PTAX 342 Lake County Illinois Form

What is the PTAX 342 Lake County Illinois

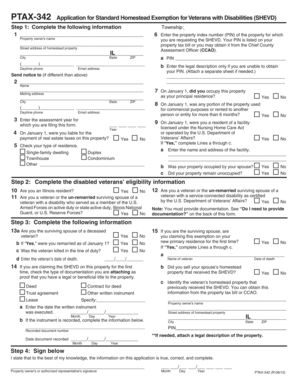

The PTAX 342 Lake County Illinois form is a property tax exemption application specifically designed for homeowners in Lake County. This form allows eligible property owners to apply for various exemptions, including the General Homestead Exemption, which reduces the assessed value of their property for tax purposes. Understanding the purpose and benefits of this form is crucial for homeowners looking to lower their property tax burden.

How to use the PTAX 342 Lake County Illinois

Using the PTAX 342 Lake County Illinois form involves several steps to ensure proper completion and submission. First, gather all necessary documentation, such as proof of ownership and residency. Next, accurately fill out the form, providing detailed information about the property and the applicant. Once completed, submit the form to the appropriate local government office, either online or by mail, depending on the submission options available.

Steps to complete the PTAX 342 Lake County Illinois

Completing the PTAX 342 Lake County Illinois form requires careful attention to detail. Follow these steps:

- Obtain the form from the Lake County Assessor's Office or download it from their website.

- Fill in your personal information, including name, address, and property details.

- Provide supporting documentation, such as a copy of your driver's license or utility bill to verify residency.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to ensure eligibility for the exemption.

Legal use of the PTAX 342 Lake County Illinois

The legal use of the PTAX 342 Lake County Illinois form is governed by state and local laws regarding property tax exemptions. It is essential for applicants to understand that submitting false information can lead to penalties or denial of the exemption. The form must be used in compliance with the Illinois Property Tax Code, ensuring that all claims for exemptions are legitimate and supported by appropriate documentation.

Required Documents

When applying for the PTAX 342 Lake County Illinois exemption, certain documents are required to support your application. These typically include:

- A copy of the property deed or tax bill to confirm ownership.

- Proof of residency, such as a utility bill or lease agreement.

- Identification, like a state-issued ID or driver's license.

Having these documents ready will streamline the application process and help ensure a successful submission.

Form Submission Methods

The PTAX 342 Lake County Illinois form can be submitted through various methods. Homeowners may choose to file the form online via the Lake County Assessor's Office website, which provides a convenient digital option. Alternatively, the form can be printed and mailed to the appropriate office or submitted in person. It is important to check the specific submission guidelines to ensure compliance with local requirements.

Quick guide on how to complete ptax 342 lake county illinois

Complete PTAX 342 Lake County Illinois effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage PTAX 342 Lake County Illinois on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign PTAX 342 Lake County Illinois with ease

- Find PTAX 342 Lake County Illinois and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign PTAX 342 Lake County Illinois to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 lake county illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PTAX 342 Lake County Illinois?

PTAX 342 Lake County Illinois is a property tax exemption form that allows residents to claim exemptions on their tax assessments. This form can help reduce the amount of property taxes owed, providing financial relief to eligible homeowners. Understanding how to fill out this form accurately is crucial for maximizing your tax savings.

-

How can airSlate SignNow help with PTAX 342 Lake County Illinois?

airSlate SignNow facilitates the sending and signing of the PTAX 342 Lake County Illinois document electronically. With our platform, users can complete and submit the form seamlessly while ensuring that all necessary signatures are obtained. This simplifies the process and saves valuable time for residents in Lake County.

-

What are the benefits of using airSlate SignNow for PTAX 342 Lake County Illinois?

Using airSlate SignNow for PTAX 342 Lake County Illinois offers numerous benefits such as enhanced efficiency, reduced processing time, and secure storage of documents. Our platform ensures that your tax exemption forms are completed promptly and accurately, allowing you to focus on other essential tasks. Additionally, the ease of use makes it ideal for all residents.

-

Is airSlate SignNow cost-effective for submitting PTAX 342 Lake County Illinois?

Yes, airSlate SignNow is a cost-effective solution for submitting PTAX 342 Lake County Illinois, especially when compared to traditional methods of document handling. Our pricing plans are designed to cater to a variety of users, making it affordable for both individuals and businesses. Users can save money while ensuring that important tax documents are handled professionally.

-

Can I integrate airSlate SignNow with other platforms for PTAX 342 Lake County Illinois?

Absolutely! airSlate SignNow offers various integrations with popular platforms, which can streamline the submission process for PTAX 342 Lake County Illinois. By connecting with your existing tools, you can enhance your workflow and make it easier to manage multiple document submissions. This flexibility is a major advantage for users.

-

What features does airSlate SignNow provide for managing PTAX 342 Lake County Illinois?

airSlate SignNow provides a suite of features tailored for managing PTAX 342 Lake County Illinois, including template creation, document tracking, and audit trails. These features ensure that your submissions are organized and compliant with local regulations. Users can monitor the status of their forms in real-time, enhancing transparency in the process.

-

How do I get started with airSlate SignNow for PTAX 342 Lake County Illinois?

Getting started with airSlate SignNow for PTAX 342 Lake County Illinois is easy! Simply sign up for an account on our website, and you will gain access to our intuitive platform. Once registered, you can create, send, and electronically sign your PTAX 342 form within minutes, making the entire process user-friendly.

Get more for PTAX 342 Lake County Illinois

- Bill of sale with warranty for corporate seller south carolina form

- Bill of sale without warranty by individual seller south carolina form

- Bill of sale without warranty by corporate seller south carolina form

- Verification of creditors matrix south carolina form

- Correction statement and agreement south carolina form

- South carolina closing form

- Flood zone statement and authorization south carolina form

- Name affidavit of buyer south carolina form

Find out other PTAX 342 Lake County Illinois

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement