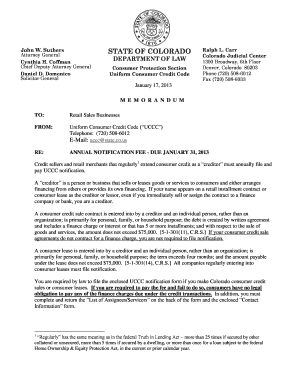

Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral

What is the Colorado Uniform Consumer Credit Code?

The Colorado Uniform Consumer Credit Code (UCCC) is a set of laws designed to regulate consumer credit transactions in the state of Colorado. It aims to protect consumers by ensuring fair practices in lending and credit agreements. The UCCC covers various aspects of consumer credit, including disclosure requirements, interest rates, and the rights of borrowers. Understanding the UCCC is crucial for both consumers and lenders to navigate the complexities of credit transactions effectively.

Key Elements of the Colorado Uniform Consumer Credit Code

Several key elements define the Colorado UCCC, including:

- Disclosure Requirements: Lenders must provide clear and concise information about the terms of credit, including interest rates and fees.

- Interest Rate Limits: The UCCC sets maximum interest rates for various types of loans to prevent predatory lending practices.

- Borrower Rights: Consumers have specific rights under the UCCC, including the right to dispute charges and seek remedies for violations.

- Regulatory Compliance: Lenders must adhere to the UCCC's provisions to ensure they operate within the legal framework established by the state.

Steps to Complete the Colorado Uniform Consumer Credit Code

Completing the Colorado UCCC involves several important steps:

- Gather Necessary Information: Collect all relevant personal and financial information required for the credit application.

- Review Terms: Carefully read the credit terms and conditions provided by the lender, ensuring you understand all aspects.

- Fill Out the Application: Accurately complete the application form, providing truthful and complete information.

- Submit the Application: Send the completed application to the lender, either online or via mail, as specified.

Legal Use of the Colorado Uniform Consumer Credit Code

The legal use of the Colorado UCCC ensures that both consumers and lenders comply with established regulations. For a credit transaction to be legally binding, it must adhere to the UCCC's requirements, including proper disclosures and compliance with interest rate limits. Failure to comply can result in penalties for lenders and potential legal recourse for consumers.

How to Use the Colorado Uniform Consumer Credit Code

Using the Colorado UCCC effectively requires understanding its provisions and applying them in credit transactions. Consumers should familiarize themselves with their rights under the UCCC and ensure that lenders provide the necessary disclosures. Lenders, on the other hand, must implement practices that comply with the UCCC to protect consumers and avoid legal issues.

State-Specific Rules for the Colorado Uniform Consumer Credit Code

Colorado has specific rules that govern the application of the UCCC, which may differ from regulations in other states. These rules include unique disclosure formats, interest rate caps, and consumer protection measures tailored to the needs of Colorado residents. It is essential for both consumers and lenders to be aware of these state-specific regulations to ensure compliance and protect their rights.

Quick guide on how to complete colorado uniform consumer credit code colorado attorney general coloradoattorneygeneral

Prepare Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without hindrances. Manage Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral effortlessly

- Find Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and electronically sign Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral and ensure impeccable communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado uniform consumer credit code colorado attorney general coloradoattorneygeneral

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado uccc and how does it relate to airSlate SignNow?

The colorado uccc, or Uniform Consumer Credit Code, establishes regulations on consumer credit transactions in Colorado. airSlate SignNow assists businesses in managing documents related to the colorado uccc by providing a secure eSigning solution that ensures compliance and simplifies the documentation process.

-

How does airSlate SignNow help with compliance regarding the colorado uccc?

airSlate SignNow helps businesses remain compliant with the colorado uccc by allowing for legally binding eSignatures on important documents. This ensures that all consumer credit transactions are documented accurately and securely, meeting the state's regulatory requirements.

-

What pricing options are available for using airSlate SignNow with colorado uccc documents?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes looking to manage colorado uccc documents. Each plan provides access to eSigning features, document templates, and compliance tools, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for managing colorado uccc transactions?

Yes, airSlate SignNow offers seamless integrations with popular software such as CRM systems and document management tools. This allows businesses to streamline their processes while handling colorado uccc-related documents efficiently.

-

What key features does airSlate SignNow provide for managing colorado uccc documentation?

AirSlate SignNow includes features such as customizable templates, bulk sending options, and advanced security measures. These tools make it easy for businesses to create, send, and manage documents related to the colorado uccc while maintaining compliance.

-

How does airSlate SignNow enhance the customer experience with colorado uccc filings?

By using airSlate SignNow, businesses can enhance customer experience by providing a fast, secure, and user-friendly eSigning process for colorado uccc filings. Customers can sign documents from any device at their convenience, improving overall satisfaction and efficiency.

-

Is airSlate SignNow suitable for small businesses handling colorado uccc documents?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal choice for small businesses dealing with colorado uccc documentation. The platform scales with your business needs while keeping compliance simple and affordable.

Get more for Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral

- Aoc pbgn3f arizona judicial branch form

- Petition for certificate releasing liens form

- Fillable form co 1082

- Safe deposit box inventory sheet form

- Sanitary permit guam form

- Statement of temporary nature form

- Adoption questionnaire cat adoption service cats catadoptionservice form

- Firearm release form

Find out other Colorado Uniform Consumer Credit Code Colorado Attorney General Coloradoattorneygeneral

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free