Pccc 1098 T Form

What is the PCCC 1098 T Form

The PCCC 1098 T form is a tax document used by Passaic County Community College to report tuition payments and related expenses for eligible students. This form is essential for students who wish to claim education tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. By providing detailed information on qualified tuition and related expenses, the PCCC 1098 T form helps students accurately report their educational costs to the IRS.

How to Obtain the PCCC 1098 T Form

Students can obtain the PCCC 1098 T form directly from Passaic County Community College. Typically, the college will provide this form electronically through the student portal or via mail. It is important for students to ensure that their contact information is up to date with the college to receive the form promptly. Additionally, students can check their tax documents section in the online portal to download the form if available.

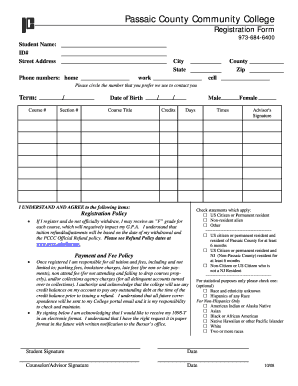

Steps to Complete the PCCC 1098 T Form

Completing the PCCC 1098 T form involves several key steps:

- Gather necessary documentation, including your tuition payment receipts and any other related expenses.

- Enter your personal information accurately, including your name, address, and Social Security number.

- Fill in the details regarding the qualified tuition and related expenses as reported by Passaic County Community College.

- Review the form for accuracy and completeness before submission.

Legal Use of the PCCC 1098 T Form

The PCCC 1098 T form is legally recognized as a valid document for reporting educational expenses to the IRS. To ensure compliance, it must be filled out accurately and submitted by the appropriate deadlines. The form serves as proof of tuition payments and is crucial for students seeking to benefit from educational tax credits. Failure to use the form correctly may result in penalties or disallowed claims on tax returns.

Filing Deadlines / Important Dates

Students should be aware of the important deadlines related to the PCCC 1098 T form. Generally, the college issues the form by January 31 of each year, allowing students time to prepare their tax returns. It is advisable for students to file their taxes as soon as they receive their 1098 T form to avoid any last-minute issues with the IRS. Keeping track of these dates ensures that students can take full advantage of available tax credits.

Who Issues the Form

The PCCC 1098 T form is issued by Passaic County Community College. The college is responsible for reporting the tuition payments received from students to the IRS. It is essential for students to ensure that their information is accurate and up to date with the college to receive their forms without delay. The college's financial aid office can assist students with any questions regarding the issuance and details of the form.

Quick guide on how to complete pccc 1098 t form

Effortlessly Prepare Pccc 1098 T Form on Any Device

Digital document management has become increasingly favored by both enterprises and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, amend, and electronically sign your documents swiftly without delays. Manage Pccc 1098 T Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to Edit and Electronically Sign Pccc 1098 T Form with Ease

- Find Pccc 1098 T Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), or invitation link—or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Pccc 1098 T Form and ensure outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pccc 1098 t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pccc 1098 t form and why do I need it?

The pccc 1098 t form is a tax document used to report tuition payments and related expenses for eligible students. Understanding this form is crucial for both students and educational institutions as it helps in determining tax credits and deductions that may be available. By using the airSlate SignNow platform, you can easily manage and sign documents related to the pccc 1098 t form, ensuring everything is organized.

-

How can airSlate SignNow help with the pccc 1098 t form?

AirSlate SignNow simplifies the process of handling the pccc 1098 t form by providing an easy-to-use interface for document management and eSigning. This allows users to quickly send, receive, and store important paperwork securely. Additionally, our platform ensures compliance with regulations, making it easier for educational institutions to manage their documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the pccc 1098 t form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including educational institutions that need to handle the pccc 1098 t form. Our plans are designed to be cost-effective, providing excellent value by streamlining your document processes. For more detailed pricing information, please visit our website or contact our sales team.

-

What features does airSlate SignNow offer for managing the pccc 1098 t form?

AirSlate SignNow provides a range of features specifically designed for managing documents like the pccc 1098 t form. These include customizable templates, automated workflows, and secure eSigning options. With these features, you can enhance your efficiency in document management while ensuring a seamless user experience.

-

Can I integrate airSlate SignNow with other software for the pccc 1098 t form?

Absolutely! AirSlate SignNow offers integrations with a variety of software solutions to help you streamline the management of the pccc 1098 t form. These integrations allow for a more cohesive workflow by connecting your eSignature needs with other applications you already use, enhancing productivity and collaboration.

-

How secure is the airSlate SignNow platform when handling the pccc 1098 t form?

The security of your documents, including the pccc 1098 t form, is a top priority for airSlate SignNow. We implement industry-standard encryption and compliance measures to protect your sensitive information. This means you can confidently manage and sign your documents without worrying about data bsignNowes or unauthorized access.

-

What are the benefits of using airSlate SignNow for educational institutions managing the pccc 1098 t form?

Using airSlate SignNow provides numerous benefits for educational institutions processing the pccc 1098 t form. Our platform streamlines document workflows, reduces paper usage, and saves time on administrative tasks. Additionally, the ability to sign documents electronically enhances accessibility and improves the overall efficiency of your operations.

Get more for Pccc 1098 T Form

- Tennessee real estate residential property disclosure form tennessee

- Claim mineral form

- Order on complaint for abandoned mineral interest tennessee form

- Tn husband wife form

- Quitclaim deed limited liability company to an individual tennessee form

- Tennessee affidavit form

- Tennessee survivorship form

- Quitclaim deed three grantors to two grantees tennessee form

Find out other Pccc 1098 T Form

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now