E Conveyancing Error Resolution Form Revenue NSW

What is the E Conveyancing Error Resolution Form Revenue NSW

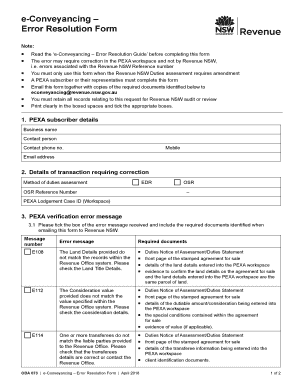

The E Conveyancing Error Resolution Form Revenue NSW is a specialized document designed to address and rectify errors that may occur during the electronic conveyancing process. This form is essential for individuals and businesses involved in property transactions, ensuring that any discrepancies are formally documented and resolved. It serves as a means to communicate issues related to property transfers, ensuring compliance with legal requirements and protecting the interests of all parties involved.

Steps to complete the E Conveyancing Error Resolution Form Revenue NSW

Completing the E Conveyancing Error Resolution Form requires a systematic approach to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary information, including details of the property and the nature of the error.

- Fill out the form with accurate and complete information, ensuring all required fields are addressed.

- Review the completed form for any errors or omissions to avoid delays in processing.

- Submit the form electronically through the designated platform, ensuring all supporting documents are attached.

Legal use of the E Conveyancing Error Resolution Form Revenue NSW

The E Conveyancing Error Resolution Form is legally recognized in the context of property transactions in New South Wales. It complies with relevant legislation governing electronic conveyancing, ensuring that any corrections made through this form are valid and enforceable. Proper use of the form helps mitigate legal risks associated with property errors and ensures that all parties adhere to the legal framework established for electronic transactions.

Key elements of the E Conveyancing Error Resolution Form Revenue NSW

Understanding the key elements of the E Conveyancing Error Resolution Form is crucial for effective use. The form typically includes:

- Property Details: Information about the property in question, including address and title details.

- Error Description: A clear explanation of the error that needs correction.

- Contact Information: Details of the parties involved, including their roles in the transaction.

- Supporting Documentation: Any additional documents that substantiate the claim or error being reported.

How to use the E Conveyancing Error Resolution Form Revenue NSW

Using the E Conveyancing Error Resolution Form effectively involves understanding its purpose and following the correct procedures. The form should be utilized when an error is identified in a property transaction that was processed electronically. Users must ensure they have all relevant information and documentation before starting the process. After completing the form, it should be submitted through the appropriate electronic channels designated by Revenue NSW, ensuring that all parties involved are notified of the submission.

Examples of using the E Conveyancing Error Resolution Form Revenue NSW

Examples of scenarios where the E Conveyancing Error Resolution Form may be used include:

- Correcting a misspelled name on the property title.

- Addressing discrepancies in property boundaries as recorded in electronic documents.

- Rectifying errors in the financial details associated with the property transaction.

Quick guide on how to complete e conveyancing error resolution form revenue nsw

Effortlessly Prepare E Conveyancing Error Resolution Form Revenue NSW on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage E Conveyancing Error Resolution Form Revenue NSW on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to Edit and eSign E Conveyancing Error Resolution Form Revenue NSW with Ease

- Find E Conveyancing Error Resolution Form Revenue NSW and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight important sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign E Conveyancing Error Resolution Form Revenue NSW and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e conveyancing error resolution form revenue nsw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 78086900?

airSlate SignNow is an advanced electronic signature solution that allows businesses to send and eSign documents efficiently. The product code 78086900 refers to a specific plan or feature set that ensures you get the best out of airSlate SignNow's capabilities for your document management needs.

-

How much does airSlate SignNow cost under the 78086900 plan?

The pricing for airSlate SignNow under the 78086900 plan is designed to be cost-effective, making it accessible for businesses of all sizes. It features a competitive subscription model, which provides excellent value for its comprehensive eSigning capabilities.

-

What features are included in the airSlate SignNow 78086900 plan?

The 78086900 plan includes features such as unlimited document signing, customized workflows, templates, and robust security measures. This ensures that you can manage all your documents with ease and trust throughout the signing process.

-

How can airSlate SignNow benefit my business compared to competitors?

airSlate SignNow provides a streamlined eSigning process, saving time and resources for businesses. The 78086900 plan enhances these benefits with unique features such as advanced integrations and a user-friendly interface that set it apart from competitors.

-

What integrations are available with airSlate SignNow under the 78086900 plan?

The 78086900 plan of airSlate SignNow offers a wide range of integrations with popular applications like Salesforce, Google Drive, and Dropbox. These integrations facilitate seamless workflows and allow users to eSign documents directly from their favorite platforms.

-

Is airSlate SignNow compliant with e-signature laws?

Yes, airSlate SignNow is fully compliant with international e-signature laws, including ESIGN and UETA. The 78086900 plan ensures that your electronically signed documents are legally binding and secure, giving you peace of mind in your transactions.

-

Can I try airSlate SignNow before committing to the 78086900 plan?

Absolutely! airSlate SignNow offers a free trial for prospective users to explore the features of the 78086900 plan. This allows you to experience how the platform can enhance your document signing processes without any initial commitment.

Get more for E Conveyancing Error Resolution Form Revenue NSW

- Letter from landlord to tenant as notice to remove wild animals in premises oregon form

- Landlord tenant notice 497323655 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497323656 form

- Oregon letter form

- Oregon tenant notice form

- Tenant landlord demand 497323659 form

- Oregon letter demand form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497323661 form

Find out other E Conveyancing Error Resolution Form Revenue NSW

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed