Pa State Tax Correction Form

What is the PA State Tax Correction Form?

The PA State Tax Correction Form, commonly referred to as the rev 1705r, is a crucial document for Pennsylvania taxpayers who need to amend their previously filed state tax returns. This form allows individuals to correct errors or omissions in their tax filings, ensuring that their tax records accurately reflect their financial situation. It is essential for maintaining compliance with Pennsylvania tax laws and for avoiding potential penalties associated with incorrect submissions.

How to Use the PA State Tax Correction Form

Using the PA State Tax Correction Form involves several steps to ensure accuracy and compliance. Taxpayers must first obtain the form, which can be downloaded from the Pennsylvania Department of Revenue's website or filled out electronically using a reliable eSignature solution. Once the form is obtained, taxpayers should carefully review their original tax return and identify the specific areas that require correction. After completing the form with the necessary adjustments, it should be signed and submitted according to the guidelines provided by the Pennsylvania Department of Revenue.

Steps to Complete the PA State Tax Correction Form

Completing the PA State Tax Correction Form requires attention to detail. The following steps should be followed:

- Download or access the rev 1705r form.

- Review your original tax return to identify errors.

- Fill out the correction form, providing accurate information for each section.

- Attach any necessary documentation that supports the corrections made.

- Sign and date the form to validate your submission.

- Submit the form via the preferred method: online, by mail, or in person.

Legal Use of the PA State Tax Correction Form

The PA State Tax Correction Form is legally recognized for amending tax returns in Pennsylvania. It complies with state regulations and is essential for taxpayers who wish to correct previously filed information. Utilizing this form ensures that taxpayers remain compliant with the law and avoid potential legal issues stemming from inaccurate tax filings. It is advisable to keep a copy of the submitted form for personal records.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the PA State Tax Correction Form is vital for taxpayers. Generally, corrections must be submitted within three years from the original filing date. It is important to note that specific deadlines may vary based on individual circumstances, such as the nature of the correction or any extensions granted. Taxpayers should consult the Pennsylvania Department of Revenue for the most current and relevant deadlines.

Form Submission Methods

Taxpayers can submit the PA State Tax Correction Form through various methods, ensuring flexibility and convenience. The options include:

- Online submission via the Pennsylvania Department of Revenue’s e-filing system.

- Mailing the completed form to the designated address provided by the Department of Revenue.

- In-person submission at local tax offices, if preferred.

Choosing the appropriate submission method can help expedite the processing of corrections and ensure timely updates to tax records.

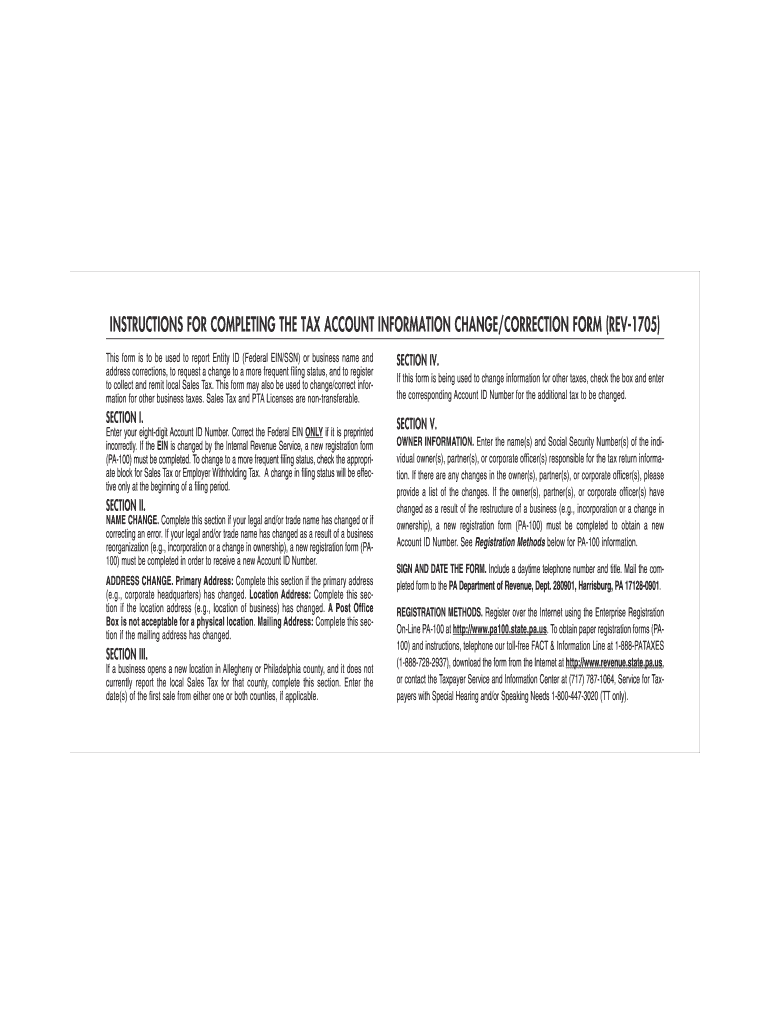

Quick guide on how to complete tax account information changecorrection form rev 1705 formspublications

Your assistance manual on how to prepare your Pa State Tax Correction Form

If you’re unsure about how to finalize and file your Pa State Tax Correction Form, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and efficient document solution that enables you to modify, generate, and complete your income tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to revise entries as necessary. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Pa State Tax Correction Form within moments:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through editions and schedules.

- Click Obtain form to access your Pa State Tax Correction Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to include your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Please be aware that submitting by mail can increase return mistakes and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

Create this form in 5 minutes!

How to create an eSignature for the tax account information changecorrection form rev 1705 formspublications

How to generate an electronic signature for your Tax Account Information Changecorrection Form Rev 1705 Formspublications online

How to generate an electronic signature for the Tax Account Information Changecorrection Form Rev 1705 Formspublications in Google Chrome

How to make an eSignature for putting it on the Tax Account Information Changecorrection Form Rev 1705 Formspublications in Gmail

How to make an electronic signature for the Tax Account Information Changecorrection Form Rev 1705 Formspublications from your smart phone

How to generate an eSignature for the Tax Account Information Changecorrection Form Rev 1705 Formspublications on iOS

How to make an eSignature for the Tax Account Information Changecorrection Form Rev 1705 Formspublications on Android

People also ask

-

What is the rev 1705r and how does it work?

The rev 1705r is a robust electronic signature solution provided by airSlate SignNow. It allows users to easily send and eSign documents online, streamlining the documentation process for businesses. With its intuitive interface, users can manage contracts and agreements efficiently, ensuring a swift turnaround.

-

What are the key features of rev 1705r?

The rev 1705r comes loaded with features such as customizable templates, advanced security protocols, and automated workflows. It supports multi-party signing, allowing multiple stakeholders to review and approve documents seamlessly. These features make rev 1705r a comprehensive tool for managing digital signatures.

-

How much does rev 1705r cost?

Pricing for rev 1705r varies based on the plan you choose, catering to businesses of all sizes. airSlate SignNow offers competitive subscription options that provide excellent value considering the feature set and support included. You can check the pricing section on the website to find a plan that suits your budget.

-

Can rev 1705r integrate with other software?

Yes, rev 1705r integrates seamlessly with various applications such as CRM systems, cloud storage services, and productivity tools. This flexibility allows businesses to incorporate electronic signing into their existing workflows without disruptions. The API provided by airSlate SignNow further enhances integration capabilities.

-

What are the benefits of using rev 1705r for my business?

By using rev 1705r, businesses can reduce turnaround time on contracts and improve efficiency in document management. The cost-effectiveness of this solution also helps organizations save on printing and mailing expenses. Furthermore, signing documents online enhances compliance and reduces the risk of lost paperwork.

-

Is rev 1705r compliant with legal standards?

Absolutely! rev 1705r complies with major electronic signature laws, including the ESIGN Act and UETA, ensuring its legality in signing documents. This compliance provides peace of mind for businesses that require secure and valid electronic signatures. airSlate SignNow prioritizes the security of your documents and data.

-

How can I get started with rev 1705r?

Getting started with rev 1705r is easy. Simply visit the airSlate SignNow website and sign up for an account. You can also take advantage of a free trial to explore its features and see how it can benefit your business before making a commitment.

Get more for Pa State Tax Correction Form

- Sgs scott la form

- Form 9100 162 lte application wisconsin department of natural my northland

- Nycha rent increase request form bostonpost affordable housing

- Iowa contempt of court form

- Rcc academic renewal form

- Pre screen application for previously approved employers forms ssb gov on

- G 639 form

- Last chance union agreement template form

Find out other Pa State Tax Correction Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors