FORM ITPS COA

What is the FORM ITPS COA

The FORM ITPS COA is a critical document used in various administrative processes, particularly in the context of tax compliance and reporting. This form serves as a Certificate of Authority, which is essential for businesses and individuals to demonstrate their eligibility for certain tax benefits or exemptions. Understanding the purpose and implications of the FORM ITPS COA is vital for ensuring compliance with state and federal regulations.

How to use the FORM ITPS COA

Using the FORM ITPS COA involves several steps that ensure proper completion and submission. First, gather all necessary information, including your business details and any relevant tax identification numbers. Next, fill out the form accurately, ensuring that all sections are completed. It is important to review the form for any errors before submission. Once completed, the form can be submitted to the relevant authority, either electronically or by mail, depending on the specific requirements of your state or local jurisdiction.

Steps to complete the FORM ITPS COA

Completing the FORM ITPS COA requires careful attention to detail. Follow these steps:

- Gather required documents, such as your tax identification number and business registration details.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any mistakes or missing information.

- Submit the form according to the instructions provided, either online or via mail.

Legal use of the FORM ITPS COA

The legal use of the FORM ITPS COA is governed by various regulations that ensure its validity. To be legally binding, the form must be completed accurately and submitted to the appropriate authorities. Compliance with state and federal laws is essential, as improper use of the form can lead to penalties or denial of benefits. Familiarizing yourself with the legal implications of the FORM ITPS COA can help avoid potential issues.

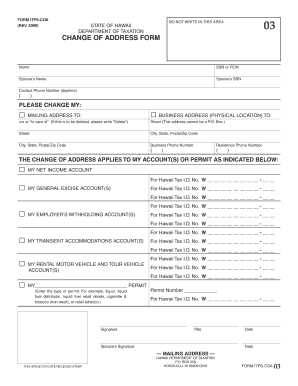

Key elements of the FORM ITPS COA

Key elements of the FORM ITPS COA include:

- Tax Identification Number: Essential for identifying the entity or individual submitting the form.

- Business Information: Details about the business, including its name, address, and type of business entity.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate.

- Date of Submission: The date when the form is submitted is crucial for compliance and record-keeping.

How to obtain the FORM ITPS COA

Obtaining the FORM ITPS COA is a straightforward process. You can typically find the form on the official website of your state’s tax authority or relevant administrative body. Many states offer the form in a downloadable format, allowing you to print and complete it at your convenience. If you prefer, you can also request a physical copy from your local tax office. Ensure you have the most current version of the form to avoid any compliance issues.

Quick guide on how to complete form itps coa

Effortlessly Prepare FORM ITPS COA on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and eSign your documents without delays. Handle FORM ITPS COA on any platform using the airSlate SignNow apps for Android or iOS, and simplify your document-centric operations today.

The Easiest Way to Edit and eSign FORM ITPS COA with Ease

- Find FORM ITPS COA and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign FORM ITPS COA while ensuring seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form itps coa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM ITPS COA and how does it work with airSlate SignNow?

FORM ITPS COA is a customizable form template that streamlines document management for businesses. With airSlate SignNow, users can easily create, send, and eSign FORM ITPS COA documents, ensuring a seamless workflow that enhances productivity.

-

What are the main features of airSlate SignNow for managing FORM ITPS COA?

airSlate SignNow offers features like template creation, automated workflows, and secure eSigning for FORM ITPS COA documents. These features help businesses expedite their document processes while maintaining compliance and security.

-

How much does it cost to use airSlate SignNow for FORM ITPS COA?

The pricing for airSlate SignNow is competitive and varies based on the features you need to manage FORM ITPS COA. Sign up for a free trial to explore the platform and see which pricing tier best suits your business's document management needs.

-

Can I integrate airSlate SignNow with other applications for FORM ITPS COA?

Yes, airSlate SignNow easily integrates with various applications, allowing you to enhance your FORM ITPS COA workflow. This means you can connect with CRM systems, cloud storage, and other productivity tools to maximize efficiency.

-

What are the benefits of using airSlate SignNow for FORM ITPS COA?

Using airSlate SignNow for FORM ITPS COA brings numerous benefits, including streamlined document processing, faster turnaround times, and improved accuracy. These enhancements help your team focus on core tasks while ensuring documents are handled efficiently.

-

Is airSlate SignNow secure for handling FORM ITPS COA documents?

Yes, airSlate SignNow prioritizes security and ensures that your FORM ITPS COA documents are protected. The platform utilizes advanced encryption and complies with industry standards to safeguard sensitive information.

-

What types of businesses can benefit from using FORM ITPS COA with airSlate SignNow?

Any business that requires efficient document management can benefit from using FORM ITPS COA with airSlate SignNow. From startups to large enterprises, the platform accommodates diverse industries seeking to streamline their eSigning processes.

Get more for FORM ITPS COA

Find out other FORM ITPS COA

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer