Nyc Cr Q3 Form

What is the NYC CR Q3?

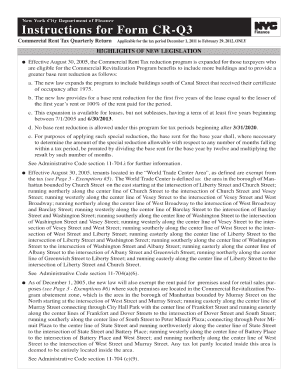

The NYC CR Q3 is a commercial rent tax form used by businesses operating in New York City. This form is specifically designed for landlords and tenants to report and pay the commercial rent tax, which applies to businesses renting commercial space in the city. The tax is calculated based on the total rent paid for the space, and it is essential for compliance with city regulations. Understanding the NYC CR Q3 is crucial for businesses to ensure they meet their tax obligations and avoid potential penalties.

Steps to Complete the NYC CR Q3

Completing the NYC CR Q3 involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding your commercial lease, including the total rent paid and the duration of the lease. Next, fill out the form by entering the required details, such as your business name, address, and tax identification number. It is important to double-check all entries for accuracy. After completing the form, submit it by the specified deadline to avoid late fees. Using an electronic signature solution can streamline this process and ensure that your submission is legally binding.

How to Obtain the NYC CR Q3

The NYC CR Q3 form can be obtained through the New York City Department of Finance website or directly from their offices. Businesses can download the fillable version of the form, which allows for easy completion and submission. Additionally, many tax preparation software solutions may provide access to the NYC CR Q3, making it easier for users to fill out and file the form electronically. Ensure that you are using the most current version of the form to comply with the latest regulations.

Legal Use of the NYC CR Q3

To ensure the legal validity of the NYC CR Q3, it is essential to adhere to the guidelines set forth by the New York City Department of Finance. The form must be completed accurately and submitted on time to avoid penalties. Utilizing a reliable electronic signature tool can enhance the legal standing of your submission, as it provides an electronic certificate that verifies the identity of the signer. Compliance with eSignature laws, such as ESIGN and UETA, further solidifies the legal use of the NYC CR Q3.

Filing Deadlines / Important Dates

Filing deadlines for the NYC CR Q3 are critical for businesses to note. Typically, the form must be filed quarterly, with specific due dates that vary based on the tax period. It is advisable to check the New York City Department of Finance's official schedule for the most accurate and up-to-date information. Missing a deadline can result in penalties and interest charges, making timely filing essential for compliance.

Penalties for Non-Compliance

Failure to comply with the requirements of the NYC CR Q3 can lead to significant penalties. Businesses may face fines for late submissions, inaccurate reporting, or failure to pay the commercial rent tax. These penalties can accumulate quickly, impacting the financial health of a business. It is crucial for landlords and tenants to understand their obligations and ensure that the NYC CR Q3 is completed and submitted correctly to avoid these consequences.

Quick guide on how to complete nyc cr q3

Complete Nyc Cr Q3 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Nyc Cr Q3 on any platform using the airSlate SignNow applications for Android or iOS and enhance your document-based tasks today.

The easiest way to alter and eSign Nyc Cr Q3 without hassle

- Obtain Nyc Cr Q3 and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign Nyc Cr Q3 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc cr q3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc cr q3?

airSlate SignNow is an electronic signature solution that enables businesses to send and eSign documents seamlessly. With the integration of features tailored for nyc cr q3, users can navigate their document workflows efficiently, ensuring compliance and ease of use.

-

What are the pricing plans available for airSlate SignNow for nyc cr q3 users?

airSlate SignNow offers competitive pricing plans suitable for individuals and businesses targeting nyc cr q3. These plans include tiered options that cater to varying volumes of document transactions, making it a cost-effective law and compliance solution.

-

What features specifically support nyc cr q3 in airSlate SignNow?

airSlate SignNow includes features geared towards nyc cr q3, such as customizable templates, automated workflows, and secure storage for documents. These features enhance productivity and ensure that businesses meet regulatory requirements effortlessly.

-

How does airSlate SignNow benefit businesses focused on nyc cr q3?

By using airSlate SignNow, businesses can streamline their document processes, especially in the context of nyc cr q3 compliance. This leads to faster approval times and reduces the risk of errors, ultimately promoting efficiency and cost savings.

-

Can airSlate SignNow integrate with other tools for managing nyc cr q3 documentation?

Yes, airSlate SignNow seamlessly integrates with various software tools that assist businesses in managing nyc cr q3 documentation. This includes popular CRMs and productivity platforms, allowing for a cohesive workflow across applications.

-

Is airSlate SignNow mobile-friendly for users dealing with nyc cr q3?

airSlate SignNow offers a mobile-friendly platform that ensures users can manage their nyc cr q3 documents on the go. This flexibility allows for eSigning and document management from any device, making it easier to stay compliant anywhere.

-

What security measures does airSlate SignNow implement for nyc cr q3?

Security is a top priority at airSlate SignNow, especially for users involved in nyc cr q3. The platform implements robust encryption, secure storage, and compliance with industry standards to protect sensitive information throughout the signing process.

Get more for Nyc Cr Q3

Find out other Nyc Cr Q3

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document