Capital Improvement Form Fillable

What is the Capital Improvement Form Fillable

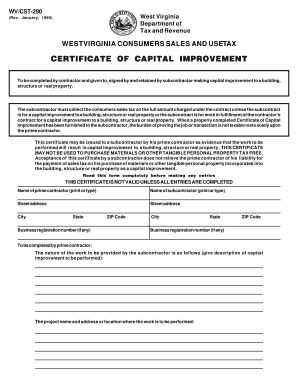

The capital improvement form fillable is a document used to request funding or approval for improvements made to a property. This form typically outlines the specific enhancements being proposed, their costs, and the anticipated benefits. By providing a structured way to present this information, the form facilitates decision-making processes for stakeholders involved in property management or development. It is essential for ensuring that all necessary details are captured, allowing for a clear understanding of the proposed improvements.

How to Use the Capital Improvement Form Fillable

Using the capital improvement form fillable involves several straightforward steps. First, access the form through a digital platform that supports fillable documents. Next, carefully read the instructions provided to ensure all required fields are understood. Fill in the relevant information, including project details, estimated costs, and any supporting documentation that may be required. Once completed, review the form for accuracy before submitting it electronically or as directed. Utilizing a digital format streamlines the process, making it easier to manage and track submissions.

Steps to Complete the Capital Improvement Form Fillable

Completing the capital improvement form fillable requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary information about the proposed improvements, including descriptions, costs, and timelines.

- Open the fillable form in a compatible application.

- Input the required data in each section, ensuring clarity and accuracy.

- Attach any supplementary documents that support your request.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified guidelines, ensuring it reaches the appropriate authority.

Legal Use of the Capital Improvement Form Fillable

The capital improvement form fillable holds legal significance when completed and submitted correctly. To ensure its legality, it must comply with relevant regulations, such as those governing eSignatures and electronic documentation. This includes adhering to the ESIGN Act and UETA, which validate electronic signatures and documents as legally binding. By using a reliable digital platform that provides compliance features, users can ensure that their submissions are recognized legally by institutions and courts.

Key Elements of the Capital Improvement Form Fillable

Several key elements are essential to include in the capital improvement form fillable to ensure its effectiveness:

- Project Description: A clear and concise explanation of the improvements being proposed.

- Cost Estimates: Detailed breakdowns of anticipated expenses associated with the project.

- Timeline: An estimated schedule for the completion of the improvements.

- Justification: Reasons for the proposed improvements, including benefits to the property or community.

- Signatures: Required approvals from relevant stakeholders, ensuring accountability.

Examples of Using the Capital Improvement Form Fillable

Examples of scenarios where the capital improvement form fillable may be utilized include:

- A property management company seeking funding for a new roof installation.

- A community organization requesting approval for a park renovation project.

- A business applying for improvements to enhance accessibility for customers.

Each of these examples highlights the importance of clearly documenting proposed improvements to facilitate approval and funding processes.

Quick guide on how to complete capital improvement form fillable

Create Capital Improvement Form Fillable effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Capital Improvement Form Fillable on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven task today.

How to amend and eSign Capital Improvement Form Fillable effortlessly

- Locate Capital Improvement Form Fillable and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require new document printouts. airSlate SignNow meets your requirements in document management with just a few clicks from any device. Modify and eSign Capital Improvement Form Fillable to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the capital improvement form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a capital improvement form fillable?

A capital improvement form fillable is a digital document that allows users to enter their information online. It simplifies the process of documenting and requesting capital improvements, making it more efficient for both businesses and clients.

-

How can I create a capital improvement form fillable using airSlate SignNow?

You can easily create a capital improvement form fillable by using our intuitive drag-and-drop editor. Simply select the form template, customize the fields to suit your needs, and save it for use. Our platform makes document creation quick and user-friendly.

-

Is there a cost associated with using capital improvement form fillable?

Yes, airSlate SignNow offers pricing plans that cater to different business needs. You can access the capital improvement form fillable as part of our standard subscription, which includes additional features for an affordable monthly fee.

-

Can I integrate the capital improvement form fillable with other software?

Absolutely! airSlate SignNow offers integrations with various platforms, including Google Drive, Dropbox, and more. This capability allows you to streamline your workflow by easily managing your capital improvement form fillable alongside your existing software tools.

-

What are the main benefits of using a capital improvement form fillable?

Using a capital improvement form fillable enhances efficiency, reduces paperwork, and improves tracking of requests. It allows for quick edits and real-time updates, ensuring all stakeholders have access to the latest information effortlessly.

-

How secure is the information submitted in the capital improvement form fillable?

Security is a top priority at airSlate SignNow. All information submitted through the capital improvement form fillable is encrypted and stored securely, ensuring your data remains confidential and protected from unauthorized access.

-

Can multiple users collaborate on a capital improvement form fillable?

Yes, multiple users can easily collaborate on a capital improvement form fillable. Our platform allows for real-time collaboration, enabling teams to work together on the form, making edits and providing feedback directly within the document.

Get more for Capital Improvement Form Fillable

Find out other Capital Improvement Form Fillable

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement