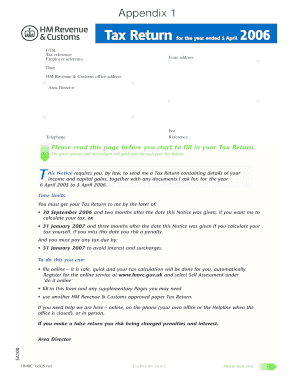

SA100 06 Tax Return Form

What is the SA100 06 Tax Return

The SA100 06 Tax Return is a specific form used by individuals in the United States to report their income and calculate their tax liabilities. This form is essential for self-employed individuals and those with additional income sources outside of traditional employment. It captures various income types, deductions, and credits, ensuring compliance with federal tax regulations. Understanding the purpose and components of this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the SA100 06 Tax Return

Completing the SA100 06 Tax Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, receipts for deductions, and previous tax returns. Next, carefully fill out each section of the form, providing detailed information about your income, expenses, and any applicable credits. It is essential to double-check all entries for accuracy before submission. Finally, choose a method for filing, whether electronically or by mail, and ensure that the form is submitted by the designated deadline.

How to obtain the SA100 06 Tax Return

The SA100 06 Tax Return can be obtained through various channels. It is available for download from the official IRS website, where individuals can access the most current version of the form. Additionally, tax preparation software often includes this form, allowing users to complete it digitally. For those who prefer a physical copy, local IRS offices or tax assistance centers may provide printed versions of the form upon request.

Legal use of the SA100 06 Tax Return

The legal use of the SA100 06 Tax Return is governed by federal tax laws, which stipulate that individuals must accurately report their income and pay any taxes owed. The form serves as a legally binding document, meaning that any false information can lead to penalties, including fines or audits. It is crucial to ensure that all information provided is truthful and complete to maintain compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the SA100 06 Tax Return are critical for avoiding penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, allowing for additional time to file without incurring penalties.

Required Documents

When preparing to complete the SA100 06 Tax Return, several documents are essential. These include W-2 forms from employers, 1099 forms for freelance or contract work, receipts for deductible expenses, and documentation of any tax credits. Collecting these documents in advance can streamline the filing process and help ensure all income and deductions are accurately reported.

Penalties for Non-Compliance

Failure to comply with the requirements of the SA100 06 Tax Return can result in significant penalties. The IRS may impose fines for late filing, underreporting income, or providing false information. In severe cases, non-compliance can lead to audits or legal action. It is vital to understand these potential consequences and take the necessary steps to ensure accurate and timely submission of the form.

Quick guide on how to complete sa100 06 tax return

Effortlessly Prepare SA100 06 Tax Return on Any Device

Online document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage SA100 06 Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign SA100 06 Tax Return with Ease

- Find SA100 06 Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign SA100 06 Tax Return and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa100 06 tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA100 06 Tax Return?

The SA100 06 Tax Return is a self-assessment tax return form used by individuals in the UK to report their income and calculate their tax liabilities. It is essential for ensuring compliance with HMRC regulations. Filing the SA100 correctly can facilitate timely refunds and avoid penalties.

-

How can airSlate SignNow assist with the SA100 06 Tax Return?

airSlate SignNow helps streamline the submission process of your SA100 06 Tax Return by enabling users to eSign and send documents securely. This easy-to-use platform minimizes errors and accelerates the filing process, making it simpler to comply with tax regulations.

-

What are the pricing options for using airSlate SignNow for SA100 06 Tax Return?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs. These plans ensure that users can access essential features for efficiently managing their SA100 06 Tax Return without breaking the bank. Check our pricing page for detailed options.

-

Are there any integrations available for managing the SA100 06 Tax Return with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and other accounting software. These integrations help users manage their SA100 06 Tax Return and associated documents in one centralized and efficient location.

-

What features does airSlate SignNow offer to help with the SA100 06 Tax Return process?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning to enhance your experience with the SA100 06 Tax Return process. These tools streamline the documentation and approval stages, making tax submissions faster and more efficient.

-

How secure is my information when using airSlate SignNow for my SA100 06 Tax Return?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption protocols and compliance measures to ensure that all information related to your SA100 06 Tax Return remains confidential and protected from unauthorized access.

-

How can I get support for my SA100 06 Tax Return questions while using airSlate SignNow?

airSlate SignNow provides dedicated customer support options, including a comprehensive help center and live chat services. Whether you have questions regarding your SA100 06 Tax Return or need assistance with the platform, our team is ready to help.

Get more for SA100 06 Tax Return

- Quitclaim deed one individual grantor to four individual grantees arizona form

- Az limited liability company form

- Arizona renunciation and disclaimer of joint tenant or tenancy interest arizona form

- Affidavit of mailing mechanic liens individual arizona form

- Quitclaim deed by two individuals to llc arizona form

- Warranty deed from two individuals to llc arizona form

- Deed husband wife 497296986 form

- Arizona death deed form

Find out other SA100 06 Tax Return

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement