Schedule FED Virginia Department of Taxation Tax Virginia Form

What is the Schedule FED Virginia Department Of Taxation Tax Virginia

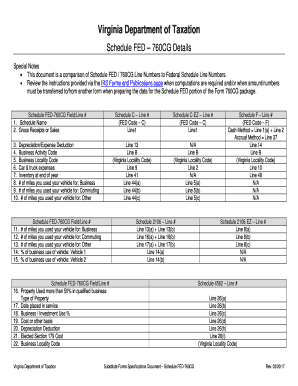

The Schedule FED is a specific form used by the Virginia Department of Taxation for reporting certain tax-related information. This form is primarily utilized by businesses and individuals to report federal income tax adjustments, ensuring that state tax obligations align with federal filings. Understanding the Schedule FED is crucial for accurate tax reporting and compliance with Virginia tax laws.

How to use the Schedule FED Virginia Department Of Taxation Tax Virginia

To effectively use the Schedule FED, taxpayers must first gather all necessary financial documents, including federal tax returns. The form requires detailed information about income, deductions, and credits that may affect state tax calculations. After completing the form, it should be submitted alongside the Virginia income tax return to ensure all relevant adjustments are considered in the state tax assessment.

Steps to complete the Schedule FED Virginia Department Of Taxation Tax Virginia

Completing the Schedule FED involves several key steps:

- Gather all relevant financial documents, including your federal tax return.

- Fill in the required sections of the Schedule FED, detailing any adjustments to federal income.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Attach the completed Schedule FED to your Virginia income tax return.

- Submit your tax return by the designated filing deadline.

Legal use of the Schedule FED Virginia Department Of Taxation Tax Virginia

The Schedule FED must be filled out and submitted in accordance with Virginia tax laws to be considered legally valid. This includes ensuring that all information provided is accurate and complete. Failure to comply with these legal requirements can result in penalties or additional tax liabilities. Using a reliable electronic signature solution can help ensure that the submission process meets legal standards.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Schedule FED. Typically, the deadline for submitting this form coincides with the Virginia income tax return due date, which is usually May first for most taxpayers. However, extensions may apply in certain situations, so it is advisable to check for any updates or changes to the filing schedule each tax year.

Required Documents

When preparing to complete the Schedule FED, several documents are necessary to ensure accurate reporting. These include:

- Your federal income tax return (Form 1040 or equivalent).

- Any supporting documentation for income adjustments, deductions, or credits.

- Previous year’s tax returns, if applicable, for reference.

Form Submission Methods (Online / Mail / In-Person)

The Schedule FED can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission through the Virginia Department of Taxation’s e-file system.

- Mailing a paper copy of the form along with your tax return to the appropriate address.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete schedule fed virginia department of taxation tax virginia

Effortlessly Prepare Schedule FED Virginia Department Of Taxation Tax Virginia on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents efficiently without delays. Handle Schedule FED Virginia Department Of Taxation Tax Virginia on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Method to Alter and Electronically Sign Schedule FED Virginia Department Of Taxation Tax Virginia with Ease

- Find Schedule FED Virginia Department Of Taxation Tax Virginia and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Schedule FED Virginia Department Of Taxation Tax Virginia and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule fed virginia department of taxation tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule FED for Virginia Department Of Taxation?

Schedule FED is a tax form used for reporting federal income tax withholding in Virginia. It is essential for businesses to comply with state regulations and ensure proper tax remittance. Understanding how to fill out Schedule FED for Virginia Department Of Taxation Tax Virginia can help avoid penalties and streamline tax filing.

-

How can airSlate SignNow help with Schedule FED Virginia Department Of Taxation?

airSlate SignNow simplifies the process of preparing and submitting your Schedule FED Virginia Department Of Taxation Tax Virginia through its easy-to-use interface. You can eSign documents quickly, ensuring accuracy in your submissions. This helps save time and reduces the chances of errors in your tax reporting.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to fit different business needs when dealing with documents like Schedule FED Virginia Department Of Taxation Tax Virginia. Each plan includes features designed to enhance productivity and streamline document management. You can choose a plan that best suits your budget and the volume of documents you handle.

-

What features does airSlate SignNow provide to assist with tax forms?

With airSlate SignNow, you get features like customizable templates, document sharing, and advanced eSignature capabilities to assist with tax forms like Schedule FED Virginia Department Of Taxation Tax Virginia. These features ensure that you can easily manage your tax documents while maintaining compliance with state regulations.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive tax information. Our platform is equipped with industry-leading encryption and compliance standards to protect your data, including documents related to Schedule FED Virginia Department Of Taxation Tax Virginia. You can safely eSign and share documents without worries.

-

Can I integrate airSlate SignNow with other software for my accounting needs?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and productivity tools to enhance your workflow when dealing with Schedule FED Virginia Department Of Taxation Tax Virginia. This allows you to manage your documents effortlessly and maintain consistent records across different platforms.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation such as Schedule FED Virginia Department Of Taxation Tax Virginia provides numerous benefits, including increased efficiency and reduced paperwork. The platform's user-friendly interface makes it easy to manage your documents, while the eSignature feature speeds up the approval process. This means you can focus more on running your business rather than getting bogged down by paperwork.

Get more for Schedule FED Virginia Department Of Taxation Tax Virginia

Find out other Schedule FED Virginia Department Of Taxation Tax Virginia

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online