8288 B Fillable Form

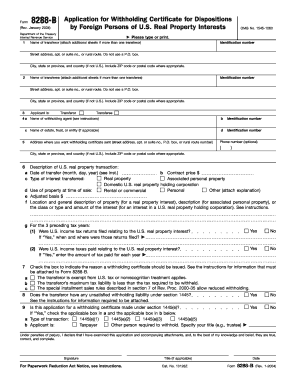

What is the 8288 B Fillable Form

The 8288 B Fillable Form is a tax document used by foreign persons to report and pay taxes on the disposition of U.S. real property interests. This form is crucial for ensuring compliance with U.S. tax regulations, particularly for non-resident aliens and foreign corporations. It serves as a means for the Internal Revenue Service (IRS) to collect taxes on gains from the sale of U.S. real estate, ensuring that foreign sellers fulfill their tax obligations. The form must be filed when a foreign individual or entity sells a property located in the United States.

How to use the 8288 B Fillable Form

Using the 8288 B Fillable Form involves several steps to ensure accurate completion and compliance with IRS guidelines. Initially, gather all necessary information, including the seller's details, property information, and the amount realized from the sale. Once this information is collected, access the fillable form through a reliable electronic platform, such as signNow, which allows for easy input and electronic signing. After filling out the form, review it thoroughly for accuracy before submitting it to the IRS.

Steps to complete the 8288 B Fillable Form

Completing the 8288 B Fillable Form requires careful attention to detail. Follow these steps:

- Download the form from a trusted source or access it through a fillable PDF tool.

- Provide the seller's name, address, and taxpayer identification number.

- Enter the details of the property being sold, including its location and sales price.

- Calculate the withholding amount based on the sale price and applicable tax rates.

- Sign and date the form, ensuring that all information is accurate and complete.

Legal use of the 8288 B Fillable Form

The legal use of the 8288 B Fillable Form is essential for foreign sellers of U.S. real estate. Filing this form ensures compliance with the Foreign Investment in Real Property Tax Act (FIRPTA), which mandates that foreign persons pay taxes on gains from U.S. property sales. The form must be submitted to the IRS to report the sale and remit any required withholding tax. Failure to file the form can result in penalties and interest charges, making it vital for sellers to understand their obligations under U.S. tax law.

IRS Guidelines

The IRS provides specific guidelines for the use of the 8288 B Fillable Form. These guidelines outline the required information, filing deadlines, and payment procedures. It is important for filers to familiarize themselves with these guidelines to ensure compliance and avoid penalties. The IRS also offers resources and assistance for understanding the obligations associated with selling U.S. real estate as a foreign person, including detailed instructions for completing the form accurately.

Form Submission Methods

The 8288 B Fillable Form can be submitted to the IRS through various methods. Filers have the option to submit the form electronically via approved e-filing systems, which can streamline the process and ensure timely delivery. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is important to verify the submission method based on the current IRS guidelines and ensure that the form is sent to the correct location to avoid delays.

Quick guide on how to complete 8288 b fillable form

Complete 8288 B Fillable Form effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage 8288 B Fillable Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign 8288 B Fillable Form with ease

- Find 8288 B Fillable Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign feature, which takes only a few seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 8288 B Fillable Form to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8288 b fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8288 B Fillable Form and why do I need it?

The 8288 B Fillable Form is a crucial document for businesses engaged in real estate transactions involving foreign investors. It helps to ensure compliance with U.S. tax laws and allows for proper withholding of taxes. By using the 8288 B Fillable Form, you streamline the process and minimize the risk of errors.

-

How can airSlate SignNow help me with the 8288 B Fillable Form?

airSlate SignNow provides an efficient platform for filling out and eSigning the 8288 B Fillable Form. Our user-friendly interface ensures that you can complete the form quickly while maintaining accuracy and compliance. Additionally, our solution allows for secure storage and easy sharing options.

-

What features does airSlate SignNow offer for the 8288 B Fillable Form?

With airSlate SignNow, you get access to features such as customizable templates, real-time tracking, and secure cloud storage specifically designed for the 8288 B Fillable Form. We also offer integration with various tools to enhance your workflow. Our eSigning capabilities ensure that your documents are legally binding and easily accessible.

-

Is airSlate SignNow affordable for using the 8288 B Fillable Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 8288 B Fillable Form. We provide flexible pricing plans that cater to businesses of all sizes. By using our service, you save both time and money on document management.

-

Can I integrate airSlate SignNow with other tools while using the 8288 B Fillable Form?

Absolutely! airSlate SignNow supports seamless integrations with popular tools like Google Drive, Dropbox, and CRM systems. This allows you to manage the 8288 B Fillable Form more effectively by combining various applications into a single workflow, enhancing your overall productivity.

-

What are the benefits of using the 8288 B Fillable Form with airSlate SignNow?

Using the 8288 B Fillable Form with airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance with IRS regulations. Our eSigning feature speeds up the signature process, making transactions faster. Additionally, you can track the status of documents in real-time.

-

Is the 8288 B Fillable Form secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud technology to protect your 8288 B Fillable Form and all sensitive data. Our compliance with industry standards ensures that your documents are safe and confidential.

Get more for 8288 B Fillable Form

Find out other 8288 B Fillable Form

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online