FIN 360, International Fuel Tax Agreement IFTA Use This Form to File Your IFTA Return and Make a Payment 2018

Understanding the FIN 360, International Fuel Tax Agreement IFTA Form

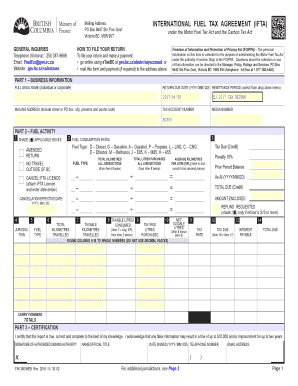

The FIN 360, International Fuel Tax Agreement (IFTA) form is essential for commercial vehicle operators who travel across multiple states or provinces. This form allows operators to file their IFTA returns and make necessary payments for fuel taxes owed to various jurisdictions. IFTA simplifies the reporting process by enabling operators to report their fuel use and mileage in a single document, rather than filing separate reports for each state or province they operate in.

Steps to Complete the FIN 360, International Fuel Tax Agreement IFTA Form

Completing the FIN 360 form involves several key steps:

- Gather necessary information, including your vehicle details, mileage records, and fuel purchase receipts.

- Calculate the total miles driven in each jurisdiction and the total gallons of fuel purchased.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your calculations for accuracy to avoid penalties.

- Submit the form electronically or via mail, depending on your preference and state requirements.

Legal Use of the FIN 360, International Fuel Tax Agreement IFTA Form

The FIN 360 form is legally binding when completed and submitted according to the regulations set forth by the IFTA. To ensure its legality, it is crucial to provide accurate information and adhere to deadlines. Electronic signatures are recognized as valid under U.S. law, provided that the signing process complies with the ESIGN and UETA acts. Using a reliable eSignature solution can enhance the legal standing of your submission.

Filing Deadlines and Important Dates for the FIN 360 Form

Filing deadlines for the FIN 360 form typically occur quarterly. Operators must submit their returns by the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, and the return is due by April 30. Staying aware of these deadlines is crucial to avoid late fees and penalties.

State-Specific Rules for the FIN 360, International Fuel Tax Agreement IFTA Form

Each state may have specific rules and regulations regarding the completion and submission of the FIN 360 form. It is important for operators to familiarize themselves with these rules, as they can vary significantly. This includes understanding tax rates, exemptions, and any additional documentation that may be required by the state in which they operate.

Examples of Using the FIN 360, International Fuel Tax Agreement IFTA Form

Operators can apply the FIN 360 form in various scenarios, such as:

- A trucking company operating in multiple states needs to report its fuel usage and mileage to comply with tax regulations.

- A logistics firm that transports goods across state lines must ensure accurate reporting to avoid penalties.

- Owner-operators who manage their own vehicles can utilize the form for efficient tax reporting.

Quick guide on how to complete fin 360 international fuel tax agreement ifta use this form to file your ifta return and make a payment

Effortlessly prepare FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without hold-ups. Handle FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment with ease

- Find FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Bid farewell to lost or disorganized documents, tiring form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 360 international fuel tax agreement ifta use this form to file your ifta return and make a payment

Create this form in 5 minutes!

How to create an eSignature for the fin 360 international fuel tax agreement ifta use this form to file your ifta return and make a payment

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

The FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment is designed to help businesses comply with tax regulations. It simplifies the process of reporting fuel use and ensuring accurate payments to jurisdictions. Utilizing this form streamlines your tax reporting, saving time and reducing errors.

-

How does airSlate SignNow facilitate the use of the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

airSlate SignNow allows users to easily eSign and submit the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment online. This digital solution not only ensures security but also accelerates the filing process. With our intuitive platform, you can manage your forms and documents seamlessly.

-

What are the pricing options for using airSlate SignNow with the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

airSlate SignNow offers various pricing plans tailored for businesses of different sizes. You can leverage our solutions for filing the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment at a competitive rate, ensuring cost-effectiveness. Additional features and integrations are available at premium tiers.

-

What features does airSlate SignNow provide for the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

airSlate SignNow includes features like templates, eSignature capabilities, and document tracking specifically for the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment. These tools enhance your efficiency and maintain compliance. You can easily create, send, and manage your tax forms digitally.

-

Can I integrate airSlate SignNow with other software for filing the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

Yes, airSlate SignNow supports integration with a variety of business applications, including accounting and ERP systems. This makes it easier to file the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment directly from your existing workflows. Enjoy seamless data transfer and improved efficiency.

-

What benefits does using airSlate SignNow offer for managing the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

Using airSlate SignNow to manage the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment provides signNow advantages. It increases speed and reduces paper waste while improving accuracy. Business owners can complete filings quicker and have peace of mind with secure digital records.

-

Is there support available for using airSlate SignNow with the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment?

Absolutely! airSlate SignNow offers robust customer support for users working with the FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment. Our support team is available through chat, email, and phone to assist you with any inquiries or technical issues that arise.

Get more for FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment

Find out other FIN 360, International Fuel Tax Agreement IFTA Use This Form To File Your IFTA Return And Make A Payment

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template