Van Wert Tax Department Form

What is the Van Wert Tax Department

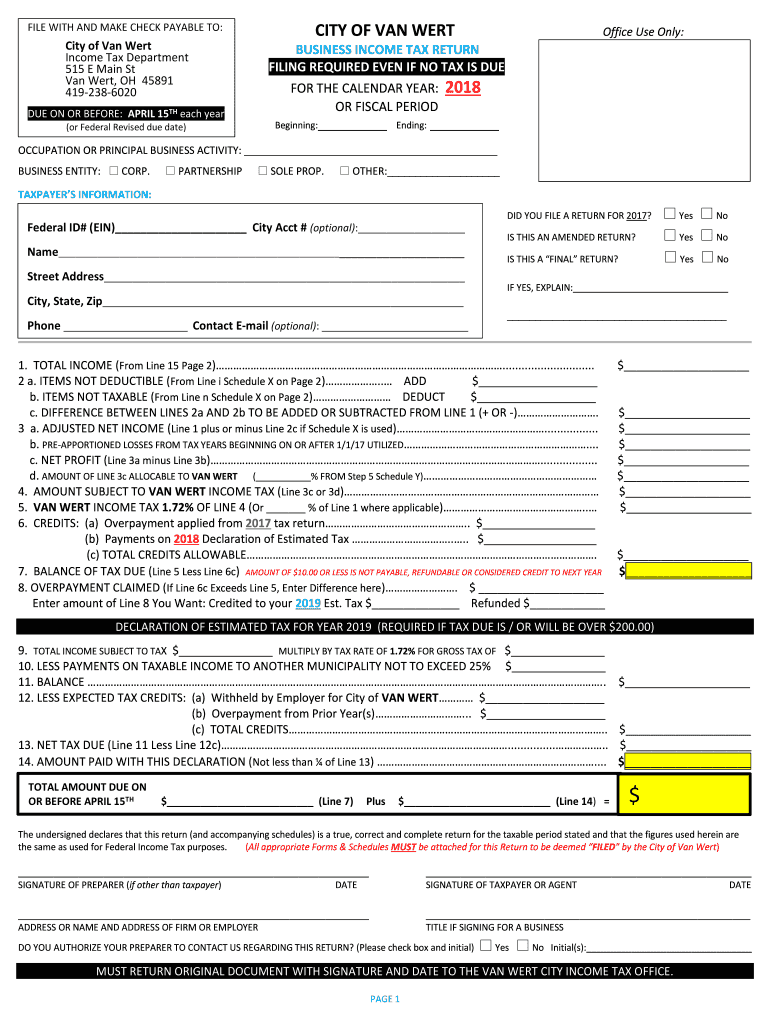

The Van Wert Tax Department is the governmental body responsible for the administration and collection of income taxes within the city of Van Wert, Ohio. This department ensures compliance with local tax laws and regulations, providing services to residents and businesses. It plays a crucial role in maintaining the financial health of the city by collecting revenue necessary for public services and infrastructure. The department also offers resources and guidance to help taxpayers understand their obligations and navigate the filing process.

Steps to Complete the Van Wert Tax Department Form

Completing the Van Wert city income tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements and previous tax returns. Next, visit the Van Wert Tax Department website or office to obtain the correct form for the current tax year. Fill out the form carefully, ensuring all information is accurate and complete. After completing the form, review it for any errors before submitting it. Finally, choose your submission method—either electronically through a secure portal or by mailing it to the department. Keeping a copy for your records is also recommended.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Van Wert city income tax is crucial for compliance. Typically, the deadline for filing is April fifteenth of each year, aligning with federal tax deadlines. However, it is important to verify any specific local extensions or changes that may apply. Taxpayers should also be aware of deadlines for estimated tax payments, which may differ. Marking these dates on a calendar can help ensure timely submissions and avoid penalties.

Required Documents

To successfully complete the Van Wert city income tax form, taxpayers must gather several essential documents. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation related to deductions, such as receipts for business expenses or charitable contributions, may be required. Having all necessary documents organized and ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

Taxpayers in Van Wert have multiple options for submitting their income tax forms. The most convenient method is online submission through the Van Wert Tax Department's secure portal, which allows for quick processing and confirmation of receipt. Alternatively, forms can be mailed directly to the department's office. For those who prefer in-person interactions, visiting the tax department office is also an option. Each method has its own advantages, so taxpayers should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with Van Wert city income tax regulations can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is important for taxpayers to understand their responsibilities and deadlines to avoid these consequences. The Van Wert Tax Department provides resources and guidance to help individuals and businesses stay informed and compliant with local tax laws.

Quick guide on how to complete van wert city tax department

Complete van wert city tax department effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without interruptions. Handle city of van wert income tax on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign van wert city income tax with ease

- Obtain van wert tax department and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management requirements with just a few clicks from any device you choose. Modify and eSign van wert city income tax form 2020 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to city of van wert income tax

Create this form in 5 minutes!

How to create an eSignature for the van wert city income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask van wert city income tax form 2020

-

What is the city of Van Wert income tax rate?

The city of Van Wert income tax rate is currently set at 1.5%. This rate applies to all residents and those working within the city limits. For accurate filing, it's important to stay updated on any potential changes to this rate.

-

How can I file my city of Van Wert income tax?

You can file your city of Van Wert income tax online, by mail, or in person. Utilizing e-signature platforms like airSlate SignNow can simplify the process by allowing you to sign documents electronically from anywhere. Make sure to gather all necessary documents to ensure a smooth filing process.

-

What are the deadlines for filing city of Van Wert income tax?

The deadline for filing the city of Van Wert income tax typically falls on April 15 each year. However, extensions may be available under certain circumstances. Checking with the local tax authority ensures you meet all filing deadlines.

-

Are there deductions available for city of Van Wert income tax?

Yes, residents may qualify for various deductions on their city of Van Wert income tax return, including personal exemptions and certain business expenses. It’s advisable to consult a tax professional or look for guidance on maximizing your deductions effectively.

-

How does airSlate SignNow help with managing city of Van Wert income tax documents?

airSlate SignNow streamlines the process of managing city of Van Wert income tax documents by providing an easy-to-use platform for electronic signatures. This makes it easier for individuals and businesses to organize, send, and store important tax-related documents securely and efficiently.

-

What features of airSlate SignNow can assist with city of Van Wert income tax filings?

Key features of airSlate SignNow include document templates, customizable workflows, and secure signing capabilities. These tools can help users prepare and send city of Van Wert income tax documents with ease, ensuring compliance and efficiency in the filing process.

-

Is airSlate SignNow affordable for filing city of Van Wert income tax?

Yes, airSlate SignNow offers competitive pricing plans to suit different budgets, making it a cost-effective choice for businesses and individuals tackling city of Van Wert income tax filings. By simplifying document management, it potentially saves users time and money, enhancing overall value.

Get more for van wert city tax department

Find out other van wert city taxes

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements