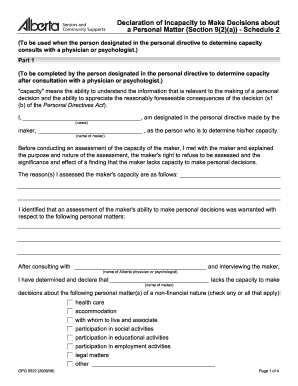

A Personal Matter Section 92a Schedule 2 Form

What is the A Personal Matter Section 92a Schedule 2

The A Personal Matter Section 92a Schedule 2 form is a legal document used primarily in the context of personal matters that require formal acknowledgment or disclosure. This form is essential for individuals needing to report specific personal information or circumstances that may affect legal proceedings or obligations. It serves as a structured way to communicate personal matters to relevant authorities or organizations, ensuring that all necessary details are documented appropriately.

How to use the A Personal Matter Section 92a Schedule 2

Using the A Personal Matter Section 92a Schedule 2 form involves several straightforward steps. First, gather all required information, including personal details and any supporting documentation. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements of the receiving entity. Utilizing a reliable electronic signature platform can enhance the process, ensuring that the form is legally binding and securely submitted.

Steps to complete the A Personal Matter Section 92a Schedule 2

Completing the A Personal Matter Section 92a Schedule 2 form involves a series of methodical steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary personal information and documentation.

- Fill out the form, ensuring accuracy and completeness in each section.

- Review the form for any errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the completed form through the designated method.

Legal use of the A Personal Matter Section 92a Schedule 2

The legal use of the A Personal Matter Section 92a Schedule 2 form is governed by specific regulations that ensure its validity. For the form to be legally recognized, it must be completed accurately and submitted in compliance with relevant laws. This includes adhering to eSignature laws, which stipulate that electronic signatures must meet certain criteria to be considered valid. Utilizing a compliant eSignature solution can help ensure that the form meets all legal standards, providing protection for the signer and the receiving entity.

Key elements of the A Personal Matter Section 92a Schedule 2

Several key elements are crucial for the A Personal Matter Section 92a Schedule 2 form to be effective:

- Personal Information: Accurate details about the individual submitting the form.

- Signature: A valid signature, either electronic or handwritten, confirming the authenticity of the submission.

- Date: The date on which the form is completed and signed, which may be important for legal timelines.

- Supporting Documentation: Any necessary attachments that provide context or evidence for the information reported.

Who Issues the Form

The A Personal Matter Section 92a Schedule 2 form is typically issued by government agencies or organizations that require formal documentation of personal matters. This may include state or federal agencies, legal entities, or other organizations that need to collect personal information for compliance or regulatory purposes. It is essential to verify the issuing authority to ensure that the correct form is being used for the intended purpose.

Quick guide on how to complete a personal matter section 92a schedule 2

Effortlessly Prepare A Personal Matter Section 92a Schedule 2 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage A Personal Matter Section 92a Schedule 2 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Alter and eSign A Personal Matter Section 92a Schedule 2 with Ease

- Locate A Personal Matter Section 92a Schedule 2 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for such tasks.

- Create your eSignature with the Sign tool, which is completed in seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your changes.

- Select your method of sharing the form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign A Personal Matter Section 92a Schedule 2 and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a personal matter section 92a schedule 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'A Personal Matter Section 92a Schedule 2' in airSlate SignNow?

'A Personal Matter Section 92a Schedule 2' refers to a specific guideline within the airSlate SignNow platform that helps users understand how to manage personal data securely while utilizing the electronic signature service. This feature ensures compliance with legal standards and enhances data privacy, making it easier for businesses to focus on their work without worries.

-

How does airSlate SignNow ensure compliance with 'A Personal Matter Section 92a Schedule 2'?

airSlate SignNow complies with 'A Personal Matter Section 92a Schedule 2' by implementing robust security measures and standards that protect users' personal data. This includes encryption, secure servers, and rigorous authentication processes, which collectively safeguard sensitive information throughout the eSignature process.

-

What are the pricing options available for using airSlate SignNow considering 'A Personal Matter Section 92a Schedule 2'?

airSlate SignNow offers several pricing tiers to accommodate different business needs while ensuring compliance with 'A Personal Matter Section 92a Schedule 2'. These options range from individual plans for freelancers to comprehensive packages for larger teams, allowing users to choose a plan that balances functionality and budget effectively.

-

What features does airSlate SignNow provide to support 'A Personal Matter Section 92a Schedule 2'?

To support 'A Personal Matter Section 92a Schedule 2', airSlate SignNow provides features such as customizable workflows, audit trails, and templates for various document types. These features empower businesses to manage documents while adhering to privacy regulations and enhancing operational efficiency.

-

How can I integrate airSlate SignNow with my existing tools while considering 'A Personal Matter Section 92a Schedule 2'?

airSlate SignNow seamlessly integrates with numerous third-party applications and tools, allowing businesses to maintain compliance with 'A Personal Matter Section 92a Schedule 2' while enhancing productivity. Whether you're using CRM systems, cloud storage solutions, or productivity apps, integration options are designed to be straightforward and secure.

-

What benefits does airSlate SignNow offer in relation to 'A Personal Matter Section 92a Schedule 2'?

The main benefits of using airSlate SignNow in relation to 'A Personal Matter Section 92a Schedule 2' include enhanced data security, compliance with legal requirements, and streamlined document management. By prioritizing these factors, businesses can reduce risks and improve their overall efficiency in handling personal information.

-

Is training available for new users to understand 'A Personal Matter Section 92a Schedule 2' compliance?

Yes, airSlate SignNow offers extensive training resources and support for new users to understand 'A Personal Matter Section 92a Schedule 2' compliance fully. These resources include tutorials, documentation, and customer support, all designed to help users navigate the platform effectively while adhering to privacy regulations.

Get more for A Personal Matter Section 92a Schedule 2

- 30 day notice to terminate month to month lease residential from landlord to tenant texas form

- Notice terminate lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord texas form

- Notice terminate form

- Texas rent pay form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497327591 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property texas form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential texas form

Find out other A Personal Matter Section 92a Schedule 2

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself