Sc Department of Revenue 1040x Form

What is the Sc Department Of Revenue 1040x Form

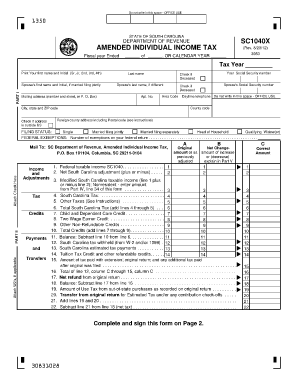

The Sc Department Of Revenue 1040x Form is a tax amendment form used by residents of South Carolina to correct errors on their previously filed state income tax returns. This form allows taxpayers to make adjustments to their reported income, deductions, or credits. It is essential for ensuring that the tax records are accurate and compliant with state regulations. Filing this form is crucial if you discover mistakes that could affect your tax liability or refund status.

How to use the Sc Department Of Revenue 1040x Form

To use the Sc Department Of Revenue 1040x Form, start by obtaining the form from the South Carolina Department of Revenue website or through authorized distribution points. Carefully read the instructions provided with the form to understand the specific amendments you need to make. Fill out the form by indicating the changes to your original return, including any new income, deductions, or credits. Ensure that you provide clear explanations for each amendment in the designated sections. Once completed, submit the form according to the guidelines provided, either electronically or via mail.

Steps to complete the Sc Department Of Revenue 1040x Form

Completing the Sc Department Of Revenue 1040x Form involves several key steps:

- Gather your original tax return and any supporting documents related to the changes.

- Obtain the 1040x form and read the instructions thoroughly.

- Fill in your personal information at the top of the form.

- Clearly indicate the changes you are making, including amounts and reasons for the amendments.

- Review your form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Sc Department Of Revenue 1040x Form

The legal use of the Sc Department Of Revenue 1040x Form is governed by state tax laws. It is essential to ensure that all information provided is truthful and accurate. Misrepresentation or fraud can lead to penalties, including fines or legal action. The form must be filed within the appropriate time frame, typically within three years of the original filing date, to be considered valid. Adhering to these legal requirements helps maintain compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Sc Department Of Revenue 1040x Form are typically aligned with the state tax calendar. Generally, taxpayers should submit the amended form within three years from the due date of the original return or within two years from the date of payment of the tax, whichever is later. It is important to stay informed about any changes in deadlines or specific dates announced by the South Carolina Department of Revenue to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Sc Department Of Revenue 1040x Form can be submitted through various methods. Taxpayers can file the form electronically using approved e-filing systems, which may offer a quicker processing time. Alternatively, the form can be mailed to the appropriate address provided in the instructions. In-person submissions are generally not recommended for this form; however, taxpayers may contact local offices for guidance if necessary. It is crucial to keep a copy of the submitted form and any correspondence for personal records.

Quick guide on how to complete sc department of revenue 1040x form

Complete Sc Department Of Revenue 1040x Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents rapidly without delays. Handle Sc Department Of Revenue 1040x Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Sc Department Of Revenue 1040x Form without hassle

- Locate Sc Department Of Revenue 1040x Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Sc Department Of Revenue 1040x Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc department of revenue 1040x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC Department Of Revenue 1040X Form?

The SC Department Of Revenue 1040X Form is an amended tax return used by residents of South Carolina to correct errors in their previously filed 1040 tax forms. It allows taxpayers to make adjustments to their income, deductions, or credits, and is essential for accurate tax reporting.

-

How can I electronically file the SC Department Of Revenue 1040X Form?

You can electronically file the SC Department Of Revenue 1040X Form through various online tax preparation services. These platforms often provide integrated eFiling options, ensuring that your amendment is submitted safely and conveniently in compliance with state regulations.

-

What features does airSlate SignNow offer for signing the SC Department Of Revenue 1040X Form?

airSlate SignNow provides a user-friendly platform for eSigning the SC Department Of Revenue 1040X Form. Features include convenient templates, seamless document sharing, and secure signing processes that ensure compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for the SC Department Of Revenue 1040X Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The affordable options allow you to process your SC Department Of Revenue 1040X Form efficiently, making it a cost-effective solution for eSigning and document management.

-

Can I integrate airSlate SignNow with other applications for processing the SC Department Of Revenue 1040X Form?

Absolutely! airSlate SignNow integrates with a variety of applications, enhancing your workflow for processing the SC Department Of Revenue 1040X Form. Popular integrations include Google Drive, Dropbox, and various CRM systems, which streamline document handling.

-

What are the benefits of using airSlate SignNow for the SC Department Of Revenue 1040X Form?

Using airSlate SignNow for the SC Department Of Revenue 1040X Form provides several benefits, including improved efficiency and the ability to access documents from anywhere. The platform ensures timely processing and secure handling of sensitive tax information.

-

How does airSlate SignNow ensure the security of my SC Department Of Revenue 1040X Form?

airSlate SignNow employs advanced encryption and security protocols to protect your SC Department Of Revenue 1040X Form. With features like two-factor authentication and secure cloud storage, your sensitive information is safeguarded throughout the signing process.

Get more for Sc Department Of Revenue 1040x Form

- Washington bill sale 497430239 form

- Living wills and health care package washington form

- Last will testament document 497430241 form

- Subcontractors package washington form

- Washington identity form

- Washington identity 497430244 form

- Wa deceased form

- Identity theft by known imposter package washington form

Find out other Sc Department Of Revenue 1040x Form

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free