San Bernardino County Excess Proceeds List Form

What is the San Bernardino County Excess Proceeds List

The San Bernardino County Excess Proceeds List is a record that details surplus funds generated from the sale of tax-defaulted properties. When a property is sold at a tax auction, any amount exceeding the total tax owed, fees, and costs is considered excess proceeds. This list is essential for property owners and interested parties to identify potential claims for these surplus funds, which may be available for distribution to former property owners or lienholders.

How to use the San Bernardino County Excess Proceeds List

To effectively utilize the San Bernardino County Excess Proceeds List, individuals should first review the list to identify any surplus funds associated with properties they have an interest in. Once identified, claimants must gather the necessary documentation to support their claim, which may include proof of ownership, identification, and any relevant court documents. Following this, the claim can be submitted to the appropriate county department for processing.

Steps to complete the San Bernardino County Excess Proceeds List

Completing the San Bernardino County Excess Proceeds List involves several key steps:

- Review the excess proceeds list to find relevant entries.

- Gather required documentation, including proof of ownership and identification.

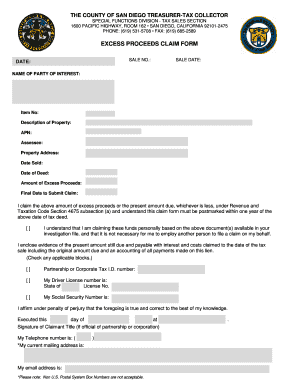

- Fill out any necessary forms to claim the excess proceeds.

- Submit the completed forms and documentation to the designated county office.

- Await confirmation and processing of your claim.

Legal use of the San Bernardino County Excess Proceeds List

The legal use of the San Bernardino County Excess Proceeds List is governed by state laws and regulations regarding tax sales and surplus funds. Claimants must ensure they meet eligibility criteria and comply with all legal requirements when filing a claim. Failure to adhere to these regulations may result in the denial of claims or legal repercussions.

Eligibility Criteria

Eligibility to claim funds from the San Bernardino County Excess Proceeds List typically requires that the claimant was the former owner of the property or a lienholder. Additionally, claimants must provide adequate proof of their identity and ownership interest. Specific eligibility criteria may vary, so it is advisable to consult the county's guidelines for detailed information.

Required Documents

To successfully file a claim for excess proceeds, certain documents are generally required. These may include:

- Proof of ownership, such as a deed or tax bill.

- Identification, like a driver's license or government-issued ID.

- Any relevant court documents if applicable.

- Completed claim forms as specified by the county.

Form Submission Methods

Claims for excess proceeds from the San Bernardino County Excess Proceeds List can typically be submitted through various methods, including:

- Online submission via the county's official website.

- Mailing the completed forms and documents to the designated office.

- In-person submission at the county office during business hours.

Quick guide on how to complete san bernardino county excess proceeds list

Complete San Bernardino County Excess Proceeds List with ease on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle San Bernardino County Excess Proceeds List on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign San Bernardino County Excess Proceeds List effortlessly

- Locate San Bernardino County Excess Proceeds List and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your needs in document management with just a few clicks from any device you prefer. Edit and sign San Bernardino County Excess Proceeds List to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the san bernardino county excess proceeds list

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the San Bernardino County excess proceeds list?

The San Bernardino County excess proceeds list is a record that documents surplus funds from the sale of tax-defaulted properties. These funds can be claimed by former property owners and beneficiaries. Understanding this list can help you retrieve any excess proceeds owed to you.

-

How can I access the San Bernardino County excess proceeds list?

You can access the San Bernardino County excess proceeds list through the official San Bernardino County website. This list is updated regularly, ensuring you have the most accurate information available for claiming any funds. It’s a straightforward process that requires minimal navigation.

-

Is there a fee to retrieve information from the San Bernardino County excess proceeds list?

There is no fee associated with accessing the San Bernardino County excess proceeds list. The county provides this information for free to help individuals claim their rightful funds from excess proceeds. It's part of the public service to ensure transparency and support in property matters.

-

What are the benefits of using the San Bernardino County excess proceeds list?

The primary benefit of using the San Bernardino County excess proceeds list is the opportunity to reclaim funds that you may not know are owed to you. This list can save you time and effort in finding out about excess proceeds. Additionally, it allows previous property owners to recover their financial losses efficiently.

-

How often is the San Bernardino County excess proceeds list updated?

The San Bernardino County excess proceeds list is updated regularly, often in accordance with upcoming tax sales or property auctions. Keeping an eye on this list can ensure you never miss the chance to claim your excess proceeds. Regular updates help you track any changes or new entries relevant to your situation.

-

Can airSlate SignNow assist me in claiming funds from the San Bernardino County excess proceeds list?

While airSlate SignNow doesn't directly assist with claiming funds from the San Bernardino County excess proceeds list, it can simplify document management for your claims process. Using our platform ensures that your application and relevant documents are signed and sent efficiently. This can streamline your efforts in managing financial claims.

-

What types of documents may I need when claiming excess proceeds from the list?

When claiming excess proceeds from the San Bernardino County excess proceeds list, you may need documents such as proof of ownership, identification, and any relevant court orders. Having these documents prepared can expedite the claiming process. AirSlate SignNow can help you organize and eSign necessary forms seamlessly.

Get more for San Bernardino County Excess Proceeds List

- Voiding diary canadian urological association cua form

- Pre application friends of housing wi form

- Portland protocol form

- Use this sheet for additional employment history information

- Wb 17 offer to purchase business without real estate to be form

- Omb no 0960 0623 form

- Ama minor release form

- Heap program woodland ca form

Find out other San Bernardino County Excess Proceeds List

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document