TEXAS EXEMPTION STATEMENT Form

What is the TEXAS EXEMPTION STATEMENT

The Texas Exemption Statement is a crucial document used primarily for tax purposes in the state of Texas. This form allows eligible individuals or entities to claim exemptions from certain taxes, such as sales tax or property tax, based on specific criteria set by state regulations. Understanding the purpose of this statement is essential for ensuring compliance and maximizing potential savings.

How to use the TEXAS EXEMPTION STATEMENT

Using the Texas Exemption Statement involves several steps to ensure proper completion and submission. First, identify the specific exemption you are eligible for, as different exemptions apply to various categories, such as non-profit organizations or governmental entities. Next, accurately fill out the form with the required information, including your name, address, and the nature of your exemption. After completing the form, submit it to the appropriate taxing authority, either online or via mail, depending on the guidelines provided by the state.

Steps to complete the TEXAS EXEMPTION STATEMENT

Completing the Texas Exemption Statement requires careful attention to detail. Follow these steps:

- Gather necessary information, including your tax identification number and details about your organization or business.

- Download the Texas Exemption Statement form from the official state website or obtain a physical copy.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority, keeping a copy for your records.

Legal use of the TEXAS EXEMPTION STATEMENT

The legal use of the Texas Exemption Statement is governed by state tax laws. It is essential to ensure that the form is used only for its intended purpose and by eligible individuals or entities. Misuse of the exemption statement can lead to penalties, including fines or back taxes owed. Therefore, it is crucial to understand the legal implications and ensure compliance with all applicable regulations when utilizing this form.

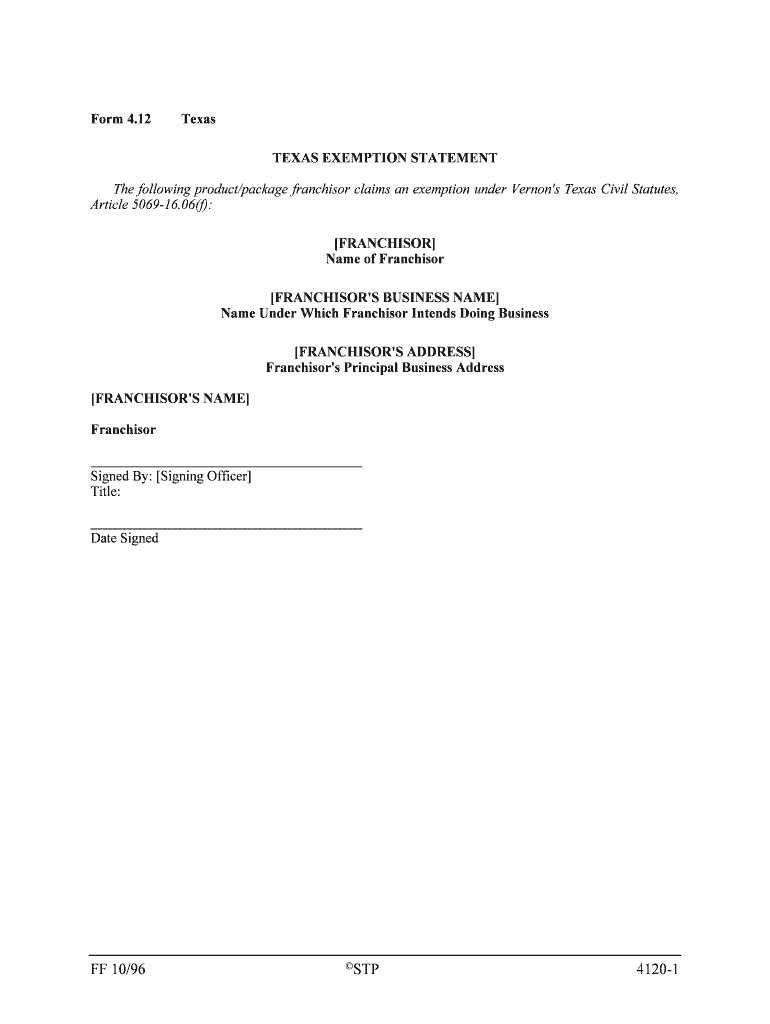

Key elements of the TEXAS EXEMPTION STATEMENT

Several key elements must be included in the Texas Exemption Statement for it to be valid:

- Identification of the exempt entity: Clearly state the name and address of the individual or organization claiming the exemption.

