IFTA 101 I MN Instructions for Form IFTA 101 MN IFTA NH Gov Nh

Understanding the IFTA 101 I MN Instructions

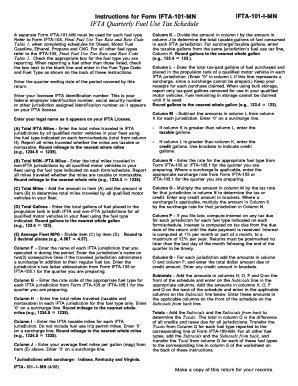

The IFTA 101 I MN instructions provide essential guidance for completing the International Fuel Tax Agreement (IFTA) form for businesses operating in New Hampshire. This form is crucial for reporting fuel usage and calculating taxes owed to various jurisdictions. The instructions detail the necessary information required, including vehicle details, fuel purchases, and miles traveled in each jurisdiction. Completing this form accurately ensures compliance with state regulations and helps avoid potential penalties.

Steps to Complete the IFTA 101 I MN Instructions

Completing the IFTA 101 I MN involves several key steps:

- Gather all necessary documents, including fuel purchase receipts and mileage logs.

- Fill in the vehicle identification details, such as the license plate number and vehicle type.

- Record the total miles traveled in each jurisdiction and the amount of fuel purchased.

- Calculate the total tax due based on the fuel consumption and mileage.

- Review all entries for accuracy before submission.

Following these steps carefully helps ensure that the form is completed correctly and submitted on time.

Legal Use of the IFTA 101 I MN Instructions

The IFTA 101 I MN instructions are legally binding documents that must be completed in accordance with state and federal regulations. Electronic signatures are accepted, provided they comply with the ESIGN and UETA acts, ensuring that the completed form holds legal weight. Utilizing a reliable electronic signing platform can enhance the validity of your submission and ensure compliance with necessary legal frameworks.

Filing Deadlines and Important Dates

Timely filing of the IFTA 101 I MN is crucial to avoid penalties. The form is typically due quarterly, with specific deadlines set by the New Hampshire Department of Revenue Administration. It is important to be aware of these dates to ensure that all required information is submitted on time. Keeping a calendar of these deadlines can help businesses stay organized and compliant.

Required Documents for IFTA 101 I MN

To complete the IFTA 101 I MN, several documents are necessary:

- Fuel purchase receipts for all jurisdictions.

- Mileage logs detailing miles driven in each state.

- Vehicle registration information.

- Previous IFTA returns, if applicable.

Having these documents ready will facilitate a smoother completion process and reduce the risk of errors.

State-Specific Rules for IFTA 101 I MN

New Hampshire has specific rules regarding the IFTA 101 I MN, including how taxes are calculated and reported. It is important to familiarize yourself with these regulations to ensure compliance. This includes understanding the tax rates applicable in different jurisdictions and the reporting requirements unique to New Hampshire. Staying informed about state-specific rules can help avoid costly mistakes.

Quick guide on how to complete ifta 101 i mn instructions for form ifta 101 mn ifta nh gov nh

Prepare IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Administer IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh effortlessly

- Obtain IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tiresome form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 101 i mn instructions for form ifta 101 mn ifta nh gov nh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NH IFTA and how does it work with airSlate SignNow?

NH IFTA, or New Hampshire International Fuel Tax Agreement, simplifies fuel tax reporting for interstate trucking. With airSlate SignNow, you can easily manage and eSign NH IFTA-related documents, ensuring compliance and timely submissions.

-

How can airSlate SignNow help with NH IFTA compliance?

airSlate SignNow provides an efficient platform for managing NH IFTA documents, allowing you to eSign forms and send them directly to the New Hampshire Department of Revenue Administration. This streamlines the compliance process and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for NH IFTA filings?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs, making it a cost-effective solution for managing NH IFTA filings. You can select a plan that best fits your business requirements while benefiting from its features.

-

What features does airSlate SignNow offer for NH IFTA document management?

airSlate SignNow includes features such as document templates, cloud storage, and customizable workflows specifically designed for NH IFTA documentation. These features make it easier to create, sign, and manage tax-related documents efficiently.

-

Can airSlate SignNow integrate with other tools for NH IFTA reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and transportation management systems, improving your workflow by allowing you to handle NH IFTA reporting and related documents in one place.

-

How secure is airSlate SignNow for managing NH IFTA documents?

Security is a priority for airSlate SignNow; it utilizes advanced encryption methods to protect your NH IFTA documents. This ensures that all signed and shared documents remain confidential and secure.

-

What benefits does airSlate SignNow provide for NH IFTA users?

Using airSlate SignNow for NH IFTA enhances efficiency and reduces paperwork by digitizing the signing process. This saves time, reduces costs, and helps businesses stay organized while managing their fuel tax filings.

Get more for IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh

- Security contractor package texas form

- Insulation contractor package texas form

- Paving contractor package texas form

- Site work contractor package texas form

- Siding contractor package texas form

- Refrigeration contractor package texas form

- Drainage contractor package texas form

- Tax free exchange package texas form

Find out other IFTA 101 I MN Instructions For Form IFTA 101 MN IFTA NH gov Nh

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy