Certification Regarding Beneficial Owners Form

What is the Certification Regarding Beneficial Owners

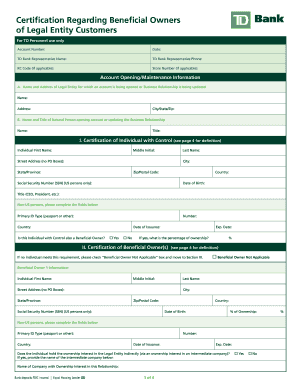

The Certification Regarding Beneficial Owners is a crucial document designed to enhance transparency in business transactions. It identifies the individuals who ultimately own or control a legal entity, ensuring compliance with anti-money laundering regulations. This form is particularly important for financial institutions and businesses, as it helps prevent illicit activities by requiring disclosure of beneficial ownership information. Understanding this form is essential for any entity engaged in financial dealings or regulatory compliance.

Steps to complete the Certification Regarding Beneficial Owners

Completing the Certification Regarding Beneficial Owners involves several key steps to ensure accuracy and compliance. First, gather necessary information about the beneficial owners, including their names, addresses, and ownership percentages. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to review the information for any errors or omissions before submission. Once completed, the form must be signed by an authorized representative of the entity, affirming the truthfulness of the information provided.

Legal use of the Certification Regarding Beneficial Owners

The legal use of the Certification Regarding Beneficial Owners is governed by various federal and state regulations aimed at promoting transparency in financial transactions. This form must be used in accordance with the Bank Secrecy Act and other relevant laws to ensure that beneficial ownership information is accurately reported. Failure to comply with these regulations can result in significant penalties, including fines and legal repercussions for the entity involved. Therefore, understanding the legal implications of this form is vital for compliance.

Required Documents

To complete the Certification Regarding Beneficial Owners, several documents may be required. These typically include identification documents for each beneficial owner, such as a driver's license or passport, as well as proof of the entity's formation, like articles of incorporation or a partnership agreement. Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported on the form.

Penalties for Non-Compliance

Non-compliance with the requirements surrounding the Certification Regarding Beneficial Owners can lead to severe penalties. Entities that fail to accurately disclose beneficial ownership information may face fines, legal action, and increased scrutiny from regulatory bodies. Additionally, individuals responsible for the inaccuracies may also be held accountable, which can result in personal liability. Understanding these potential consequences underscores the importance of diligent compliance with this form.

Form Submission Methods

The Certification Regarding Beneficial Owners can typically be submitted through various methods, including online platforms, mail, or in-person submission at designated offices. Each method has its own requirements and processing times, so it is essential to choose the most appropriate option based on the entity's needs. Online submission is often the quickest and most efficient way to ensure timely processing, while mail submissions may require additional time for delivery and handling.

Examples of using the Certification Regarding Beneficial Owners

Examples of using the Certification Regarding Beneficial Owners include scenarios where businesses apply for loans, open bank accounts, or engage in mergers and acquisitions. In each case, financial institutions require this certification to verify the identities of the individuals who ultimately control the entity. This form serves as a safeguard against fraud and ensures that all parties involved are compliant with relevant regulations, thereby fostering a more transparent business environment.

Quick guide on how to complete certification regarding beneficial owners

Easily Prepare Certification Regarding Beneficial Owners on Any Device

Digital document management is becoming increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and effortlessly. Manage Certification Regarding Beneficial Owners on any device using the airSlate SignNow mobile applications for Android or iOS and streamline your document-related tasks today.

The Easiest Way to Alter and eSign Certification Regarding Beneficial Owners Without Stress

- Locate Certification Regarding Beneficial Owners and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information with tools provided by airSlate SignNow designed for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Certification Regarding Beneficial Owners to ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certification regarding beneficial owners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certification Regarding Beneficial Owners?

A Certification Regarding Beneficial Owners is a legal document that verifies the identity of individuals who hold signNow ownership or control over an entity. This certification is essential for compliance with various regulatory requirements, ensuring transparency in business operations.

-

How does airSlate SignNow support the Certification Regarding Beneficial Owners process?

airSlate SignNow streamlines the process of obtaining a Certification Regarding Beneficial Owners by providing a user-friendly platform for electronic signatures. This not only accelerates the approval workflow but also ensures that all documents are securely stored and easily accessible for future reference.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans that cater to the needs of different businesses. The plans are designed to provide cost-effective solutions for eSigning documents, including the Certification Regarding Beneficial Owners, making compliance easier without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing the Certification Regarding Beneficial Owners?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your document management processes. This capability allows users to collect, store, and manage their Certifications Regarding Beneficial Owners alongside other essential business documents.

-

What features does airSlate SignNow offer that enhance document security for the Certification Regarding Beneficial Owners?

airSlate SignNow prioritizes document security with features such as digital signature encryption, secure storage, and audit trails. These measures ensure that your Certification Regarding Beneficial Owners remains confidential and legally compliant throughout its lifecycle.

-

Is airSlate SignNow suitable for small businesses looking to handle Certification Regarding Beneficial Owners?

Absolutely! airSlate SignNow is designed to be accessible for businesses of all sizes, including small enterprises. Its cost-effective solutions and user-friendly interface make it easy for small businesses to manage their Certification Regarding Beneficial Owners efficiently.

-

What are the benefits of using airSlate SignNow for the Certification Regarding Beneficial Owners?

Using airSlate SignNow for your Certification Regarding Beneficial Owners can greatly increase efficiency and reduce turnaround times. The platform minimizes paperwork and allows for quick electronic signing, ensuring your compliance documentation is always up to date.

Get more for Certification Regarding Beneficial Owners

- Form district court

- Acknowledgment of responsibilities of conservator andor guardian colorado form

- Acceptance of office colorado form

- Notice respondent form

- Response generic colorado form

- Report conservatorship form

- Instructions for collecting a judgment and completing a writ of garnishment colorado form

- Instructions for appointment of guardian for minor by will or other signed writing colorado form

Find out other Certification Regarding Beneficial Owners

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now