VERMONT 8879 VT F Fiduciary Income Tax Declaration for Tax Vermont Form

What is the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

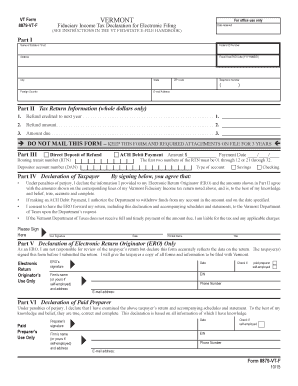

The VERMONT 8879 VT F Fiduciary Income Tax Declaration is a crucial document used by fiduciaries in Vermont to declare the income tax liability of a trust or estate. This form serves as a declaration of the fiduciary's intent to file a tax return on behalf of the estate or trust. It is essential for ensuring compliance with state tax laws and for accurately reporting income generated by the estate or trust's assets.

How to use the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

Using the VERMONT 8879 VT F Fiduciary Income Tax Declaration involves several key steps. First, the fiduciary must gather all relevant financial information related to the estate or trust, including income, deductions, and credits. Next, the fiduciary will complete the form by providing necessary details, such as the name of the estate or trust, the fiduciary's name, and the tax identification number. Once the form is completed, it must be signed and submitted to the Vermont Department of Taxes as part of the tax filing process.

Steps to complete the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

Completing the VERMONT 8879 VT F Fiduciary Income Tax Declaration involves a systematic approach:

- Gather all necessary financial documents, including income statements and prior tax returns.

- Fill out the form with accurate information about the estate or trust, including its name and tax identification number.

- Provide details about the fiduciary, including their name and contact information.

- Review the completed form for accuracy and completeness.

- Sign the form to validate the declaration.

- Submit the form to the Vermont Department of Taxes by the specified deadline.

Legal use of the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

The legal use of the VERMONT 8879 VT F Fiduciary Income Tax Declaration is essential for ensuring that the fiduciary complies with state tax laws. This form must be accurately completed and submitted to avoid penalties. The declaration serves as a formal acknowledgment of the fiduciary's responsibility to report the income and pay any taxes owed on behalf of the estate or trust. Failure to properly use this form can lead to legal repercussions and financial liabilities.

Key elements of the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

Key elements of the VERMONT 8879 VT F Fiduciary Income Tax Declaration include:

- The name and address of the estate or trust.

- The tax identification number assigned to the estate or trust.

- The fiduciary's name and contact information.

- Income details, including sources and amounts.

- Signature of the fiduciary to validate the declaration.

Filing Deadlines / Important Dates

Filing deadlines for the VERMONT 8879 VT F Fiduciary Income Tax Declaration are typically aligned with the overall income tax return deadlines for estates and trusts. It is important for fiduciaries to be aware of these dates to ensure timely submission. Generally, the form must be filed by the due date of the income tax return for the estate or trust, which is usually April fifteenth of the following year. Adhering to these deadlines helps avoid penalties and interest on unpaid taxes.

Quick guide on how to complete vermont 8879 vt f fiduciary income tax declaration for tax vermont

Prepare VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to generate, modify, and electronically sign your documents swiftly without interruptions. Handle VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont with ease

- Obtain VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont 8879 vt f fiduciary income tax declaration for tax vermont

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

The VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont is an essential form used by fiduciaries in Vermont to declare their income tax responsibilities. It serves to verify that the fiduciary has the authority to act on behalf of the estate or trust. Completing this form accurately ensures compliance with Vermont tax regulations.

-

How can airSlate SignNow help with the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

AirSlate SignNow offers a seamless way to prepare, sign, and send the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont. Our intuitive platform simplifies document management and ensures you can gather necessary signatures quickly and efficiently, streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

Yes, airSlate SignNow provides various pricing plans to fit your business needs, which include features designed for managing forms like the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont. Our cost-effective solutions allow you to choose a plan that meets your budget, with additional features available based on your selection.

-

What features does airSlate SignNow offer for handling the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

AirSlate SignNow includes features such as customizable templates, e-signatures, and automated workflows specifically designed for forms like the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont. These features enhance efficiency, providing quick access to required documentation and ensuring compliance.

-

Can I integrate airSlate SignNow with other software for the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

Absolutely! AirSlate SignNow allows integration with various third-party applications, enhancing your ability to manage documents like the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont seamlessly. You can connect tools like Google Drive, Salesforce, and more to simplify your document workflows.

-

How secure is airSlate SignNow for processing the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and compliance with regulatory requirements to keep sensitive information safe, including data related to the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont, ensuring peace of mind for our users.

-

What benefits do users gain from using airSlate SignNow for the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont?

Users of airSlate SignNow enjoy increased efficiency and time savings when completing the VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont. Our user-friendly interface and automation capabilities allow users to manage their documents with ease, enhancing overall productivity.

Get more for VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

Find out other VERMONT 8879 VT F Fiduciary Income Tax Declaration For Tax Vermont

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online