Irs Letter 324c Fax Number Form

What is the IRS Letter 324c Fax Number

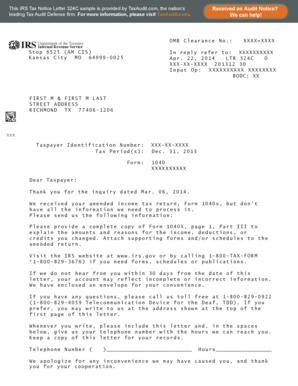

The IRS Letter 324c refers to a communication sent by the Internal Revenue Service that typically addresses issues related to tax returns or account inquiries. The fax number associated with this letter is crucial for taxpayers who need to respond or submit additional information to the IRS. The specific fax number for the IRS Letter 324c is . This number is used to facilitate quick and secure communication between taxpayers and the IRS, ensuring that necessary documents are transmitted efficiently.

How to Use the IRS Letter 324c Fax Number

To utilize the IRS Letter 324c fax number effectively, follow these steps:

- Gather all relevant documents that the IRS has requested in the letter.

- Ensure that your documents are clear and legible to avoid any processing delays.

- Include a cover letter that outlines the purpose of your fax and any specific instructions related to your submission.

- Fax your documents to , ensuring that you keep a confirmation of the fax transmission for your records.

Key Elements of the IRS Letter 324c Fax Number

Understanding the key elements of the IRS Letter 324c fax number can help ensure proper communication with the IRS. These elements include:

- Recipient Information: The fax number is designated for the IRS, specifically for handling inquiries related to the 324c letter.

- Document Clarity: All documents sent should be clear and easy to read to prevent misunderstandings.

- Cover Letter: A cover letter should accompany your fax, detailing the contents and purpose of the submission.

Steps to Complete the IRS Letter 324c Fax Number

Completing the process associated with the IRS Letter 324c involves several important steps:

- Review the IRS Letter 324c carefully to understand what information is required.

- Prepare the necessary documents, ensuring they meet IRS standards.

- Draft a cover letter that includes your contact information and a summary of the enclosed documents.

- Send the documents via fax to , and retain a copy of the transmission confirmation.

Legal Use of the IRS Letter 324c Fax Number

The legal use of the IRS Letter 324c fax number is governed by specific regulations that ensure secure and compliant communication with the IRS. When sending documents via this fax number:

- Ensure that all documents are relevant to the inquiries made in the letter.

- Maintain compliance with IRS guidelines regarding document submissions.

- Keep records of all communications for future reference, as they may be needed for verification or follow-up.

Filing Deadlines / Important Dates

It is essential to be aware of any filing deadlines associated with the IRS Letter 324c. Typically, the IRS will specify a timeline in the letter for submitting the required documents. Missing these deadlines can lead to penalties or delays in processing your tax matters. Always check the date mentioned in the letter and plan your submission accordingly to ensure compliance.

Quick guide on how to complete irs letter 324c fax number

Effortlessly Prepare Irs Letter 324c Fax Number on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Irs Letter 324c Fax Number on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

How to Alter and Electronically Sign Irs Letter 324c Fax Number with Ease

- Obtain Irs Letter 324c Fax Number and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Irs Letter 324c Fax Number and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs letter 324c fax number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS letter 324c and why might I need it?

An IRS letter 324c is a notification from the IRS regarding your tax return status. Businesses may need to respond to this letter promptly to avoid penalties. Having access to the IRS letter 324c fax number is essential for quick communication and document submission.

-

How can airSlate SignNow help me respond to an IRS letter 324c?

airSlate SignNow simplifies the process of responding to an IRS letter 324c by allowing you to electronically sign and send your documents securely. You can quickly create, edit, and send necessary documentation using the IRS letter 324c fax number provided. This ensures your responses are timely and professional.

-

What features does airSlate SignNow offer for handling IRS documents?

airSlate SignNow offers a variety of features tailored for managing IRS documents, including eSignature capabilities, document templates, and secure storage. These features streamline your workflow when dealing with IRS letter 324c and similar documents. Additionally, you can track your document status in real-time.

-

Is there a cost associated with using airSlate SignNow for IRS letter 324c?

Yes, using airSlate SignNow involves a subscription fee, but it is cost-effective compared to traditional methods of document handling. Plans are available to suit different business needs, and the efficiency gained from using the IRS letter 324c fax number can save businesses money in the long run.

-

Can I integrate airSlate SignNow with other platforms for managing IRS communications?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as CRM systems and cloud storage services. This means you can easily manage documents related to IRS letter 324c while keeping your workflow interconnected, reducing the need to switch between applications.

-

How secure is my information when using airSlate SignNow to send an IRS letter 324c?

Security is a top priority for airSlate SignNow. Your documents, including responses to IRS letter 324c, are encrypted and stored securely. Additionally, the platform complies with industry standards to ensure that your sensitive information remains protected during transmission and storage.

-

What types of documents can I send along with my IRS letter 324c?

Alongside your IRS letter 324c, you can send various types of supporting documents such as tax returns, financial statements, and identification forms. airSlate SignNow enables you to collect signatures on these documents easily, making your entire submission process smoother.

Get more for Irs Letter 324c Fax Number

- Warranty deed from husband to himself and wife tennessee form

- Quitclaim deed from husband to himself and wife tennessee form

- Tennessee joint property form

- Quitclaim deed from husband and wife to husband and wife tennessee form

- Tennessee husband form

- Tn revocation form

- Postnuptial property agreement tennessee tennessee form

- Amendment to postnuptial property agreement tennessee tennessee form

Find out other Irs Letter 324c Fax Number

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy