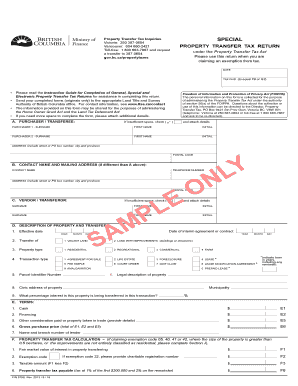

FIN 579S Sample Special Property Transfer Tax Return This is a Sample Version of a Special Property Transfer Tax Return Rev Gov Form

Understanding the FIN 579S Sample Special Property Transfer Tax Return

The FIN 579S Sample Special Property Transfer Tax Return is a specific form used in the United States for reporting property transfer taxes. This form is essential for individuals or entities involved in the transfer of property, ensuring compliance with state tax regulations. It is designed to capture information about the transaction, including the parties involved, the property details, and the tax amount due. Understanding the purpose and requirements of this form is crucial for accurate filing and avoiding penalties.

Steps to Complete the FIN 579S Sample Special Property Transfer Tax Return

Completing the FIN 579S Sample Special Property Transfer Tax Return involves several key steps:

- Gather necessary information about the property and the parties involved in the transfer.

- Fill out the form accurately, ensuring all sections are completed, including property descriptions and transfer details.

- Calculate the transfer tax based on the property's value and applicable rates.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate state tax authority, either online or by mail, depending on local regulations.

Legal Use of the FIN 579S Sample Special Property Transfer Tax Return

The FIN 579S Sample Special Property Transfer Tax Return is legally binding when completed and submitted according to state laws. It serves as an official record of the property transfer and the associated tax obligation. To ensure its legal validity, all required signatures must be present, and the form must be filed within the designated time frame. Compliance with state regulations regarding property transfers is essential to avoid legal issues and penalties.

Required Documents for the FIN 579S Sample Special Property Transfer Tax Return

When preparing to file the FIN 579S Sample Special Property Transfer Tax Return, certain documents are typically required:

- Proof of property ownership, such as a deed or title.

- Identification details of the parties involved in the transfer.

- Valuation documents to support the assessed value of the property.

- Any prior tax documents related to the property, if applicable.

Filing Deadlines for the FIN 579S Sample Special Property Transfer Tax Return

Filing deadlines for the FIN 579S Sample Special Property Transfer Tax Return vary by state. Typically, the form must be submitted within a specific period following the property transfer date. It is important to check local regulations to ensure timely submission and avoid late fees or penalties. Staying informed about these deadlines is crucial for compliance and proper tax management.

Examples of Using the FIN 579S Sample Special Property Transfer Tax Return

The FIN 579S Sample Special Property Transfer Tax Return can be used in various scenarios, including:

- When an individual sells their home to a new buyer.

- In the case of a property inheritance, where the property is transferred to heirs.

- During a business transaction involving the transfer of commercial real estate.

Each of these examples illustrates the importance of accurately completing the form to ensure all tax obligations are met.

Quick guide on how to complete fin 579s sample special property transfer tax return this is a sample version of a special property transfer tax return rev gov

Effortlessly prepare FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov on any device

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov with ease

- Locate FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Disregard the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 579s sample special property transfer tax return this is a sample version of a special property transfer tax return rev gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax return example?

A tax return example is a sample document that demonstrates how various sections of a tax return form should be filled out. It helps individuals understand what information is required and how to properly report their income and deductions. By reviewing a tax return example, users can gain insights into best practices for their own tax filings.

-

How can airSlate SignNow assist with signing tax return examples?

airSlate SignNow makes it easy to eSign tax return examples and other important documents digitally. With our user-friendly platform, you can upload your tax return example, send it to others for their signatures, and ensure that all signatures are legally binding. This streamlines the process, making tax preparation less stressful.

-

Is there a free trial for airSlate SignNow to work with tax return examples?

Yes! airSlate SignNow offers a free trial that allows users to explore the platform's features, including handling tax return examples. During the trial, you can test the document management and eSigning capabilities, helping you decide if it meets your needs for processing tax return examples.

-

What features does airSlate SignNow offer that are beneficial for tax return examples?

airSlate SignNow provides a range of features designed for efficient document management, making it perfect for handling tax return examples. These features include customizable templates, automated workflows, and secure cloud storage. All these tools help ensure that your tax return examples are organized and easily accessible.

-

Can I integrate airSlate SignNow with accounting software for tax return examples?

Absolutely! airSlate SignNow integrates seamlessly with many accounting software solutions, allowing for easy access to tax return examples. This integration simplifies the data transfer between your accounting platform and the eSigning process, enhancing efficiency in completing your tax returns.

-

What are the pricing options for airSlate SignNow if I need to handle tax return examples regularly?

airSlate SignNow offers several pricing tiers to accommodate various business needs, especially for those handling tax return examples regularly. Our plans are designed to be cost-effective while providing access to advanced features such as bulk sending and custom branding. Choose a plan that aligns with your requirements for ease of tax document management.

-

How secure is airSlate SignNow for storing tax return examples?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like tax return examples. We employ bank-level encryption and secure cloud storage to protect your data. Additionally, our compliance with major regulations ensures that your tax return examples are stored safely.

Get more for FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov

- Letter from landlord to tenant as notice of default on commercial lease pennsylvania form

- Pa lease form

- Commercial rental lease application questionnaire pennsylvania form

- Apartment lease rental application questionnaire pennsylvania form

- Residential rental lease application pennsylvania form

- Salary verification form for potential lease pennsylvania

- Pennsylvania landlord tenant 497324627 form

- Notice of default on residential lease pennsylvania form

Find out other FIN 579S Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property Transfer Tax Return Rev Gov

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now