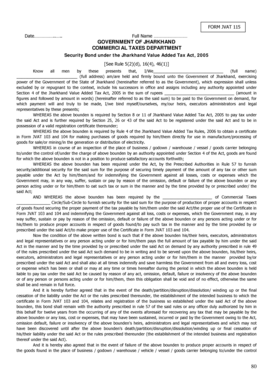

FORM JVAT 115

What is the FORM JVAT 115

The FORM JVAT 115 is a specific tax form used in the United States for various tax-related purposes. It is primarily utilized by individuals and businesses to report specific information to the relevant tax authorities. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and accurately reporting financial activities. The form captures detailed information that may affect tax liabilities and entitlements, making it crucial for proper tax management.

How to use the FORM JVAT 115

Using the FORM JVAT 115 involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required for the form. This may include income statements, expense records, and other relevant financial data. Next, fill out the form carefully, ensuring that all entries are accurate and reflect the current tax year. After completing the form, review it for any errors before submission. Finally, submit the form through the appropriate channels, whether online or via mail, based on the specific requirements of the tax authority.

Steps to complete the FORM JVAT 115

Completing the FORM JVAT 115 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Step One: Collect necessary documents, such as income and expense records.

- Step Two: Begin filling out the form, starting with personal or business identification information.

- Step Three: Input relevant financial data as required by the form.

- Step Four: Double-check all entries for accuracy and completeness.

- Step Five: Sign and date the form, if required.

- Step Six: Submit the completed form through the designated method.

Legal use of the FORM JVAT 115

The legal use of the FORM JVAT 115 is governed by specific tax laws and regulations. To ensure that the form is considered valid, it must be completed accurately and submitted within the required deadlines. Additionally, the information provided must be truthful and reflect the taxpayer's actual financial situation. Misrepresentation or failure to comply with legal requirements can lead to penalties or legal repercussions. It is essential to understand the legal implications of submitting the form to maintain compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the FORM JVAT 115 are critical to avoid penalties and ensure compliance. Typically, the form must be submitted by a specific date each year, often aligned with the general tax filing deadline. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Marking these dates on a calendar can help taxpayers manage their filing obligations effectively and avoid last-minute issues.

Required Documents

To complete the FORM JVAT 115, certain documents are required to provide accurate information. These documents may include:

- Income statements, such as W-2s or 1099s.

- Expense records, including receipts and invoices.

- Previous tax returns for reference.

- Any supporting documentation relevant to the information reported on the form.

Gathering these documents in advance can streamline the completion process and ensure that all necessary information is included.

Quick guide on how to complete form jvat 115

Effortlessly prepare FORM JVAT 115 on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents quickly and without issues. Handle FORM JVAT 115 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The simplest method to edit and electronically sign FORM JVAT 115 effortlessly

- Locate FORM JVAT 115 and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and electronically sign FORM JVAT 115 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form jvat 115

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM JVAT 115 and why is it important?

FORM JVAT 115 is a crucial document used for tax compliance in many jurisdictions. It helps businesses report their tax liabilities accurately and timely. Understanding FORM JVAT 115 is essential to ensure your business meets regulatory requirements and avoids penalties.

-

How does airSlate SignNow assist with FORM JVAT 115?

airSlate SignNow offers a seamless way to prepare, send, and eSign FORM JVAT 115 electronically. By simplifying the document workflow, businesses can ensure that FORM JVAT 115 is handled efficiently. This reduces the time spent on paperwork and enhances compliance.

-

What features of airSlate SignNow help in managing FORM JVAT 115?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure eSignatures, which are all beneficial for managing FORM JVAT 115. These tools ensure that the document is filled out accurately and processed swiftly. The platform’s user-friendly interface makes it easy to manage all aspects of FORM JVAT 115.

-

Is airSlate SignNow a cost-effective solution for handling FORM JVAT 115?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing paper costs and minimizing delays in processing FORM JVAT 115, businesses can save on overall expenses. With various pricing plans available, airSlate SignNow offers flexibility to meet your budget.

-

Can I integrate airSlate SignNow with other software for FORM JVAT 115?

Absolutely! airSlate SignNow supports integrations with various productivity and business management tools. This means you can easily sync your existing systems to facilitate the preparation and submission of FORM JVAT 115. Integrating with tools you already use enhances efficiency in your document management process.

-

What benefits does eSigning FORM JVAT 115 provide?

eSigning FORM JVAT 115 through airSlate SignNow offers increased security and speed compared to traditional methods. The digital signature process ensures authenticity while also expediting the turnaround time for document approval. With eSigning, you can submit FORM JVAT 115 instantly, ensuring compliance without delay.

-

Is there a trial period available for using airSlate SignNow for FORM JVAT 115?

Yes, airSlate SignNow typically offers a trial period for users to explore its capabilities in handling FORM JVAT 115. During the trial, you can experience firsthand how the platform simplifies the document signing process. This allows you to evaluate its benefits for your business without any initial investment.

Get more for FORM JVAT 115

- Form gst reg 25 certificate of provisional registration fhrai com

- Tender documents form

- Commercial building zoning clearance amp certificate of occupancy permit application cityoftulsa form

- Student engagement tool center for school transformation

- Hunter college transcript form

- Parent emergency contact form

- Acta de divorcio para imprimir form

- Donation request form rochester ny

Find out other FORM JVAT 115

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation