Fr Hd Homestead Deduction Form

What is the Fr Hd Homestead Deduction Form

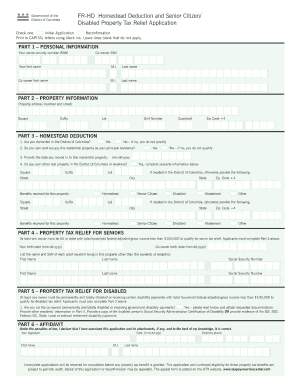

The Fr Hd Homestead Deduction Form is a crucial document used by homeowners in the United States to claim a homestead exemption on their property taxes. This exemption can significantly reduce the amount of property tax owed, providing financial relief to eligible homeowners. The form typically requires information about the property, the homeowner's residency status, and other relevant details to establish eligibility for the deduction.

How to use the Fr Hd Homestead Deduction Form

To effectively use the Fr Hd Homestead Deduction Form, begin by gathering all necessary information, including property details and proof of residency. Once you have the required documents, complete the form accurately, ensuring that all sections are filled out. After completing the form, you can submit it according to your local jurisdiction's guidelines, which may include online submission, mailing, or in-person delivery. It is essential to follow these instructions carefully to ensure your application is processed without delays.

Steps to complete the Fr Hd Homestead Deduction Form

Completing the Fr Hd Homestead Deduction Form involves several key steps:

- Gather necessary documents: Collect proof of ownership, residency, and any other supporting documents required by your state.

- Fill out the form: Provide accurate information in all sections, including personal details and property specifics.

- Review your submission: Double-check all entries for accuracy and completeness to avoid any issues during processing.

- Submit the form: Follow the submission guidelines provided by your local tax authority, whether online, by mail, or in person.

Eligibility Criteria

To qualify for the Fr Hd Homestead Deduction, homeowners must meet specific eligibility criteria that vary by state. Generally, applicants must be the legal owner of the property, occupy it as their primary residence, and meet any income or age requirements set by local laws. Some states may also have additional stipulations, such as restrictions on previous exemptions or property types. It is essential to review your state's guidelines to ensure compliance with all eligibility requirements.

Form Submission Methods

The Fr Hd Homestead Deduction Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions offer an online portal for submitting the form electronically, which can expedite processing.

- Mail: You may choose to print the completed form and send it via postal service to your local tax office.

- In-person: Some homeowners prefer to submit the form in person at their local tax office to receive immediate confirmation of receipt.

Key elements of the Fr Hd Homestead Deduction Form

The Fr Hd Homestead Deduction Form contains several key elements that are essential for determining eligibility and processing the exemption. These elements typically include:

- Homeowner information: Name, contact details, and social security number.

- Property information: Address, parcel number, and description of the property.

- Residency status: Confirmation that the property is the homeowner's primary residence.

- Signature: The homeowner's signature is often required to validate the information provided.

Quick guide on how to complete fr hd homestead deduction form

Effortlessly Prepare Fr Hd Homestead Deduction Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed files, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, alter, and eSign your documents quickly and efficiently. Handle Fr Hd Homestead Deduction Form seamlessly on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The Simplest Way to Alter and eSign Fr Hd Homestead Deduction Form Effortlessly

- Find Fr Hd Homestead Deduction Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Fr Hd Homestead Deduction Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fr hd homestead deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fr Hd Homestead Deduction Form?

The Fr Hd Homestead Deduction Form is a crucial document that homeowners must complete to claim their homestead property tax exemption. This form helps reduce the amount of property tax owed, providing financial relief to eligible homeowners. Understanding its requirements is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with the Fr Hd Homestead Deduction Form?

airSlate SignNow streamlines the process of filling out and signing the Fr Hd Homestead Deduction Form. Our user-friendly platform allows you to easily complete and eSign documents, ensuring you submit the form accurately and on time. This efficiency helps you focus on getting your homestead tax benefits faster.

-

Is there a cost associated with using airSlate SignNow for the Fr Hd Homestead Deduction Form?

airSlate SignNow offers competitive pricing that is designed to be cost-effective for individuals and businesses. Users can access various plans, including options suitable for filing the Fr Hd Homestead Deduction Form without breaking the bank. Our commitment is to provide quality service that fits your budget.

-

What features does airSlate SignNow offer for managing the Fr Hd Homestead Deduction Form?

airSlate SignNow provides several features tailored to facilitate the completion of the Fr Hd Homestead Deduction Form. Key features include customizable templates, secure document storage, and real-time collaboration, ensuring every detail is accurately represented. These tools empower users to handle their documents efficiently.

-

Can I integrate airSlate SignNow with other software for filing the Fr Hd Homestead Deduction Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your efficiency when filing the Fr Hd Homestead Deduction Form. Through integration, you can automatically populate the form with necessary data, reducing manual entry and the potential for errors.

-

What are the benefits of using airSlate SignNow for eSigning the Fr Hd Homestead Deduction Form?

Using airSlate SignNow for eSigning the Fr Hd Homestead Deduction Form brings numerous benefits, including speed and convenience. The platform allows you to sign documents from anywhere, at any time, which is especially useful for busy homeowners. Additionally, it provides a secure and legally binding way to execute your forms.

-

How does airSlate SignNow ensure the security of the Fr Hd Homestead Deduction Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the Fr Hd Homestead Deduction Form. We utilize robust encryption methods and secure cloud storage to protect your data. Our compliance with regulatory standards guarantees that your information remains safe throughout the signing process.

Get more for Fr Hd Homestead Deduction Form

- Work permit format in excel

- Vending machine pdf form

- 1998 chevy silverado repair manual pdf form

- Form no e 5

- Briggs and stratton repair manual pdf form

- Wheelers atlas of tooth form pdf

- Information for health departments on reporting cases of covid 19

- Behavioral health ampampamp substance abuse services form

Find out other Fr Hd Homestead Deduction Form

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online