CA1889 HM Revenue & Customs Hmrc Gov Form

What is the CA1889 HM Revenue & Customs HMRC Gov?

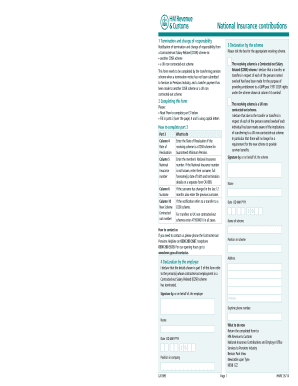

The CA1889 form is a document issued by HM Revenue & Customs (HMRC) in the United Kingdom, primarily used for national insurance contributions. This form is essential for individuals who need to report their national insurance contributions, ensuring compliance with UK tax regulations. It serves as a record for both the contributor and HMRC, detailing the contributions made over a specified period.

How to use the CA1889 HM Revenue & Customs HMRC Gov

Using the CA1889 form involves several steps. First, individuals must gather relevant financial information, including income details and previous contributions. Once this information is compiled, the form can be filled out accurately. It is important to follow the instructions provided on the form carefully to ensure all required fields are completed. After filling out the form, it can be submitted either online or via traditional mail, depending on the preferred method of submission.

Steps to complete the CA1889 HM Revenue & Customs HMRC Gov

Completing the CA1889 form requires a systematic approach:

- Gather necessary documents, including income statements and previous national insurance records.

- Fill out personal details accurately, including your name, address, and national insurance number.

- Detail your income and contributions for the relevant period.

- Review the form for accuracy and completeness.

- Submit the form through your chosen method, ensuring you keep a copy for your records.

Legal use of the CA1889 HM Revenue & Customs HMRC Gov

The CA1889 form is legally recognized as a valid document for reporting national insurance contributions. It must be completed in accordance with HMRC guidelines to ensure that it holds legal weight. Properly filled forms can serve as evidence of compliance with tax obligations, which is crucial in case of audits or disputes regarding contributions.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the CA1889 form. Typically, forms must be submitted by specific dates set forth by HMRC to avoid penalties. Keeping track of these deadlines helps ensure compliance and prevents unnecessary fines. Individuals should consult the HMRC website or official communications for the most current deadlines.

Penalties for Non-Compliance

Failure to submit the CA1889 form or inaccuracies in reporting can result in penalties from HMRC. These penalties may include fines and additional interest on unpaid contributions. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences. Understanding the implications of non-compliance can motivate individuals to prioritize their national insurance contributions.

Quick guide on how to complete ca1889 hm revenue amp customs hmrc gov

Complete CA1889 HM Revenue & Customs Hmrc Gov seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage CA1889 HM Revenue & Customs Hmrc Gov on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign CA1889 HM Revenue & Customs Hmrc Gov with ease

- Locate CA1889 HM Revenue & Customs Hmrc Gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in a few clicks from any device of your choosing. Modify and electronically sign CA1889 HM Revenue & Customs Hmrc Gov and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca1889 hm revenue amp customs hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are national insurance contributions HMRC and why are they important for businesses?

National insurance contributions HMRC are payments made by both employers and employees to qualify for certain benefits. For businesses, understanding these contributions is crucial as they impact payroll calculations, tax responsibilities, and employee rights. Ensuring accurate contributions helps maintain compliance with UK regulations.

-

How can airSlate SignNow help with managing national insurance contributions HMRC?

airSlate SignNow streamlines the process of handling documents related to national insurance contributions HMRC. By facilitating eSignatures on essential forms and contracts, it reduces paperwork and speeds up compliance processes. Our platform ensures that all your documentation is securely stored and easily accessible.

-

Are there any features in airSlate SignNow that support national insurance contributions HMRC tracking?

Yes, airSlate SignNow offers features that allow businesses to track and manage documents linked to national insurance contributions HMRC. With automated reminders and tracking capabilities, you can ensure timely submissions and stay updated on compliance requirements. This minimizes the risk of errors and penalties.

-

What pricing plans are available for airSlate SignNow, particularly for businesses concerned about national insurance contributions HMRC?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes. Each plan includes features that support document management related to national insurance contributions HMRC, ensuring compliance is cost-effective. By choosing a suitable plan, you can optimize your workflow without incurring unnecessary expenses.

-

How does eSigning with airSlate SignNow benefit my team's management of national insurance contributions HMRC?

eSigning with airSlate SignNow enhances collaboration within your team when managing national insurance contributions HMRC. It allows multiple users to review and sign documents in real-time, ensuring that everyone is on the same page. This speeds up the approval process and reduces administrative burdens.

-

Can airSlate SignNow integrate with accounting software to help monitor national insurance contributions HMRC?

Yes, airSlate SignNow easily integrates with popular accounting software to aid in monitoring national insurance contributions HMRC. This integration allows for seamless data transfer and accurate record-keeping, making it easier for businesses to manage their financial obligations. Accurate integration helps ensure compliance and simplifies reporting.

-

What security measures does airSlate SignNow have in place for documents related to national insurance contributions HMRC?

airSlate SignNow prioritizes security with robust measures in place for all documents, including those related to national insurance contributions HMRC. We use end-to-end encryption and secure cloud storage to protect your sensitive information. Compliance with industry standards ensures that your data remains safe throughout the signing process.

Get more for CA1889 HM Revenue & Customs Hmrc Gov

Find out other CA1889 HM Revenue & Customs Hmrc Gov

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free