Form 73A181 Kentucky Department of Revenue Revenue Ky

What is the Form 73A181 Kentucky Department Of Revenue Revenue Ky

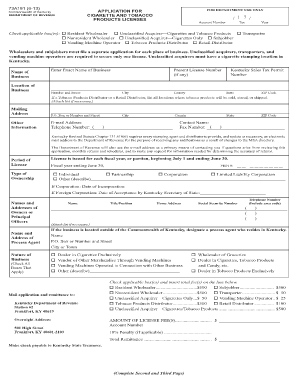

The Form 73A181 is a specific document issued by the Kentucky Department of Revenue. It is primarily used for tax purposes, allowing individuals and businesses to report various financial information required by the state. This form plays a crucial role in ensuring compliance with Kentucky's tax laws and regulations. Understanding its purpose is essential for accurate reporting and avoiding potential penalties.

How to obtain the Form 73A181 Kentucky Department Of Revenue Revenue Ky

Obtaining the Form 73A181 is a straightforward process. Individuals can access the form directly from the Kentucky Department of Revenue's official website. It is available in a downloadable format, allowing users to print and fill it out as needed. Additionally, physical copies may be available at local revenue offices for those who prefer in-person assistance.

Steps to complete the Form 73A181 Kentucky Department Of Revenue Revenue Ky

Completing the Form 73A181 involves several key steps. First, gather all necessary financial documents and information that pertain to your tax situation. Next, carefully fill out each section of the form, ensuring that all details are accurate. It is important to double-check for any errors or omissions before submission. Finally, sign and date the form, as this is a critical step in validating your submission.

Legal use of the Form 73A181 Kentucky Department Of Revenue Revenue Ky

The Form 73A181 is legally binding when completed correctly and submitted according to Kentucky's tax regulations. It must be filled out with accurate information, as any discrepancies may lead to legal issues or penalties. Utilizing reliable digital tools to eSign the form can enhance its legal validity, ensuring compliance with electronic signature laws.

Key elements of the Form 73A181 Kentucky Department Of Revenue Revenue Ky

Key elements of the Form 73A181 include personal identification information, financial data relevant to the tax year, and specific sections that require signatures. Each part of the form serves a distinct purpose in the tax reporting process, making it essential to provide complete and accurate information. Understanding these elements can help users navigate the form more effectively.

Form Submission Methods (Online / Mail / In-Person)

The Form 73A181 can be submitted through various methods, providing flexibility for users. It can be filed online through the Kentucky Department of Revenue's e-filing system, which may offer quicker processing times. Alternatively, individuals can mail the completed form to the appropriate address listed on the form itself. For those who prefer direct interaction, in-person submissions are also accepted at local revenue offices.

Quick guide on how to complete form 73a181 kentucky department of revenue revenue ky

Complete Form 73A181 Kentucky Department Of Revenue Revenue Ky effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form 73A181 Kentucky Department Of Revenue Revenue Ky on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to amend and eSign Form 73A181 Kentucky Department Of Revenue Revenue Ky without hassle

- Locate Form 73A181 Kentucky Department Of Revenue Revenue Ky and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to confirm your modifications.

- Select your preferred method to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow manages your document organization needs in just a few clicks from any device of your choice. Edit and eSign Form 73A181 Kentucky Department Of Revenue Revenue Ky and guarantee excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 73a181 kentucky department of revenue revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

The Form 73A181 Kentucky Department Of Revenue Revenue Ky is a specific tax form used for various revenue-related submissions in Kentucky. Understanding its requirements is crucial for compliance with state tax regulations. This form helps streamline the submission process for businesses and individuals alike.

-

How can airSlate SignNow help with the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form 73A181 Kentucky Department Of Revenue Revenue Ky. The user-friendly interface allows you to complete and submit this form quickly, reducing processing time and enhancing accuracy in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

Yes, there is a subscription fee to use airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing model is competitive, and the value it provides in saving time and reducing errors when submitting the Form 73A181 Kentucky Department Of Revenue Revenue Ky is well worth the investment.

-

What features does airSlate SignNow offer for managing the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure document storage to efficiently manage the Form 73A181 Kentucky Department Of Revenue Revenue Ky. Additionally, you can track document status in real-time, ensuring you know when submissions are completed and received.

-

Can I integrate airSlate SignNow with other software for the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

Absolutely! airSlate SignNow offers a range of integrations with popular software applications that help streamline your business processes. This means you can easily incorporate the Form 73A181 Kentucky Department Of Revenue Revenue Ky into existing workflows and software ecosystems.

-

What are the benefits of using airSlate SignNow for the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

Using airSlate SignNow to handle the Form 73A181 Kentucky Department Of Revenue Revenue Ky provides several advantages. It enhances document security, speeds up the signing process, and reduces the risk of errors that can arise from paper forms, ultimately leading to a more efficient tax submission experience.

-

Is airSlate SignNow compliant with regulations for the Form 73A181 Kentucky Department Of Revenue Revenue Ky?

Yes, airSlate SignNow complies with the necessary regulations to ensure that the Form 73A181 Kentucky Department Of Revenue Revenue Ky is handled securely and legally. The platform is designed to meet industry standards for data protection and electronic signatures, providing peace of mind for users.

Get more for Form 73A181 Kentucky Department Of Revenue Revenue Ky

- Sheetrock drywall contractor package new york form

- Flooring contractor package new york form

- Trim carpentry contractor package new york form

- Fencing contractor package new york form

- Hvac contractor package new york form

- Landscaping contractor package new york form

- Commercial contractor package new york form

- Excavation contractor package new york form

Find out other Form 73A181 Kentucky Department Of Revenue Revenue Ky

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast