Form IL 1040 Illinois Department of Revenue

What is the Form IL 1040 Illinois Department Of Revenue

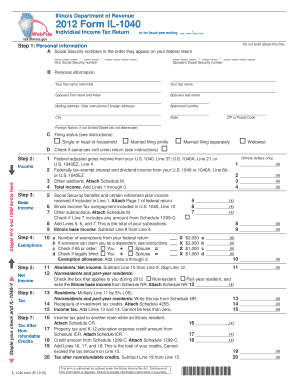

The Form IL 1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Illinois, as it allows them to report wages, salaries, and other sources of income. The Illinois Department of Revenue uses this form to assess the amount of tax owed or the refund due to the taxpayer. It is important for residents to accurately complete this form to ensure compliance with state tax laws.

How to use the Form IL 1040 Illinois Department Of Revenue

Using the Form IL 1040 involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other relevant income statements. Next, fill out the form by providing personal information, income details, and any applicable deductions or credits. It is crucial to ensure that all information is accurate and complete to avoid delays in processing. Once the form is filled out, it can be submitted electronically or by mail to the Illinois Department of Revenue.

Steps to complete the Form IL 1040 Illinois Department Of Revenue

Completing the Form IL 1040 requires a systematic approach to ensure accuracy. Start by entering your personal information, including your name, address, and Social Security number. Next, report your total income, which may include wages, interest, and dividends. After calculating your total income, apply any deductions or credits for which you qualify. Finally, determine your tax liability and any payments or refunds due. Review the completed form carefully before submission to ensure all information is correct.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1040 are critical to avoid penalties and interest. Typically, the deadline for submitting the form is April 15 of each year, coinciding with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each tax year to ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form IL 1040 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically using approved e-filing software, which often provides a faster processing time. Alternatively, the form can be printed and mailed to the Illinois Department of Revenue. For those who prefer in-person submission, visits to designated tax offices may also be an option. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Penalties for Non-Compliance

Failure to file the Form IL 1040 or inaccuracies in reporting can lead to penalties imposed by the Illinois Department of Revenue. Common penalties include late filing fees, interest on unpaid taxes, and potential legal action for severe cases of tax evasion. It is essential for taxpayers to understand these consequences and ensure timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form il 1040 illinois department of revenue

Complete Form IL 1040 Illinois Department Of Revenue effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without holdups. Manage Form IL 1040 Illinois Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Form IL 1040 Illinois Department Of Revenue with ease

- Obtain Form IL 1040 Illinois Department Of Revenue and click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or disorganized documents, tiresome form searching, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form IL 1040 Illinois Department Of Revenue and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 1040 illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IL 1040 from the Illinois Department Of Revenue?

Form IL 1040 is the individual income tax return form required by the Illinois Department Of Revenue for state tax filing. This form helps residents report their income, deductions, and ultimately calculate their tax obligation. Completing this form accurately is essential for compliance with Illinois tax laws.

-

How can I eSign Form IL 1040 using airSlate SignNow?

With airSlate SignNow, you can easily eSign Form IL 1040 from the Illinois Department Of Revenue by uploading the document into our platform. Once uploaded, add the necessary signature fields and invite other parties to sign electronically. This streamlines the signing process, making tax filing efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for Form IL 1040?

Using airSlate SignNow for Form IL 1040 offers numerous benefits, including increased efficiency and reduced paper usage. Our platform allows you to track the signing process in real-time and securely store your documents, ensuring compliance with the Illinois Department Of Revenue's requirements. Plus, our intuitive interface makes it simple for anyone to use.

-

Is there a cost to use airSlate SignNow for eSigning Form IL 1040?

airSlate SignNow offers various pricing plans that cater to different needs, whether you're an individual or a business. Our plans are cost-effective and designed to provide value while allowing you to eSign and manage documents like Form IL 1040 easily. Visit our pricing page for detailed information about each plan.

-

Can I integrate airSlate SignNow with other applications for Form IL 1040 processing?

Yes, airSlate SignNow supports a variety of integrations with popular applications, making it convenient to manage Form IL 1040 alongside other tools you use. This includes CRM systems, cloud storage services, and workflow management tools. Integrating these systems ensures a seamless experience in handling your tax documents.

-

How secure is airSlate SignNow when handling Form IL 1040?

At airSlate SignNow, we prioritize security and compliance, especially when dealing with sensitive documents like Form IL 1040 from the Illinois Department Of Revenue. Our platform employs advanced encryption protocols, ensuring your data is protected at all times. You can trust us to keep your information safe and confidential.

-

What features does airSlate SignNow offer for managing Form IL 1040?

airSlate SignNow provides several features designed to streamline the management of Form IL 1040, including customizable templates, real-time tracking, and automated reminders. These features help ensure that you never miss a deadline and that all necessary signatures are obtained. Simplifying your tax process is our goal.

Get more for Form IL 1040 Illinois Department Of Revenue

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages rhode form

- Rhode island tenant 497325139 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable rhode island form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration rhode form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497325142 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement rhode island form

- Rhode island tenant 497325144 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants rhode island form

Find out other Form IL 1040 Illinois Department Of Revenue

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free