FORM NO 30B See Rule 43 No Objection Certificate for a Person Incometaxindiapr Gov

What is the FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

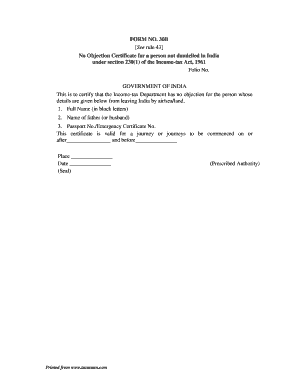

The FORM NO 30B, as outlined in Rule 43, serves as a No Objection Certificate for individuals in relation to income tax matters. This document is essential for confirming that an individual does not have any outstanding tax liabilities or objections that could hinder specific transactions or processes. It is often required in various contexts, such as when applying for loans, transferring property, or during other financial dealings where proof of tax compliance is necessary.

How to use the FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

Utilizing the FORM NO 30B involves understanding its purpose and the specific requirements for completion. Individuals must fill out the form accurately, providing necessary personal and financial details. Once completed, the form should be submitted to the relevant tax authority or organization requesting the certificate. It is important to ensure that all information is correct to avoid delays in processing or potential legal issues.

Steps to complete the FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

Completing the FORM NO 30B involves several key steps:

- Gather necessary documents, including identification and tax records.

- Fill out the form with accurate personal details, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form to the appropriate authority, either online or in person.

Following these steps carefully will help ensure that the form is processed smoothly and efficiently.

Legal use of the FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

The FORM NO 30B is legally binding when filled out and submitted according to the established guidelines. For it to be considered valid, it must meet specific legal requirements, including proper signatures and adherence to local tax laws. The form is recognized by various institutions as proof of tax compliance, making it crucial for individuals engaging in significant financial transactions.

Key elements of the FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

Key elements of the FORM NO 30B include:

- Personal identification information of the applicant.

- Details regarding tax filings and compliance status.

- Signature of the individual certifying the accuracy of the information.

- Date of submission and any relevant reference numbers.

Each of these components is essential for ensuring the form's validity and acceptance by the requesting authority.

Eligibility Criteria

To be eligible for the FORM NO 30B, individuals must meet certain criteria, including:

- Being a resident of the jurisdiction where the form is submitted.

- Having no outstanding tax liabilities or objections.

- Providing accurate and complete information on the form.

Meeting these criteria is crucial for obtaining the No Objection Certificate without complications.

Quick guide on how to complete form no 30b see rule 43 no objection certificate for a person incometaxindiapr gov

Accomplish FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov effortlessly

- Locate FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether via email, text message (SMS), invitation link, or by downloading it to your computer.

No more worrying about lost or misplaced paperwork, tedious form searches, or mistakes necessitating new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 30b see rule 43 no objection certificate for a person incometaxindiapr gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov.?

FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. is a crucial document required for individuals seeking a no objection certificate from tax authorities. It serves as a verification tool for financial transactions and compliance. Understanding its specifics can greatly benefit individuals navigating tax obligations.

-

How can airSlate SignNow help in managing FORM NO 30B submissions?

airSlate SignNow empowers users to quickly create, send, and eSign FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. documents. With its intuitive interface, you can streamline your submission process and ensure that all necessary documentation is correctly handled. This saves time and reduces the risk of errors.

-

What are the key features of airSlate SignNow for handling FORM NO 30B?

Key features of airSlate SignNow include easy-to-use templates, seamless eSignature options, and robust tracking capabilities for FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. documents. These tools allow you to manage approvals efficiently and maintain compliance. Plus, you can access your documents from anywhere, enhancing flexibility.

-

Is there a cost associated with using airSlate SignNow for FORM NO 30B?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing plans offer various levels of service tailored to meet your needs, whether you're handling FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. or other document types. You can choose a plan that aligns with your budget.

-

Can I integrate airSlate SignNow with other tools when working with FORM NO 30B?

Absolutely! airSlate SignNow provides integration capabilities with various third-party applications. This allows you to enhance your workflows while managing FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. and other documents, ensuring all your digital tools work seamlessly together.

-

What benefits does airSlate SignNow offer for electronic signatures on FORM NO 30B?

Using airSlate SignNow for electronic signatures on FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. offers convenience and security. The eSignature process is quick and legally binding, ensuring that your documents are accepted by authorities. This signNowly accelerates approval times and simplifies compliance.

-

How does airSlate SignNow ensure the security of my FORM NO 30B documents?

airSlate SignNow uses advanced security measures to protect your data and documents, including those related to FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov. This includes encryption, secure storage, and regular security audits, ensuring that your sensitive information remains confidential and protected.

Get more for FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

Find out other FORM NO 30B See Rule 43 No Objection Certificate For A Person Incometaxindiapr Gov

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed