Ct Tr 1 Form

What is the Ct Tr 1

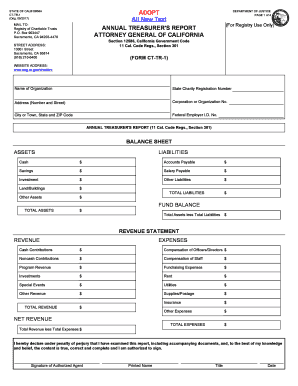

The Ct Tr 1 form is a crucial document used primarily in the context of tax and legal compliance in the United States. It serves as a means for individuals and businesses to report specific information required by state authorities. Understanding the purpose of the Ct Tr 1 is essential for ensuring compliance with local regulations and for facilitating proper record-keeping.

How to Use the Ct Tr 1

Using the Ct Tr 1 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, review the form for any errors before submission. This attention to detail helps prevent delays and ensures that the form is processed smoothly.

Steps to Complete the Ct Tr 1

Completing the Ct Tr 1 form requires a systematic approach:

- Collect necessary documents, such as identification and financial records.

- Access the Ct Tr 1 form online or obtain a physical copy.

- Fill in all required fields, ensuring accuracy in every entry.

- Double-check the information for any mistakes or omissions.

- Submit the form according to the specified guidelines, whether online or by mail.

Legal Use of the Ct Tr 1

The legal use of the Ct Tr 1 form is governed by various regulations that ensure its validity in official matters. When completed correctly, the form can serve as a legally binding document, provided it meets the necessary requirements set forth by state laws. It is essential to adhere to these regulations to avoid potential legal issues or penalties.

Key Elements of the Ct Tr 1

Key elements of the Ct Tr 1 form include personal identification information, financial details, and any relevant disclosures required by law. Each section of the form plays a vital role in ensuring that the information provided is comprehensive and accurate. Understanding these elements helps in completing the form correctly and in compliance with legal standards.

Required Documents

To successfully complete the Ct Tr 1 form, certain documents are typically required. These may include:

- Government-issued identification, such as a driver's license or passport.

- Financial statements or tax documents relevant to the information being reported.

- Any additional paperwork specified by state authorities that may support the information provided on the form.

Form Submission Methods

The Ct Tr 1 form can be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online submission via a designated state portal.

- Mailing a physical copy to the appropriate state office.

- In-person submission at a local government office, if applicable.

Quick guide on how to complete ct tr 1 469938251

Complete Ct Tr 1 effortlessly on any device

Managing documents online has gained considerable traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the appropriate form and securely archive it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Ct Tr 1 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign Ct Tr 1 easily

- Find Ct Tr 1 and click Get Form to begin.

- Employ the tools provided to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct Tr 1 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct tr 1 469938251

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to cttr1?

airSlate SignNow is a powerful eSignature solution that enables businesses to streamline their document workflows. By integrating cttr1, users can efficiently send and sign documents, thereby enhancing productivity and reducing turnaround times.

-

How does the pricing for airSlate SignNow work for cttr1 users?

The pricing for airSlate SignNow is designed to be cost-effective, making it accessible for all business sizes. Users interested in cttr1 can choose from various subscription plans that offer features tailored to their needs, ensuring they get the best value for their investment.

-

What features does airSlate SignNow offer with regard to cttr1?

airSlate SignNow offers a multitude of features that support cttr1, including document templates, team collaboration tools, and automated workflows. These features help simplify the signing process, making it easier for businesses to manage their documentation.

-

Can airSlate SignNow integrate with other tools, especially for cttr1 users?

Yes, airSlate SignNow can seamlessly integrate with various business applications, enhancing its utility for cttr1 users. This integration enables businesses to connect their existing workflows with eSignature capabilities, ensuring a smooth and efficient process.

-

What are the benefits of using airSlate SignNow for cttr1?

Using airSlate SignNow for cttr1 provides numerous benefits, including improved efficiency, reduced paperwork, and expedited document processing. Additionally, the user-friendly interface ensures that even those unfamiliar with technology can quickly adopt and utilize the tool.

-

Is airSlate SignNow compliant with regulations relevant to cttr1 users?

Absolutely! airSlate SignNow is compliant with industry regulations, such as ESIGN and UETA, which is crucial for cttr1 users that need to adhere to legal standards. This compliance gives businesses the confidence to use eSignatures securely.

-

How can businesses get started with airSlate SignNow for cttr1?

Getting started with airSlate SignNow for cttr1 is easy. Prospective users can sign up for a free trial to explore its features, allowing them to understand how it can benefit their business before committing to a subscription.

Get more for Ct Tr 1

Find out other Ct Tr 1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors