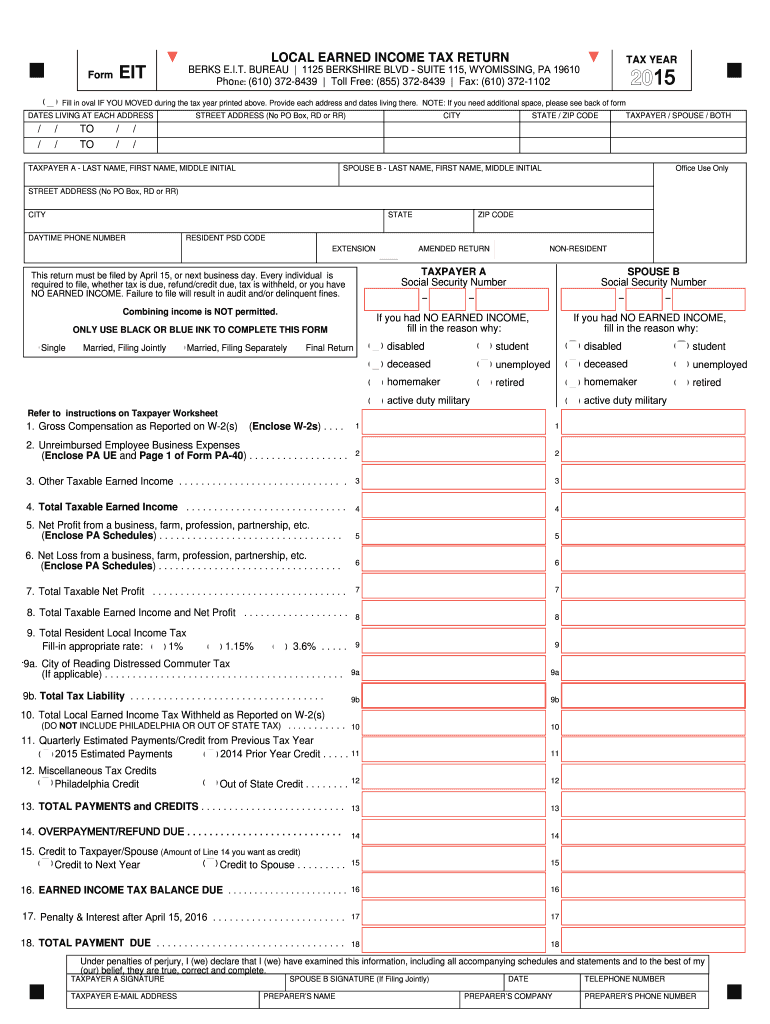

The Berks Local Income Tax Form is a crucial document for residents of Berks County, Pennsylvania, who are subject to the local earned income tax. This form is used to report income earned by individuals and is necessary for compliance with local tax regulations. The Berks Earned Income Tax Bureau oversees the administration of this tax, ensuring that residents fulfill their tax obligations accurately and on time. Understanding this form is essential for maintaining compliance and avoiding penalties.

How to use the Berks Local Income Tax Form

Using the Berks Local Income Tax Form involves several steps to ensure accurate reporting of your income. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and calculate the tax owed based on the local tax rate. Finally, review your form for accuracy before submission to avoid any potential issues.

Steps to complete the Berks Local Income Tax Form

Completing the Berks Local Income Tax Form can be broken down into a series of clear steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information accurately.

- Report your total income from all sources.

- Calculate the local earned income tax based on the applicable rate.

- Double-check all entries for accuracy.

- Submit the form either electronically or by mail, as per your preference.

Legal use of the Berks Local Income Tax Form

The Berks Local Income Tax Form is legally binding when filled out correctly and submitted to the appropriate authorities. It is essential to comply with local tax laws to avoid penalties. The form must be signed and dated by the taxpayer, indicating that the information provided is accurate to the best of their knowledge. Electronic submissions are also valid, provided they meet the legal requirements for eSignatures under U.S. law.

Filing Deadlines / Important Dates

Timely filing of the Berks Local Income Tax Form is critical to avoid penalties. The typical deadline for submission is April 15 for the previous tax year. However, it is important to verify specific dates each year, as they may vary due to weekends or holidays. Keeping track of these deadlines helps ensure compliance and avoids unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

Residents have several options for submitting the Berks Local Income Tax Form. The form can be submitted online through the Berks Earned Income Tax Bureau's website, which often provides a streamlined process for electronic filing. Alternatively, individuals may choose to mail the completed form to the bureau's office or deliver it in person. Each method has its own advantages, and choosing the right one depends on personal preference and convenience.

Quick guide on how to complete berks local income tax form

Effortlessly Complete Berks Local Income Tax Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Berks Local Income Tax Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Alter and Electronically Sign Berks Local Income Tax Form with Ease

- Find Berks Local Income Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your document, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Berks Local Income Tax Form to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the berks local income tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is berks earned income tax and how does it relate to airSlate SignNow?

Berks earned income tax is a local tax imposed on earned income in Berks County, Pennsylvania. airSlate SignNow simplifies the process of managing documents related to this tax, allowing you to eSign and send tax forms quickly and securely. This ensures you can efficiently handle your tax obligations without unnecessary delays.

-

How can airSlate SignNow help with filing berks earned income tax?

Using airSlate SignNow, you can easily eSign and submit documents required for berks earned income tax. The platform allows for seamless document sharing and collaboration, making it easier to track changes and ensure compliance with local tax regulations. This streamlines the overall filing process and helps avoid errors.

-

What are the pricing options for using airSlate SignNow for berks earned income tax?

airSlate SignNow offers a range of pricing plans designed to fit various business needs, allowing you to manage documents for berks earned income tax effectively. Each plan includes essential features such as unlimited signing and document storage. For precise pricing, visit our website or contact our sales team.

-

What features does airSlate SignNow provide for managing berks earned income tax documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for berks earned income tax documents. These tools help ensure that all required forms are correctly filled out and signed. Additionally, built-in security measures protect your sensitive tax information.

-

Can airSlate SignNow integrate with other platforms used for managing berks earned income tax?

Yes, airSlate SignNow offers integrations with various business applications that can assist with berks earned income tax management. This includes accounting software and tax filing systems, enabling you to streamline your workflows and improve overall efficiency when dealing with tax documents.

-

Is there customer support available for questions related to berks earned income tax?

Absolutely! airSlate SignNow provides robust customer support to assist with any inquiries regarding berks earned income tax. Our dedicated support team is available via chat, email, or phone to help you navigate any challenges you may encounter.

-

What benefits can businesses expect from using airSlate SignNow for berks earned income tax?

By using airSlate SignNow for berks earned income tax, businesses can expedite their document signing process, reduce paper clutter, and ensure compliance with local tax laws. The platform enhances productivity by allowing for easy collaboration and tracking of all tax-related documents.

Get more for Berks Local Income Tax Form

- Subcontractors package new mexico form

- Nm theft 497320343 form

- New mexico identity form

- New mexico theft form

- Identity theft by known imposter package new mexico form

- Organizing your personal assets package new mexico form

- Essential documents for the organized traveler package new mexico form

- Essential documents for the organized traveler package with personal organizer new mexico form

Find out other Berks Local Income Tax Form

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template