Ky Form 001 Fy Instructions

What is the Ky Form 001 Fy Instructions

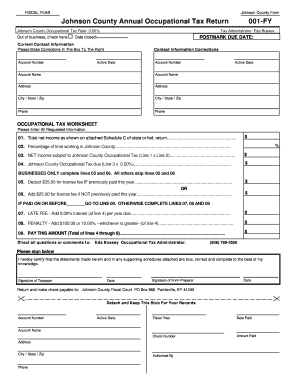

The Ky Form 001 Fy Instructions are essential guidelines for individuals and businesses in Kentucky that need to complete specific forms for financial reporting or compliance purposes. This form typically relates to state financial disclosures, ensuring that all necessary information is accurately reported to the appropriate authorities. Understanding the purpose and requirements of the Ky Form 001 Fy Instructions is crucial for maintaining compliance with state regulations.

How to use the Ky Form 001 Fy Instructions

Utilizing the Ky Form 001 Fy Instructions involves carefully following the outlined steps to ensure accurate completion. Begin by reviewing the instructions thoroughly to understand the required information and format. Gather all necessary documents and data before starting the form. As you fill it out, refer back to the instructions to confirm that each section is completed correctly. This attention to detail helps prevent errors that could lead to delays or penalties.

Steps to complete the Ky Form 001 Fy Instructions

Completing the Ky Form 001 Fy Instructions involves several key steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information, including financial records.

- Fill out the form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Ky Form 001 Fy Instructions

The legal use of the Ky Form 001 Fy Instructions is governed by state laws that dictate how financial information must be reported. It is essential to ensure that the form is completed in compliance with these regulations to avoid potential legal issues. Proper use of the form not only fulfills legal obligations but also contributes to transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Ky Form 001 Fy Instructions are critical to ensure compliance with state regulations. Typically, these deadlines are set annually and may vary depending on the specific requirements of the form. It is important to stay informed about these dates to avoid late submissions, which could result in penalties or other repercussions. Always check the latest information from the state to confirm the current deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Ky Form 001 Fy Instructions can be submitted through various methods to accommodate different preferences. Common submission options include:

- Online submission via the state’s official website.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Choosing the most convenient method for submission can help ensure that the form is received on time and processed efficiently.

Who Issues the Form

The Ky Form 001 Fy Instructions are issued by the Kentucky state government, specifically the department responsible for financial oversight and compliance. This department is tasked with ensuring that all financial forms are correctly filled out and submitted in accordance with state laws. Understanding the issuing authority can provide clarity on any additional requirements or resources available for completing the form.

Quick guide on how to complete ky form 001 fy instructions

Complete Ky Form 001 Fy Instructions effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, enabling you to obtain the necessary documents and securely maintain them online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage Ky Form 001 Fy Instructions on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ky Form 001 Fy Instructions with ease

- Find Ky Form 001 Fy Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Ky Form 001 Fy Instructions to ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky form 001 fy instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ky Form 001 Fy Instructions and why are they important?

Ky Form 001 Fy Instructions are essential guidelines for completing the Kentucky Form 001 for state financial transactions. They ensure that businesses correctly fill out the required information to remain compliant with state regulations. Having a clear understanding of these instructions is crucial to avoid errors that could lead to delays or penalties.

-

How does airSlate SignNow facilitate the completion of Ky Form 001 Fy Instructions?

airSlate SignNow streamlines the process of completing Ky Form 001 Fy Instructions by allowing users to fill out and eSign documents electronically. The platform provides an intuitive interface that simplifies the document preparation process, ensuring compliance with state requirements. This minimizes the hassle of paperwork and enhances efficiency.

-

What is the pricing structure for airSlate SignNow services related to Ky Form 001 Fy Instructions?

airSlate SignNow offers competitive pricing for its services, including support for Ky Form 001 Fy Instructions. Users can choose from several subscription plans tailored to their needs, ensuring they only pay for what they use. Additionally, airSlate SignNow often provides a free trial, allowing potential users to evaluate the service before committing.

-

Can I integrate airSlate SignNow with other tools for managing Ky Form 001 Fy Instructions?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance the management of Ky Form 001 Fy Instructions. This includes popular software like Google Drive, Salesforce, and others. These integrations allow for a smoother workflow, enabling users to manage their documents more efficiently.

-

What features does airSlate SignNow offer to simplify Ky Form 001 Fy Instructions?

AirSlate SignNow includes features like templates for Ky Form 001 Fy Instructions, electronic signatures, and tracking capabilities. These tools help users save time and ensure that documents are accurately filled out and signed. Additionally, users can collaborate in real-time, making it easier to gather necessary input from multiple parties.

-

Are there any benefits to using airSlate SignNow for Ky Form 001 Fy Instructions over traditional methods?

Using airSlate SignNow for Ky Form 001 Fy Instructions provides several benefits over traditional paper methods. It reduces processing time, eliminates the risk of lost documents, and ensures secure storage and access. Moreover, the electronic signature feature enhances the overall efficiency of finalizing important documents.

-

How secure is airSlate SignNow when handling documents like Ky Form 001 Fy Instructions?

AirSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to safeguard documents, including Ky Form 001 Fy Instructions. The platform’s robust security protocols ensure that sensitive information remains confidential and protected from unauthorized access. Users can trust that their documents are handled with the highest level of security.

Get more for Ky Form 001 Fy Instructions

- Mo corporation 497313118 form

- Notice of satisfaction corporation or llc missouri form

- Mo release lien form

- Quitclaim deed from individual to llc missouri form

- Warranty deed from individual to llc missouri form

- Missouri waiver form

- Mo husband wife form

- Warranty deed from husband and wife to corporation missouri form

Find out other Ky Form 001 Fy Instructions

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online