Schedule C Form 1040 Internal Revenue Service

What is the Schedule C Form 1040 Internal Revenue Service

The Schedule C Form 1040 is a tax form used by sole proprietors in the United States to report income or loss from their business. This form is part of the individual income tax return process and is essential for self-employed individuals. It allows taxpayers to detail their business income, expenses, and deductions, which ultimately affect their overall tax liability. The IRS uses this information to assess the correct amount of tax owed by the individual.

How to use the Schedule C Form 1040 Internal Revenue Service

Using the Schedule C Form 1040 involves several steps. First, gather all necessary financial records, including income statements and receipts for expenses. Next, accurately fill out the form by entering your business name, address, and the type of business you operate. You will report your gross income, followed by deducting allowable expenses such as advertising, utilities, and supplies. It's important to ensure that all entries are accurate to avoid issues with the IRS.

Steps to complete the Schedule C Form 1040 Internal Revenue Service

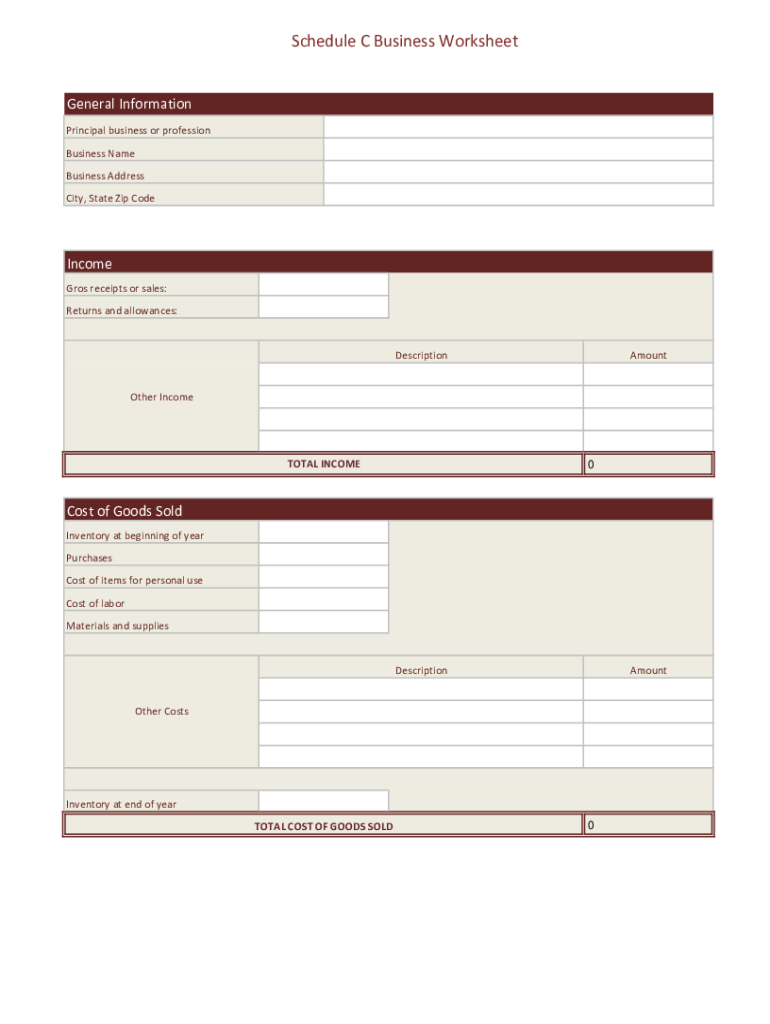

Completing the Schedule C Form 1040 requires careful attention to detail. Start by entering your business information at the top of the form. Then, list your gross receipts or sales. Following this, categorize your expenses into sections such as cost of goods sold, expenses for business use of home, and other deductions. Be sure to keep thorough records to support your claims. Finally, calculate your net profit or loss and transfer this figure to your Form 1040.

Key elements of the Schedule C Form 1040 Internal Revenue Service

Key elements of the Schedule C Form 1040 include the business name and address, gross income, cost of goods sold, and various expense categories. Each section is designed to capture specific financial details about your business operations. The form also includes a section for calculating the net profit or loss, which is crucial for determining your tax obligations. Understanding these elements can help ensure that you complete the form accurately and comprehensively.

Filing Deadlines / Important Dates

The filing deadline for the Schedule C Form 1040 typically aligns with the individual income tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, as late submissions can result in penalties. Taxpayers may also consider filing for an extension if they need additional time to prepare their forms.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule C Form 1040 can lead to significant penalties. The IRS may impose fines for late filing, underreporting income, or failing to pay taxes owed. Additionally, non-compliance can trigger audits, which can further complicate your tax situation. It is essential to ensure that all information is accurate and submitted on time to avoid these potential penalties.

Quick guide on how to complete schedule c form 1040 internal revenue service

Prepare Schedule C Form 1040 Internal Revenue Service effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Schedule C Form 1040 Internal Revenue Service on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Schedule C Form 1040 Internal Revenue Service without hassle

- Locate Schedule C Form 1040 Internal Revenue Service and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Edit and eSign Schedule C Form 1040 Internal Revenue Service and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 1040 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a returns and allowances schedule C?

A returns and allowances schedule C is a critical document used by businesses to track returns and allowances related to sales. It provides a detailed account of any deductions from revenue, helping to ensure accurate financial reporting. This schedule is essential for understanding the overall profitability of your business.

-

How can airSlate SignNow assist in managing returns and allowances schedule C?

airSlate SignNow offers streamlined eSigning capabilities that can simplify the process of creating and managing your returns and allowances schedule C. With user-friendly templates and a secure platform, you can efficiently send, sign, and store essential documents. This helps businesses maintain accuracy and compliance in their financial records.

-

Is there a cost associated with using airSlate SignNow for returns and allowances schedule C?

Yes, airSlate SignNow is a cost-effective solution with various pricing plans to suit different business sizes. Each plan includes features that help you manage your returns and allowances schedule C efficiently. You can choose a plan that meets your budget and usage needs.

-

What features does airSlate SignNow offer for managing financial documents like returns and allowances schedule C?

airSlate SignNow provides features such as electronic signatures, document templates, and automated workflows that are perfect for managing financial documents like returns and allowances schedule C. These tools enhance efficiency and accuracy in your financial processes. Additionally, real-time tracking and notifications keep you updated on document status.

-

Can I integrate airSlate SignNow with other accounting software for my returns and allowances schedule C?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to link your returns and allowances schedule C with your financial systems. This integration helps streamline workflows, ensuring that all financial data is consistent and easily accessible. Simplifying your processes enhances productivity and accuracy.

-

What are the benefits of using airSlate SignNow for eSigning returns and allowances schedule C?

Using airSlate SignNow to eSign your returns and allowances schedule C enhances security and saves time. The platform allows you to sign documents from anywhere, which is particularly beneficial for remote teams. With the added layer of encryption, your sensitive financial information remains protected.

-

How does airSlate SignNow ensure the security of my returns and allowances schedule C?

AirSlate SignNow prioritizes security by using advanced encryption methods to protect your returns and allowances schedule C and other documents. The platform complies with industry standards to ensure that your sensitive information is secure. Regular audits and updates further bolster the safety of your data.

Get more for Schedule C Form 1040 Internal Revenue Service

- Agreement for payment of unpaid rent texas form

- Commercial lease assignment from tenant to new tenant texas form

- Tenant consent to background and reference check texas form

- Associate judge 497327665 form

- Order restraining court form

- Temporary restraining order 497327667 form

- Texas divorce template form

- Texas appearance form

Find out other Schedule C Form 1040 Internal Revenue Service

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe