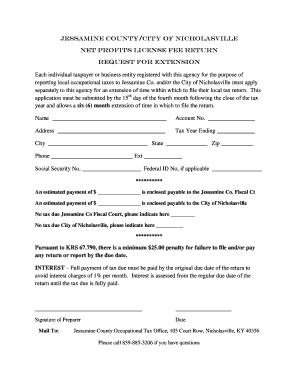

Jessamine County Net Profit License Fee Return Form

What is the Jessamine County Net Profit License Fee Return

The Jessamine County net profit license fee return is a tax form required for businesses operating within Jessamine County, Kentucky. This form is used to report the net profits earned by the business and calculate the corresponding license fee owed to the county. It is essential for compliance with local tax regulations and ensures that businesses contribute fairly to the community's resources.

Steps to complete the Jessamine County Net Profit License Fee Return

Completing the Jessamine County net profit license fee return involves several key steps:

- Gather all financial documents, including income statements and expense records.

- Calculate your total net profit for the reporting period.

- Fill out the form accurately, ensuring all figures are correct.

- Double-check the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the Jessamine County Net Profit License Fee Return

The legal use of the Jessamine County net profit license fee return is crucial for maintaining compliance with local tax laws. This form must be completed and submitted according to the regulations set forth by the county. Failure to file correctly or on time can result in penalties, making it important for businesses to understand their obligations under the law.

Filing Deadlines / Important Dates

Filing deadlines for the Jessamine County net profit license fee return are typically set annually. Businesses should be aware of these dates to avoid late fees or penalties. It is advisable to check with the local tax authority for the most current deadlines and any changes that may occur from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Jessamine County net profit license fee return can be submitted through various methods to accommodate different preferences:

- Online: Many businesses prefer to file electronically for convenience and speed.

- Mail: Completed forms can be sent via postal service to the appropriate county office.

- In-Person: Businesses may also choose to submit their forms directly at the county office during business hours.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Jessamine County net profit license fee return can lead to significant penalties. These may include fines, interest on unpaid fees, and potential legal action. It is essential for businesses to stay informed about their filing obligations to avoid these consequences.

Quick guide on how to complete jessamine county net profit license fee return

Prepare Jessamine County Net Profit License Fee Return effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, enabling you to access the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Jessamine County Net Profit License Fee Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Jessamine County Net Profit License Fee Return effortlessly

- Locate Jessamine County Net Profit License Fee Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or censor sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign Jessamine County Net Profit License Fee Return and ensure excellent communication at every step of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jessamine county net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the jessamine county net profit license fee return, and why is it important?

The jessamine county net profit license fee return is a required document for businesses operating in Jessamine County to report their net profits and pay applicable license fees. This return ensures compliance with local regulations, helping businesses avoid penalties and maintain good standing with the county.

-

How can airSlate SignNow assist with the jessamine county net profit license fee return?

airSlate SignNow provides an easy-to-use platform to handle your jessamine county net profit license fee return efficiently. You can create, send, eSign, and manage your documents securely, which streamlines the filing process and reduces the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for my jessamine county net profit license fee return?

Using airSlate SignNow for your jessamine county net profit license fee return offers numerous benefits including time savings, enhanced accuracy, and improved document security. This platform allows you to track your submissions and digitally sign documents, making the process hassle-free and reliable.

-

Is there a cost associated with using airSlate SignNow for filing the jessamine county net profit license fee return?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. The pricing plans are flexible, ensuring that you only pay for the services you need while gaining access to features that simplify the jessamine county net profit license fee return process.

-

Can I integrate airSlate SignNow with other accounting software for my jessamine county net profit license fee return?

Absolutely! airSlate SignNow offers integrations with various accounting software that can streamline the preparation of your jessamine county net profit license fee return. This compatibility allows for a smooth transfer of information, helping to reduce errors and increase efficiency.

-

What features does airSlate SignNow offer that can help with my jessamine county net profit license fee return?

airSlate SignNow provides features such as customizable templates, eSigning capabilities, and document tracking specifically designed to assist with your jessamine county net profit license fee return. These features ensure that your filings are completed accurately and submitted on time.

-

Is airSlate SignNow secure enough for handling sensitive documents like the jessamine county net profit license fee return?

Yes, airSlate SignNow prioritizes document security, employing advanced encryption and authentication measures to protect sensitive information during the filing of your jessamine county net profit license fee return. You can trust that your data is safeguarded against unauthorized access.

Get more for Jessamine County Net Profit License Fee Return

Find out other Jessamine County Net Profit License Fee Return

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer