IRS Issues Standard Mileage Rates for 2019Internal Revenue Form

What is the IRS Issues Standard Mileage Rates For 2019Internal Revenue

The IRS Issues Standard Mileage Rates for 2019 provides taxpayers with a guideline for calculating deductible vehicle expenses. These rates are set annually and apply to business, medical, and charitable driving. The standard mileage rate simplifies the process of claiming deductions by allowing taxpayers to multiply the number of miles driven by the applicable rate, rather than keeping detailed records of all vehicle expenses. For 2019, the rates were established at fifty-eight cents per mile for business use, twenty cents per mile for medical or moving purposes, and fourteen cents per mile for charitable activities.

Steps to complete the IRS Issues Standard Mileage Rates For 2019Internal Revenue

To effectively use the IRS Issues Standard Mileage Rates for 2019, follow these steps:

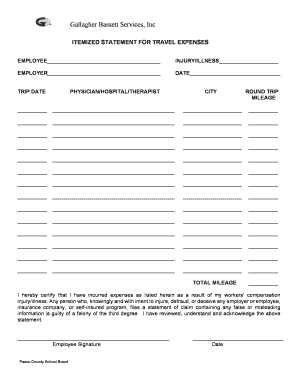

- Determine the purpose of your driving: Identify whether your mileage is for business, medical, or charitable reasons.

- Keep accurate records: Document the date, destination, purpose, and total miles driven for each trip.

- Calculate your deduction: Multiply the total miles driven by the applicable standard mileage rate for the year.

- Report the deduction: Enter the calculated amount on your tax return in the appropriate section for deductions.

Legal use of the IRS Issues Standard Mileage Rates For 2019Internal Revenue

The legal use of the IRS Issues Standard Mileage Rates for 2019 is crucial for ensuring compliance with tax regulations. Taxpayers must adhere to the IRS guidelines when claiming deductions. This includes maintaining proper documentation and using the correct mileage rates. Failure to comply may result in penalties or disallowed deductions during an audit. Understanding the legal framework surrounding these rates helps taxpayers maximize their deductions while remaining within legal boundaries.

Examples of using the IRS Issues Standard Mileage Rates For 2019Internal Revenue

Examples of utilizing the IRS Issues Standard Mileage Rates for 2019 can clarify how to apply the rates in real scenarios. For instance, if a self-employed consultant drives one hundred miles for client meetings, they would calculate their deduction by multiplying one hundred miles by fifty-eight cents, resulting in a deduction of fifty-eight dollars. Another example is a volunteer who drives fifty miles for charitable work; they would multiply fifty miles by fourteen cents, yielding a deduction of seven dollars.

Filing Deadlines / Important Dates

Filing deadlines are essential for taxpayers using the IRS Issues Standard Mileage Rates for 2019. Typically, individual tax returns are due on April fifteenth of the following year, unless an extension is filed. It is crucial to be aware of these dates to ensure timely submission of tax returns and to avoid penalties. Additionally, any changes to the standard mileage rates or related IRS announcements should be monitored throughout the year.

Required Documents

When claiming deductions using the IRS Issues Standard Mileage Rates for 2019, certain documents are necessary. Taxpayers should maintain a mileage log that records the date, purpose, and miles driven for each trip. Additionally, any receipts related to vehicle expenses, such as maintenance or fuel, may be beneficial for substantiating claims. Having organized documentation simplifies the tax filing process and supports claims in case of an audit.

Quick guide on how to complete irs issues standard mileage rates for 2019internal revenue

Prepare IRS Issues Standard Mileage Rates For 2019Internal Revenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage IRS Issues Standard Mileage Rates For 2019Internal Revenue on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign IRS Issues Standard Mileage Rates For 2019Internal Revenue with ease

- Locate IRS Issues Standard Mileage Rates For 2019Internal Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or shared link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or mistakes that require the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign IRS Issues Standard Mileage Rates For 2019Internal Revenue and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs issues standard mileage rates for 2019internal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Issues Standard Mileage Rates For 2019Internal Revenue?

The IRS Issues Standard Mileage Rates For 2019Internal Revenue outlines the reimbursement rates you can claim for business travel. For 2019, the standard mileage rate was set at 58 cents per mile driven for business purposes. It's essential for businesses to track their miles accurately to optimize tax deductions.

-

How can airSlate SignNow help with IRS tax documentation?

airSlate SignNow streamlines the process of completing and submitting IRS tax documents related to the IRS Issues Standard Mileage Rates For 2019Internal Revenue. Our platform allows you to electronically sign and send necessary forms, ensuring compliance and timely submission. This capability helps reduce paperwork and automates your business workflow.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing features that include eSigning and document management, which can be crucial for maintaining records related to the IRS Issues Standard Mileage Rates For 2019Internal Revenue. A free trial is also available for new users.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a robust suite of document management features, including eSigning, document templates, and collaboration tools. These features ensure you can efficiently manage all documents related to IRS Issues Standard Mileage Rates For 2019Internal Revenue. Enhanced security and compliance features protect sensitive tax-related information.

-

How does airSlate SignNow ensure compliance with IRS regulations?

airSlate SignNow is designed with compliance in mind, particularly with IRS regulations such as those outlined in the IRS Issues Standard Mileage Rates For 2019Internal Revenue. Our platform complies with eSignature laws, ensuring that your digitally signed documents hold the same legal weight as traditional signatures. This gives users peace of mind when handling critical tax documents.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software tools like CRM systems and accounting software. This helps streamline workflows related to the IRS Issues Standard Mileage Rates For 2019Internal Revenue and ensures that all your business documents are connected seamlessly. This integration reduces the effort needed to manage multiple platforms.

-

Is customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides extensive customer support for all users. Whether you have questions about the IRS Issues Standard Mileage Rates For 2019Internal Revenue or need assistance with the platform, our support team is available via chat, email, or phone to ensure a smooth experience.

Get more for IRS Issues Standard Mileage Rates For 2019Internal Revenue

- Maintenance request form 244113634

- Odometer disclosure statement atlantic city classic car auction form

- Wwworegongovodotdmvoregon department of transportation vehicle trip permits form

- Daily outdoor safety checklist form

- City of encinitas permits form

- Pdf charity golf tournament flyer the italian catholic federation form

- Request to withdra from m ocps form

- Medical history form for personal training

Find out other IRS Issues Standard Mileage Rates For 2019Internal Revenue

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement