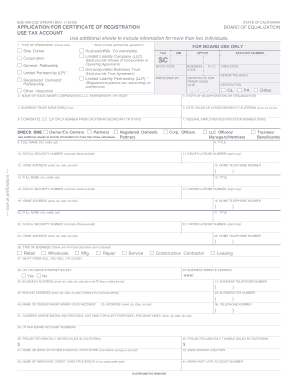

Tax Registration Certification Form

What is the Tax Registration Certification

The Tax Registration Certification serves as an official document that allows businesses to claim exemption from certain taxes, particularly in the District of Columbia. This certification is essential for entities that qualify for tax exemptions based on their operational status or the nature of their activities. It ensures compliance with local tax laws while providing necessary documentation for transactions that may otherwise incur tax liabilities.

How to obtain the Tax Registration Certification

To obtain the Tax Registration Certification in the District of Columbia, businesses must follow a specific process. First, they need to gather all required documentation, including proof of eligibility for the exemption. This may involve submitting forms that detail the nature of the business and its activities. Once the documentation is ready, applicants can submit their request through the appropriate government agency, either online or by mail. It is advisable to check the official guidelines to ensure all criteria are met and to avoid delays in processing.

Steps to complete the Tax Registration Certification

Completing the Tax Registration Certification involves several key steps:

- Gather necessary documents, including identification and proof of business activities.

- Fill out the Tax Registration Certification form accurately, ensuring all information is complete.

- Review the form for any errors or omissions before submission.

- Submit the form along with any required documentation to the designated agency.

- Await confirmation of receipt and processing from the agency.

Legal use of the Tax Registration Certification

The legal use of the Tax Registration Certification is crucial for businesses seeking to operate without incurring unnecessary tax liabilities. This certification must be used in accordance with local tax laws and regulations. It is important for businesses to maintain accurate records and ensure that the certification is renewed or updated as necessary to reflect any changes in business operations or eligibility status.

Required Documents

When applying for the Tax Registration Certification, businesses must provide several required documents. These typically include:

- Proof of business registration in the District of Columbia.

- Identification documents for the business owner or authorized representative.

- Documentation supporting the claim for tax exemption, such as financial statements or operational descriptions.

Who Issues the Form

The Tax Registration Certification is issued by the Office of Tax and Revenue in the District of Columbia. This agency is responsible for overseeing tax compliance and providing necessary certifications to eligible businesses. It is important for applicants to ensure they are submitting their requests to the correct agency to facilitate timely processing.

Quick guide on how to complete tax registration certification

Complete Tax Registration Certification effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the relevant form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Tax Registration Certification on any device with airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

The easiest way to edit and eSign Tax Registration Certification without hassle

- Find Tax Registration Certification and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Craft your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Edit and eSign Tax Registration Certification and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax registration certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the district of columbia certificate of exemption registration?

The district of columbia certificate of exemption registration is an official document that allows eligible businesses to operate without paying certain taxes in Washington, D.C. This certificate can signNowly impact your business's financial health by providing tax relief for qualified entities operating within the district.

-

How can I apply for the district of columbia certificate of exemption registration?

To apply for the district of columbia certificate of exemption registration, you will need to complete the application form available through the D.C. government's website. Make sure to gather all required documentation to support your application and submit it through the appropriate channels to ensure a timely process.

-

What are the benefits of obtaining the district of columbia certificate of exemption registration?

Obtaining the district of columbia certificate of exemption registration offers several benefits, including signNow tax savings that can enhance your business's cash flow. Additionally, this registration demonstrates compliance with local regulations, which can improve your company's credibility and reputation.

-

Are there any fees associated with the district of columbia certificate of exemption registration?

Typically, there are no fees associated with obtaining the district of columbia certificate of exemption registration; however, you should check with the D.C. government for any specific costs related to your application or additional documentation. Being informed about potential fees will help you manage your budget effectively.

-

Can I use airSlate SignNow to manage my district of columbia certificate of exemption registration documents?

Yes, airSlate SignNow provides an easy-to-use platform for managing all your important documents, including the district of columbia certificate of exemption registration. You can securely store, eSign, and share your exemptions and related paperwork, streamlining your administrative processes.

-

Does airSlate SignNow integrate with other tools for managing the district of columbia certificate of exemption registration?

Absolutely! airSlate SignNow offers seamless integrations with various business tools, allowing you to manage your district of columbia certificate of exemption registration alongside your other operational applications. This helps create a more efficient workflow by consolidating tasks in one platform.

-

What features make airSlate SignNow suitable for managing tax exemption registrations?

airSlate SignNow comes equipped with features such as customizable templates, real-time tracking, and efficient eSignature capabilities, making it ideal for handling your district of columbia certificate of exemption registration. These tools not only simplify document management but also enhance collaboration and compliance.

Get more for Tax Registration Certification

- Sy015 form

- Behavior based safety observation checklist xls form

- Raf 1 form

- Equity bank kenya funds transfer form

- Non creamy layer certificate pdf form

- Lost and found form pdf 20345427

- Public partnerships form

- Application to licence a vehicle or transfer a vehicle licence motor vehicle dealers form vl12

Find out other Tax Registration Certification

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement