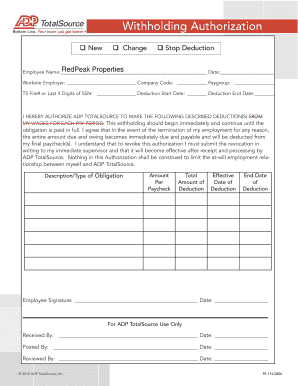

Withholding Authorization Form

What is the Withholding Authorization

The withholding authorization form is a crucial document used by employees to request adjustments in the amount of federal income tax withheld from their paychecks. This form allows individuals to specify their desired withholding amount based on personal circumstances, such as changes in marital status, dependents, or other tax situations. By accurately completing this form, employees can ensure that the correct amount is withheld, helping them avoid underpayment or overpayment of taxes throughout the year.

Steps to complete the Withholding Authorization

Completing the withholding authorization form involves several straightforward steps. First, gather necessary information, including your Social Security number and details about your income and deductions. Next, fill out the form by providing personal information and indicating your desired withholding amount. It is essential to review the form for accuracy before submission. Finally, submit the completed form to your employer's payroll department, ensuring that it is processed in time for the next payroll cycle.

Legal use of the Withholding Authorization

The withholding authorization form is legally recognized and must comply with federal tax regulations. It serves as an official request for your employer to adjust the withholding amounts based on your instructions. To ensure its legal validity, the form should be filled out accurately and submitted in a timely manner. Employers are required to honor the requests made on the form, provided they are completed correctly and adhere to IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines regarding the withholding authorization form, outlining how it should be completed and submitted. These guidelines include instructions on how to determine the appropriate withholding amount based on individual tax situations. It is important for employees to consult the IRS website or a tax professional to understand the implications of their withholding choices and to ensure compliance with the latest tax laws.

Required Documents

To complete the withholding authorization form, certain documents may be required. These typically include your Social Security card, recent pay stubs, and any relevant tax documents that reflect your financial situation. Having these documents on hand can facilitate the completion of the form and help ensure that your withholding amount is accurately calculated based on your current circumstances.

Form Submission Methods

The withholding authorization form can be submitted through various methods, depending on your employer's policies. Common submission methods include online submission via the employer's payroll system, mailing a physical copy to the payroll department, or delivering it in person. It is advisable to confirm with your employer which method is preferred to ensure timely processing of your request.

Penalties for Non-Compliance

Failure to submit a withholding authorization form or submitting it incorrectly can lead to penalties. If too little tax is withheld, employees may face underpayment penalties when filing their tax returns. Conversely, over-withholding can result in cash flow issues throughout the year. Understanding the importance of this form can help individuals avoid potential penalties and ensure their tax obligations are met accurately and efficiently.

Quick guide on how to complete withholding authorization

Complete Withholding Authorization easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle Withholding Authorization on any platform with airSlate SignNow Android or iOS applications and simplify any document-related operation today.

How to modify and electronically sign Withholding Authorization effortlessly

- Obtain Withholding Authorization and click on Get Form to begin.

- Use the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Withholding Authorization and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding authorization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Withholding Authorization and how can airSlate SignNow help?

Withholding Authorization is a legal document that allows an organization to manage tax withholding on behalf of employees. airSlate SignNow streamlines the process of creating, signing, and managing Withholding Authorization documents, making it easier for businesses to stay compliant and efficiently handle employee requests.

-

How does airSlate SignNow ensure the security of Withholding Authorization documents?

airSlate SignNow prioritizes security with encryption protocols and secure cloud storage to protect your Withholding Authorization documents. Our platform complies with industry standards, ensuring that sensitive information remains confidential and only accessible to authorized users.

-

What features does airSlate SignNow offer for managing Withholding Authorization?

airSlate SignNow provides features like customizable templates, electronic signatures, and automated workflows for Withholding Authorization. These tools simplify the document management process, allowing users to collect signatures quickly and efficiently while reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Withholding Authorization?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for managing Withholding Authorization. Our cost-effective solutions provide great value, enabling businesses to utilize essential document management features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Withholding Authorization?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Workspace, Salesforce, and Microsoft Office, enhancing your ability to manage Withholding Authorization documents efficiently. These integrations help centralize your document processes and improve overall productivity.

-

How does electronic signing of Withholding Authorization documents work?

With airSlate SignNow, electronic signing of Withholding Authorization documents is a straightforward process. Users can send documents for signature via email, and signers can review and sign them with just a few clicks, all while maintaining a legally binding status recognized by eSignature laws.

-

What are the benefits of using airSlate SignNow for Withholding Authorization?

Using airSlate SignNow for Withholding Authorization offers numerous benefits, including faster turnaround times, reduced paper waste, and enhanced compliance. The intuitive platform makes it easy for businesses to manage their documentation needs efficiently, contributing to overall operational effectiveness.

Get more for Withholding Authorization

- Sc judgment form

- Conditional waiver and release of claim of lien upon final payment south carolina form

- Landlord notice premises form

- South carolina notice 497325636 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497325637 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair south carolina form

- South carolina broken form

- Letter from tenant to landlord with demand that landlord repair broken windows south carolina form

Find out other Withholding Authorization

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online