- Type of exemption: Specify the type of exemption being claimed, such as sales tax or property tax exemption.

- Signature: The form must be signed by an authorized representative of the entity, confirming the accuracy of the information provided.

- Date: Include the date of submission to establish a timeline for the exemption request.

Eligibility Criteria

Eligibility for the Texas Exemption Statement varies based on the type of exemption being claimed. Generally, non-profit organizations, governmental entities, and certain educational institutions may qualify for exemptions. To determine eligibility, review the specific criteria outlined by the Texas Comptroller's office. It is essential to ensure that all requirements are met before submitting the form to avoid complications or rejections.

Quick guide on how to complete texas exemption statement

Easily Prepare TEXAS EXEMPTION STATEMENT on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any delays. Handle TEXAS EXEMPTION STATEMENT on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

Effortlessly Edit and eSign TEXAS EXEMPTION STATEMENT

- Obtain TEXAS EXEMPTION STATEMENT and click on Get Form to begin.

- Leverage the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign TEXAS EXEMPTION STATEMENT to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a TEXAS EXEMPTION STATEMENT?

A TEXAS EXEMPTION STATEMENT is a document that allows certain transactions and purchases to be exempt from sales tax in Texas. This statement is critical for individuals and businesses claiming tax exemptions on purchases that qualify under Texas law. By using airSlate SignNow, you can streamline the process of completing and signing your TEXAS EXEMPTION STATEMENT.

-

How does airSlate SignNow help with TEXAS EXEMPTION STATEMENTS?

airSlate SignNow enables users to create, send, and eSign TEXAS EXEMPTION STATEMENTS effortlessly. Our platform is user-friendly and provides templates specifically designed for exemption statements, ensuring compliance and accuracy. This automated solution reduces errors and saves time, making it easier for your business to manage tax exemptions.

-

Is there a cost associated with using airSlate SignNow for TEXAS EXEMPTION STATEMENTS?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. While there may be a nominal fee for specific features, eSigning and managing TEXAS EXEMPTION STATEMENTS can be very cost-effective compared to traditional methods. We encourage businesses to explore our pricing options to find the best fit for their needs.

-

What features does airSlate SignNow offer for completing TEXAS EXEMPTION STATEMENTS?

airSlate SignNow offers features such as customizable templates, eSignature functionality, and easy document tracking for TEXAS EXEMPTION STATEMENTS. These tools enable you to fill out and sign documents securely and efficiently. Additionally, the platform supports collaboration between multiple parties, making it easier to get necessary approvals.

-

Can I integrate airSlate SignNow with other software for TEXAS EXEMPTION STATEMENTS?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications to enhance your experience with TEXAS EXEMPTION STATEMENTS. These integrations allow you to sync data, automate workflows, and maintain organization across your relevant documents and software platforms.

-

How secure is airSlate SignNow for managing TEXAS EXEMPTION STATEMENTS?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure servers to protect sensitive information related to TEXAS EXEMPTION STATEMENTS. You can trust our platform to safeguard your data and ensure compliance with regulations pertaining to document storage and signatures.

-

What are the benefits of using airSlate SignNow for TEXAS EXEMPTION STATEMENTS?

Using airSlate SignNow for your TEXAS EXEMPTION STATEMENTS provides signNow benefits, including faster processing times, reduced paper usage, and improved accuracy. Our platform simplifies the preparation and signing of exemption statements, which can help your business thrive while adhering to Texas tax regulations. Enjoy enhanced flexibility and ease of use with our digital solution.

Get more for TEXAS EXEMPTION STATEMENT

Find out other TEXAS EXEMPTION STATEMENT

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure