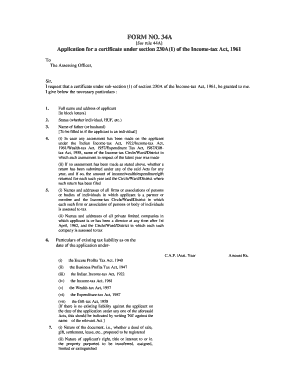

Form 34a Income Tax

What is the Form 34a Income Tax

The Form 34a income tax is a specific tax form used by individuals and businesses in the United States to report income and calculate their tax obligations. This form is essential for ensuring compliance with federal tax laws and provides the Internal Revenue Service (IRS) with necessary information regarding an individual's or entity's financial activities during the tax year. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the Form 34a Income Tax

Using the Form 34a income tax involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts, and any relevant tax information. Next, fill out the form accurately, ensuring that all sections are completed based on the information gathered. Once the form is filled out, review it for any errors before submission. It can be submitted electronically or via mail, depending on the preferences of the taxpayer and the specific requirements of the IRS.

Steps to complete the Form 34a Income Tax

Completing the Form 34a income tax involves a systematic approach:

- Gather all necessary financial documents, such as W-2s, 1099s, and other income records.

- Begin filling out the form by entering personal information, including your name, address, and Social Security number.

- Report income accurately in the designated sections, ensuring that all figures are correct.

- Calculate deductions and credits that may apply to your situation, as these can significantly affect your tax liability.

- Review the completed form for accuracy before submitting it to avoid potential penalties or delays.

Legal use of the Form 34a Income Tax

The legal use of the Form 34a income tax is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted by the appropriate deadline. Additionally, any signatures required must be provided in accordance with IRS guidelines. Utilizing a reliable electronic signature solution can enhance the legal validity of the form, as it ensures compliance with eSignature laws and provides an audit trail for verification.

Filing Deadlines / Important Dates

Filing deadlines for the Form 34a income tax are critical to avoid penalties. Typically, individual taxpayers must submit their forms by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses may have different deadlines based on their structure and fiscal year. It is important to keep track of these dates to ensure timely filing.

Required Documents

To complete the Form 34a income tax, several documents are required:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work performed.

- Records of any additional income, such as rental income or dividends.

- Documentation of deductions, including receipts for business expenses or charitable contributions.

Form Submission Methods (Online / Mail / In-Person)

The Form 34a income tax can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which often simplifies the process and allows for faster processing. Alternatively, the form can be printed and mailed to the appropriate IRS address. In some cases, individuals may also submit the form in person at designated IRS offices, although this is less common. Each method has its own advantages, so selecting the right one depends on personal preferences and circumstances.

Quick guide on how to complete form 34a income tax

Prepare Form 34a Income Tax effortlessly on any device

Managing documents online has become popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form 34a Income Tax on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The simplest way to modify and eSign Form 34a Income Tax effortlessly

- Locate Form 34a Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 34a Income Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 34a income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 34a income tax and why is it important?

Form 34a income tax is a crucial document used by businesses and individuals for filing income tax returns. It simplifies the reporting process and ensures compliance with tax regulations. Understanding its requirements can help taxpayers avoid penalties and streamline their financial management.

-

How can airSlate SignNow help with form 34a income tax?

airSlate SignNow provides an efficient way to manage and sign documents related to form 34a income tax. With our easy-to-use platform, you can eSign and send your tax forms securely and quickly. This not only saves time but also enhances accuracy when filing your income tax.

-

What features does airSlate SignNow offer for form 34a income tax?

Our platform includes features such as customizable templates, secure cloud storage, and real-time document tracking for form 34a income tax. These tools help you manage your tax documents more effectively and maintain organization throughout the filing process. Furthermore, our easy-to-navigate interface simplifies the signing process.

-

Are there any integrations available for working with form 34a income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software tools that handle form 34a income tax. This ensures that you can import necessary data directly into your tax forms, reducing manual entry and errors. Our integrations save you time and enhance productivity across different applications.

-

Is airSlate SignNow a cost-effective solution for managing form 34a income tax?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By utilizing our platform for form 34a income tax documentation, you can signNowly reduce costs associated with printing, mailing, and in-person signatures, leading to overall savings.

-

Can I customize my form 34a income tax documents using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your form 34a income tax documents. You can create templates tailored to your specific needs, add branding elements, and include necessary fields for signatures and information. This customization helps ensure compliance and presents a professional appearance.

-

Is it secure to use airSlate SignNow for my form 34a income tax documents?

Security is a top priority at airSlate SignNow, and our platform utilizes advanced encryption and security measures to protect your form 34a income tax documents. We are compliant with the highest industry standards to ensure that your sensitive data remains safe and confidential throughout the signing process.

Get more for Form 34a Income Tax

- Tenant consent to background and reference check vermont form

- Residential lease or rental agreement for month to month vermont form

- Residential rental lease agreement vermont form

- Tenant welcome letter vermont form

- Warning of default on commercial lease vermont form

- Warning of default on residential lease vermont form

- Landlord tenant closing statement to reconcile security deposit vermont form

- Vermont name change form

Find out other Form 34a Income Tax

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple