592 F Form

What is the 592 F Form

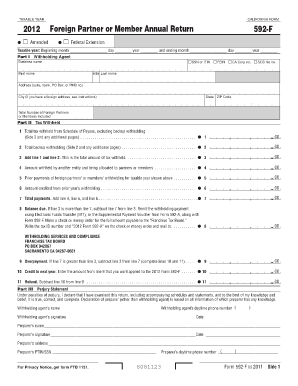

The 592 F Form is a tax-related document used in the United States, specifically for reporting California source income paid to non-residents. This form is essential for businesses and individuals who make payments to non-residents, ensuring compliance with California tax laws. By accurately completing the 592 F Form, payers can report the necessary information to the California Franchise Tax Board (FTB) regarding the income distributed to non-residents, which may include dividends, interest, rents, and royalties.

How to use the 592 F Form

Using the 592 F Form involves several key steps. First, gather all relevant information regarding the payments made to non-residents, including the recipient's name, address, and taxpayer identification number. Next, accurately fill out the form by entering the total amount paid and any applicable withholding amounts. Once completed, the form must be submitted to the California FTB along with any required payment of withholding tax. It is crucial to retain a copy of the form for your records and provide a copy to the non-resident recipient for their tax reporting purposes.

Steps to complete the 592 F Form

Completing the 592 F Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information about the non-resident recipient, including their identification details.

- Enter the total California source income paid to the non-resident on the form.

- Calculate any withholding tax that must be reported.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the California FTB by the specified deadline.

Legal use of the 592 F Form

The legal use of the 592 F Form is governed by California tax regulations. It is a requirement for any entity making payments to non-residents that are subject to California withholding tax. Failure to file the form correctly or on time can result in penalties and interest charges. Ensuring compliance with the legal requirements associated with the 592 F Form is essential for maintaining good standing with the California FTB and avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 592 F Form are critical to avoid penalties. Typically, the form must be filed by the last day of the month following the close of the calendar year in which the payments were made. For example, if payments were made in 2023, the form would be due by January 31, 2024. It is important to check for any updates or changes to deadlines each tax year to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 592 F Form can be submitted through various methods to accommodate different preferences. It can be filed online via the California FTB's e-file system, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address provided by the FTB. In-person submissions may also be possible at designated FTB offices, although this option may vary based on current regulations and office availability. Always verify the submission method that best suits your needs and ensures compliance.

Quick guide on how to complete 592 f form

Accomplish 592 F Form effortlessly on any gadget

Web-based document management has become increasingly popular among companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Manage 592 F Form on any device using the airSlate SignNow applications for Android or iOS and enhance your document-driven processes today.

The easiest method to modify and electronically sign 592 F Form without difficulty

- Find 592 F Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Edit and electronically sign 592 F Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 592 f form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 592 F Form?

The 592 F Form is a tax form used by foreign individuals and entities to report California-source income. It is essential for ensuring compliance with California tax regulations. airSlate SignNow provides an efficient way to eSign and submit your 592 F Form electronically.

-

How can airSlate SignNow help with the 592 F Form?

airSlate SignNow simplifies the process of completing and signing the 592 F Form by providing a user-friendly platform. You can easily fill out the form, add necessary fields, and obtain electronic signatures from all parties involved, ensuring quick and secure submissions.

-

Is there a cost associated with using airSlate SignNow for the 592 F Form?

Yes, there is a cost for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. We offer various pricing plans tailored to meet your needs, ensuring that you get good value while efficiently managing your 592 F Form eSignatures.

-

What features does airSlate SignNow offer for the 592 F Form?

AirSlate SignNow offers a range of features for the 592 F Form, including customizable templates, secure storage, and real-time tracking of document status. Our platform also supports various file formats, making it easy to handle any related documentation seamlessly.

-

Are there specific benefits to using airSlate SignNow for tax forms like the 592 F Form?

Utilizing airSlate SignNow for the 592 F Form streamlines the signing process, reduces paperwork, and enhances efficiency. Additionally, our platform provides advanced security features to protect sensitive information and ensures compliance with relevant regulations.

-

Can airSlate SignNow integrate with other tools for managing the 592 F Form?

Yes, airSlate SignNow offers seamless integrations with several popular business applications, enhancing your overall workflow for managing the 592 F Form. You can connect with platforms like Google Drive, Salesforce, and many others to streamline document management processes.

-

How does airSlate SignNow ensure the security of my 592 F Form?

AirSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your 592 F Form and other sensitive documents. Additionally, our platform is compliant with industry standards, ensuring your data is safe during the eSigning process.

Get more for 592 F Form

Find out other 592 F Form

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now