Louisiana Department of Revenue R 60010 711 Form

What is the Louisiana Department Of Revenue R 60010 711 Form

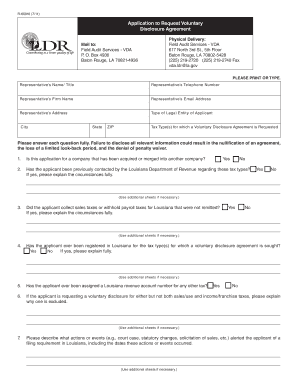

The Louisiana Department Of Revenue R 60010 711 Form is a tax-related document used primarily for reporting specific financial information to the state. This form is essential for individuals and businesses that need to comply with Louisiana tax regulations. It serves various purposes, including the declaration of income, deductions, and credits applicable under state law. Understanding the form's purpose is crucial for ensuring accurate tax reporting and compliance with state requirements.

How to use the Louisiana Department Of Revenue R 60010 711 Form

Using the Louisiana Department Of Revenue R 60010 711 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before submission. Utilizing a digital platform can simplify this process, allowing for easy corrections and secure submission.

Steps to complete the Louisiana Department Of Revenue R 60010 711 Form

Completing the Louisiana Department Of Revenue R 60010 711 Form requires attention to detail. Follow these steps:

- Gather necessary documentation, such as W-2s, 1099s, and other income records.

- Access the form online or obtain a physical copy from the Louisiana Department of Revenue.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions or credits.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Louisiana Department Of Revenue R 60010 711 Form

The Louisiana Department Of Revenue R 60010 711 Form is legally binding when completed and submitted according to state regulations. It must be filled out accurately to avoid potential legal issues, such as fines or audits. The form is designed to comply with Louisiana tax laws, ensuring that taxpayers fulfill their obligations. Proper use of the form helps maintain transparency and accountability in tax reporting.

Form Submission Methods

The Louisiana Department Of Revenue R 60010 711 Form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Louisiana Department of Revenue's website, which offers a secure and efficient way to file.

- Mailing a printed copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, allowing for direct interaction with tax officials.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana Department Of Revenue R 60010 711 Form are crucial for compliance. Typically, the form must be submitted by the state tax deadline, which aligns with federal tax deadlines. Taxpayers should be aware of any extensions or specific dates relevant to their situation to avoid penalties. Keeping track of these important dates ensures timely filing and adherence to state regulations.

Quick guide on how to complete louisiana department of revenue r 60010 711 form

Easily Prepare Louisiana Department Of Revenue R 60010 711 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a commendable eco-friendly option to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without any delays. Manage Louisiana Department Of Revenue R 60010 711 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to Alter and eSign Louisiana Department Of Revenue R 60010 711 Form with Ease

- Find Louisiana Department Of Revenue R 60010 711 Form and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your files or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and eSign Louisiana Department Of Revenue R 60010 711 Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana department of revenue r 60010 711 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Department Of Revenue R 60010 711 Form?

The Louisiana Department Of Revenue R 60010 711 Form is a tax-related document used for various purposes, such as reporting specific financial activities to the state. This form is crucial for compliance with Louisiana tax regulations, ensuring that businesses fulfill their reporting requirements accurately.

-

How can I complete the Louisiana Department Of Revenue R 60010 711 Form?

To complete the Louisiana Department Of Revenue R 60010 711 Form, gather all necessary financial documents and information required for the filing. You can fill out the form manually or use digital platforms like airSlate SignNow, which simplifies the process with user-friendly features and eSignature capabilities.

-

Is there a fee associated with filing the Louisiana Department Of Revenue R 60010 711 Form?

Filing the Louisiana Department Of Revenue R 60010 711 Form itself does not incur a direct fee; however, there may be costs associated with any tax payments owed or penalties for late filing. Additionally, if you opt for a digital solution like airSlate SignNow, there may be subscription fees depending on the plan you choose.

-

What features does airSlate SignNow offer for the Louisiana Department Of Revenue R 60010 711 Form?

airSlate SignNow offers several features for handling the Louisiana Department Of Revenue R 60010 711 Form, including eSigning, document templates, and secure cloud storage. These tools streamline the submission process and ensure that documents are legally compliant and easily accessible.

-

Can I integrate airSlate SignNow with other tools for the Louisiana Department Of Revenue R 60010 711 Form?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage the Louisiana Department Of Revenue R 60010 711 Form alongside your preferred software. This enhances workflow efficiency by allowing you to connect with tools like CRM systems and accounting software.

-

What are the benefits of using airSlate SignNow for the Louisiana Department Of Revenue R 60010 711 Form?

Using airSlate SignNow for the Louisiana Department Of Revenue R 60010 711 Form offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform's easy-to-use interface allows for quick edits and approvals, which ensures that you stay compliant with state tax requirements.

-

How secure is the information shared on airSlate SignNow when filing the Louisiana Department Of Revenue R 60010 711 Form?

airSlate SignNow prioritizes security, employing encryption and comprehensive data protection measures to safeguard information shared while filing the Louisiana Department Of Revenue R 60010 711 Form. This ensures that sensitive tax information remains confidential and protected from unauthorized access.

Get more for Louisiana Department Of Revenue R 60010 711 Form

Find out other Louisiana Department Of Revenue R 60010 711 Form

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free