Form1040department

What is the Form1040department

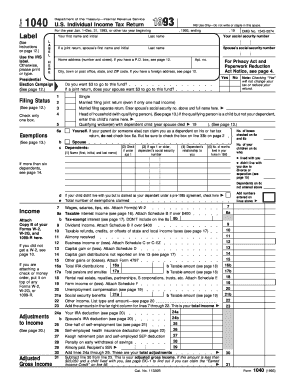

The Form1040department is a crucial document used by individuals in the United States for reporting personal income to the Internal Revenue Service (IRS). This form is essential for taxpayers to calculate their tax liability and determine any refunds or amounts owed. It encompasses various sections that require detailed financial information, including wages, interest, dividends, and other sources of income. Understanding the purpose and structure of the Form1040department is vital for accurate tax filing and compliance with federal regulations.

How to use the Form1040department

Using the Form1040department involves several steps to ensure accurate completion. First, gather all necessary documents, such as W-2s, 1099s, and any other income statements. Next, begin filling out the form by entering personal information, including your name, address, and Social Security number. Follow the instructions carefully to report income and deductions. Once completed, review the form for accuracy before submitting it to the IRS. Utilizing digital tools can streamline this process, allowing for easy editing and eSigning.

Steps to complete the Form1040department

Completing the Form1040department requires a systematic approach:

- Collect all relevant financial documents.

- Fill in personal information accurately.

- Report all sources of income, including wages and investment earnings.

- Claim deductions and credits applicable to your situation.

- Calculate your total tax liability.

- Review the completed form for errors.

- Submit the form electronically or by mail to the IRS.

Legal use of the Form1040department

The legal use of the Form1040department is governed by IRS regulations, which stipulate that the information provided must be accurate and complete. Filing this form is a legal requirement for most individuals earning income in the United States. Failure to file or providing false information can result in penalties, including fines or legal action. It is essential to ensure compliance with all IRS guidelines to maintain the legality of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Form1040department are critical for taxpayers to observe. Typically, the deadline for submitting this form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available and the importance of timely filing to avoid penalties. Keeping track of these dates is essential for effective tax management.

Required Documents

To complete the Form1040department accurately, several documents are necessary:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income sources

- Documentation for deductions and credits, such as mortgage interest statements

- Proof of health insurance coverage, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete form1040department

Effortlessly Prepare Form1040department on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an excellent eco-conscious substitute for traditional printed and signed documentation, allowing you to find the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form1040department on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign Form1040department with Ease

- Find Form1040department and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to finalize your changes.

- Select how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Form1040department while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form1040department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form1040department and how can airSlate SignNow help?

The form1040department is responsible for processing U.S. federal tax returns, specifically Form 1040. airSlate SignNow simplifies the process of signing and submitting this important document, ensuring that users can eSign their forms efficiently and securely.

-

What features does airSlate SignNow offer for managing form1040department documents?

airSlate SignNow offers features such as document templates, secure eSigning, and automated workflows that help manage forms required by the form1040department. These features streamline your tax filing process, making it simpler for individuals and businesses.

-

Is airSlate SignNow cost-effective for users dealing with form1040department?

Yes, airSlate SignNow provides a cost-effective solution for those interacting with the form1040department. With flexible pricing plans, users can choose the option that best suits their needs, allowing for efficient document handling without breaking the bank.

-

How secure is airSlate SignNow when dealing with sensitive form1040department documents?

airSlate SignNow prioritizes security, employing advanced encryption to protect all documents, including those related to the form1040department. Users can trust that their personal and tax information remains confidential throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for form1040department?

Absolutely! airSlate SignNow seamlessly integrates with various software, enhancing your experience with form1040department documents. Whether it's accounting software or cloud storage, integrations help streamline workflows and improve document management.

-

What are the benefits of using airSlate SignNow for the form1040department?

Using airSlate SignNow for the form1040department provides users with greater efficiency, reduced processing times, and improved document accuracy. The platform's user-friendly interface makes it accessible for anyone looking to eSign and manage important tax documents.

-

How do I get started with airSlate SignNow for my form1040department needs?

Getting started with airSlate SignNow is simple. Sign up for an account, explore the features tailored for the form1040department, and begin uploading your documents. Our support resources are also available to assist you throughout the process.

Get more for Form1040department

- Vessel title application dol wa gov form

- Backflow prevention assembly test report pass fail pass fail form

- Merchant information sheet networkamericanexpresscom

- National guard application pdf form

- Icbc accident report form pdf

- Dbq 10 what caused secession answer key form

- Psychosocial pain assessment form pain resource center city prc coh

- Laryngectomy attendance allowance form

Find out other Form1040department

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement